Oh, what a tragic spectacle! The coin, once proud and lofty, now tumbles through the dust, its fall marked by a cacophony of liquidations. Yet, as the dust settles, one might dare to whisper: has the madness subsided? Perhaps, in this quiet interlude, the market breathes anew, seeking not chaos but… organic price discovery? How poetic.

The asset, now cloaked in cautiousness, clings desperately to its lower range, as if fearing even the shadow of volatility. Leverage, that fickle lover, has retreated, leaving behind a barren landscape of reduced exposure. One can almost hear the sighs of relief from the weary traders.

Open Interest Collapse Marks End of Leverage Cycle

On the 4-hour chart, OP has descended into a somber waltz of lower highs and lows since mid-September. Once a noble $0.70, it now lies prostrate at $0.40, a victim of its own hubris. The crash? A tempest of selling volume, as leveraged traders fled like frightened rabbits. 🐇💨

Open Interest, that barometer of greed and fear, has plummeted from 150 million to a meager 52 million. A steep contraction, they say, as if the market had taken a cold shower. Speculators, those brave (or foolish) souls, have vanished, resetting the stage for a “healthier” dance. One wonders if the next act will be a waltz or a wobble.

Today, price and OI linger in uneasy truce, as if both parties are politely avoiding conversation. Should buying pressure rise, perhaps accompanied by a measured OI crescendo, we might witness the return of “controlled speculation.” But beware! A stumble below $0.42-$0.45 could send the coin tumbling toward $0.35, a fate as bleak as a rainy Tuesday. ☁️🌧️

Market Data Shows Stabilizing Fundamentals

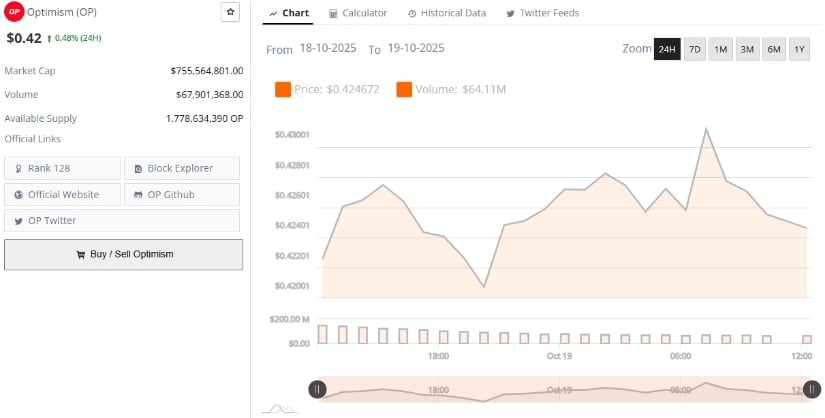

BraveNewCoin reports Optimism trading at $0.42, a 0.48% rebound, with a market cap of $755.56 million. A modest victory, yet the volume remains anemic, as if buyers are whispering, “Not here, not now.” The circulating supply? 1.77 billion tokens-a mountain to climb. Rank 128 globally? A title of dubious honor. 🏆

Liquidity flows like a timid stream, with traders accumulating in whispers rather than shouts. Volatility? A distant memory, while Bitcoin’s dominance casts a long shadow over Layer 2 networks. Capital, ever the skeptic, hoards its coins like a dragon guarding gold. 🐉💰

Technical Indicators Reflect Oversold Market Conditions

OP/USDT hovers near $0.4237, clinging to the lower Bollinger Band like a child to a teddy bear. The basis line at $0.5902 looms like a phantom, while the upper band at $0.8600 dreams of a bullish resurgence. One might call this an “oversold condition”-a fancy way of saying, “Hold on, it might bounce!”

The RSI, at 28.58, is as bearish as a grumpy old man in a card game. Yet, even grumps know when to quit. Sellers, dear readers, may soon tire of their losing streak. History, that fickle friend, suggests RSI below 30 often precedes a recovery-if the market remembers how to dance. 🕺

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

2025-10-20 00:00