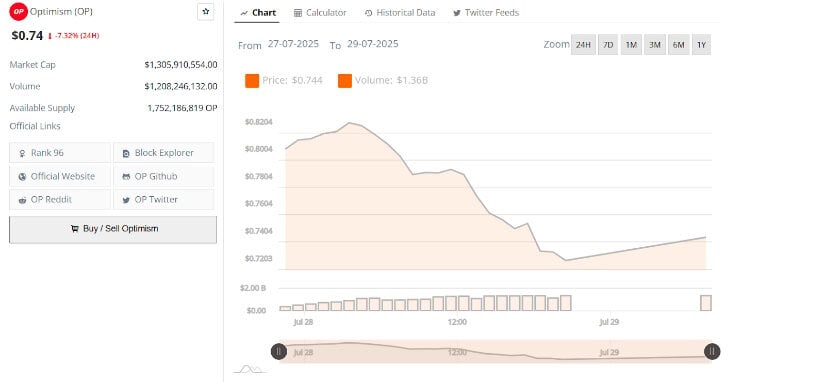

Amidst the swirling mists of the market, Optimism (OP) briefly soared to the heights of $0.82, only to descend with a thud, losing 7.32% over the past 24 hours and settling around $0.74. A spectacle, one might say, worthy of a Greek tragedy, yet with a twist of modern financial comedy. 😂

Despite this dramatic fall, the wise and often overly optimistic analysts remain fixated on the subtle whispers of structural developments that hint at a miraculous trend reversal. The token’s recent dip below $0.76 has, in their eyes, become a beacon of hope, pointing towards key support zones and the tantalizing possibility of a liquidity sweep before any grand bullish continuation. 🎭

As the esteemed Liz opines, Optimism may yet revisit the $0.745–$0.713 area, a mere prelude to its triumphant return to glory. Meanwhile, Alex Clay, with the precision of a seasoned astrologer, identifies a confirmed falling wedge breakout, bolstered by the divine intervention of RSI divergence. With celestial targets set at $1.975 and $2.775, the fate of Optimism’s recovery hangs precariously on the reclaiming of short-term resistance levels. 🌠

Optimism (OP) Price, like a wayward actor in a poorly written play, declined by 7.32% in the last 24 hours, tumbling to $0.74 amidst a cacophony of increased trading activity and the broader market’s sudden bout of melancholy. The asset, which had flirted with the lofty sum of $0.82 on July 28, found itself ensnared in a web of renewed selling pressure, dragging it below the $0.76 support region. The volume, as if summoned by some dark force, surged past $1.2 billion, a testament to the market’s insatiable appetite for drama.

Though OP displayed a fleeting moment of resilience near the close of the daily candle, it remained stubbornly below its short-term support range. This precarious position, akin to a tightrope walker teetering on the edge, could precipitate a further descent if no support is forthcoming. Traders, ever the keen observers of human folly, watch the $0.76 level with bated breath, eager to see if it can be reclaimed in the near future. 🕵️♂️

Breakout From Long-Term Trendline Adds Structural Support

Liz, our resident seer, noted that OP had recently broken free from the shackles of a descending trendline that had bound it for months. This liberation placed OP in a transitional phase, now perched above a resistance-turned-support zone near $0.79. According to Liz’s prophetic vision, the price action suggests a potential sweep of liquidity in the $0.745–$0.713 region, a necessary purgatory before a possible ascent to greater heights.

The analyst’s chart, a tapestry of market indecision, hints at a consolidation pattern just above the descending trendline. Such patterns, as history has shown, often precede a breakout, a moment of clarity in the midst of chaos. The move, supported by price levels remaining above the reclaimed downtrend line, offers a framework for potential bullish continuation, provided the broader market sentiment stabilizes. 📈

Weekly Reversal Confirmed by Falling Wedge Breakout

Alex Clay, a crypto analyst with the foresight of a medieval alchemist, identified a confirmed reversal pattern on the weekly chart of OP. The asset, in a moment of defiance, broke out of a long-standing falling wedge formation, a pattern historically linked to bullish transformations. Clay, with the authority of a sage, emphasized that this move is supported by a bullish divergence on the Relative Strength Index (RSI), a sign that momentum is on the rise even as prices form lower lows.

The analyst’s projection, a map of the future, includes short-term and medium-term upside targets at $1.975 and $2.775, respectively. These levels, like ancient landmarks, correspond to prior structural resistance areas and Fibonacci retracement zones. With the RSI trending upward, traders watch eagerly to see if OP can maintain its position above the wedge breakout, a crucial step in confirming a reversal. 🚀

Consolidation Watch Near Key Price Zones

The current structure of Optimism suggests that the $0.74–$0.76 region could serve as a temporary resting place for price consolidation. Should the asset fail to hold above this area, it may find itself descending to lower support levels near $0.713, a zone that aligns with the bottom of Liz’s projected sweep. This level remains critical for maintaining the bullish narrative.

If Optimism’s price begins to recover and breaches the $0.76 barrier once more, traders may view this as a local victory, potentially leading to a retest of the $0.79 resistance. A successful consolidation followed by a clean breakout may herald a return to the higher timeframe targets outlined in the weekly projections. Until then, market participants, like voyeurs at a soap opera, continue to monitor trading volume and key support reactions with a mix of anticipation and dread. 🎬

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Weight of Choice: Chipotle and Dutch Bros

2025-07-29 21:18