Opendoor Technologies (OPEN), that tantalizing chimera of modern real estate alchemy, has lately danced its way into the speculative hearts of meme-stock aficionados. Barely a month ago, its shares languished below the dollar mark-a numismatic nadir-but now they have pirouetted upwards, doubling in value with all the grace of a drunken ballerina.

This enterprise traffics in iBuying, a peculiar form of house-flipping which demands not merely capital but an almost Faustian pact with liquidity itself. In halcyon days past, when housing markets frolicked like lambs under azure skies, Opendoor thrived; alas, those verdant pastures have since turned to arid plains, and growth has become as elusive as a shadow at noon.

Yet investors, those eternal optimists armed with calculators and dreams, seem willing to wager on this stock despite its labyrinthine challenges. Recent earnings figures whisper tantalizingly of improvement-could this be the harbinger of redemption for Opendoor, or merely another mirage shimmering cruelly on the horizon?

A Glimmer of Fiscal Lucidity Amidst Chaos

Last week, Opendoor unfurled its second-quarter tapestry, revealing-for the first time since 2022-a positive adjusted EBITDA figure. Ah, what sweet music are these numbers: $23 million in adjusted EBITDA, a stark contrast to the mournful dirge of a $5 million loss from yesteryear’s ledger.

But let us not don our laurels too hastily, dear reader; this is no true profit but rather a gilded simulacrum thereof. The company still bled red ink to the tune of $29 million, though this was undeniably less catastrophic than the $92 million hemorrhage it suffered the previous year.

Revenue ascended by a modest 4% to $1.6 billion during the period, buoyed by increased home sales and a reduction in inventory to 4,538 homes-a far cry from the 6,399 domiciles languishing unsold last year. Yet even this ostensibly rosy picture failed to ignite the market’s ardor, as wary investors peered into the murky crystal ball of future uncertainties.

The Sisyphean Struggle Toward Profitability

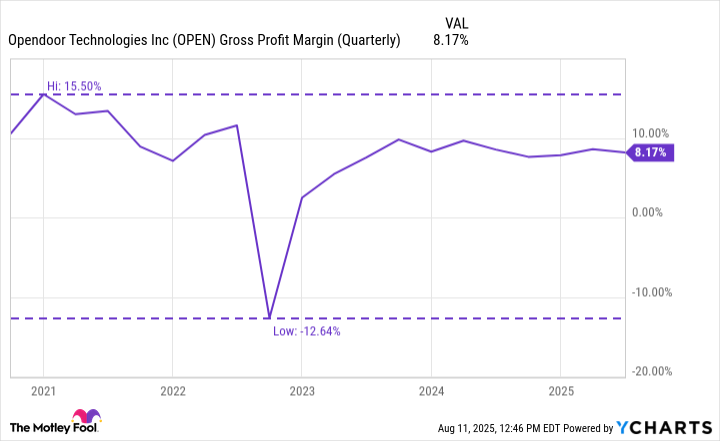

Though Opendoor’s bottom line displayed encouraging signs last quarter, one must tread cautiously before heralding any imminent arrival at the promised land of profitability. Thin gross margins loom over the enterprise like brooding storm clouds, threatening to drench any nascent hopes of fiscal sunshine.

Gross profit stood at $128 million, while operating expenses consumed $141 million-a grim arithmetic indeed. What renders this equation particularly disheartening is that despite rising sales, gross profit fell short of last year’s $129 million. It comes as little surprise, then, that erstwhile titans of iBuying such as Zillow and Redfin chose to abandon ship, deeming the business model about as lucrative as selling sand in the Sahara.

An Odyssey Fraught with Peril

For all its recent cachet among the meme-stock cognoscenti, Opendoor remains a high-stakes gamble, teetering precariously atop shifting economic sands. With recessionary whispers swirling like autumn leaves, and tariffs casting long shadows across commerce, the company faces a future as uncertain as a poet’s muse.

While the latest results offer some cause for cautious optimism, they do not transmute leaden risks into golden assurances. Without a robust resurgence in the housing market and firmer financial foundations, Opendoor will likely remain a siren song for speculators rather than a steadfast vessel for long-term investment.

Intriguing to observe, yes-but perhaps best admired from afar, lest one tumble into its churning maelstrom of volatility and doubt 🌊.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-08-14 15:47