Recent market exuberance has focused considerable attention, and capital, on Nvidia Corporation. Its dominance in accelerated computing, particularly as it pertains to artificial intelligence workloads, is undeniable. However, the resulting valuation appears, to state the matter plainly, ambitious. This assessment prompts a consideration of alternatives, and a closer examination of Oracle Corporation reveals a potentially compelling, if less-celebrated, growth trajectory.

Oracle: Navigating the Infrastructure Build-Out

Oracle, with a current market capitalization significantly below that of Nvidia, has largely remained outside the immediate purview of the AI-driven market rally. This is not to suggest a lack of engagement with the same underlying trends. Rather, Oracle’s approach is characterized by a substantial, and presently unfashionable, commitment to the underlying infrastructure required to support these advancements. This entails significant capital expenditure, and a corresponding impact on near-term profitability metrics.

The company’s substantial debt load – exceeding $100 billion – has understandably raised concerns amongst equity investors. The financing of data center projects in Texas, Wisconsin, and New Mexico, while strategically sound in the long-term, necessitates a degree of patience that the current market environment often lacks. The $300 billion agreement with OpenAI, while representing a substantial revenue opportunity, is contingent upon the successful deployment and scaling of AI infrastructure, and will require considerable investment to realize.

Recent Performance and Underlying Drivers

Oracle’s fiscal 2026 second quarter results, ending November 30, 2025, demonstrate underlying momentum. Revenue increased by 14% year-over-year to $16.058 billion, while net income reached $6.13 billion. It is important to acknowledge that a $2.7 billion pre-tax gain from the sale of Ampere Computing to SoftBank Group materially contributed to this figure. Absent this non-recurring item, net income growth would have been approximately 9%. Nevertheless, the trajectory is indicative of a business undergoing a structural shift.

| Segment | Q2 FY2026 (Ending Nov. 30, 2025) | Q2 FY2025 (Ending Nov. 30, 2024) | Year-Over-Year Change |

|---|---|---|---|

| Cloud | $7.977 billion | $5.937 billion | 34% |

| Software | $5.877 billion | $6.064 billion | -3% |

| Hardware | $766 million | $728 million | 7% |

| Services | $1.428 billion | $1.330 billion | 7% |

| Total | $16.058 billion | $14.059 billion | 14% |

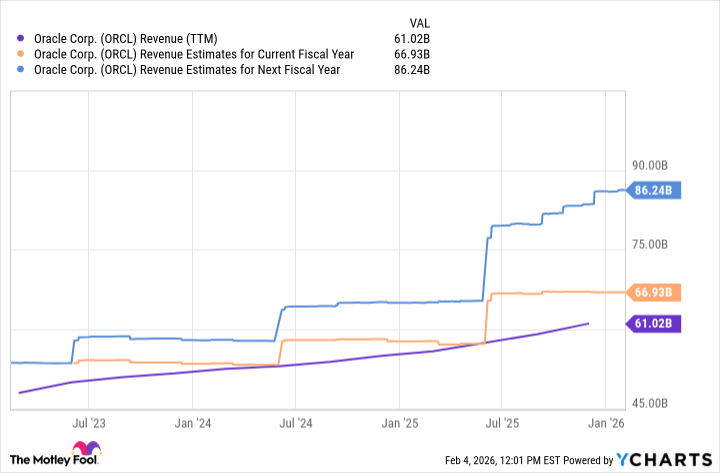

Forward-looking revenue estimates suggest continued growth, albeit contingent upon the successful execution of its infrastructure build-out and the continued adoption of its cloud offerings.

Valuation and Considerations

Oracle’s current forward price-to-earnings ratio of 19.8 represents a relatively modest valuation, particularly when compared to the multiples observed in the broader technology sector. This suggests that the market is not fully appreciating the company’s long-term growth potential. However, investors should remain cognizant of the inherent risks associated with a substantial infrastructure build-out, including potential cost overruns, delays, and the possibility that demand may not materialize as anticipated. Furthermore, the company’s debt load warrants careful monitoring.

In conclusion, while Nvidia undoubtedly represents a compelling narrative, Oracle presents a contrarian growth proposition that merits consideration. The company’s commitment to infrastructure, coupled with its relatively modest valuation, suggests that it may offer a more attractive risk-reward profile for long-term investors.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-08 10:13