There exists a certain charm in witnessing a stock rise 500% in three months, as one might admire a particularly audacious opera buffa. Opendoor Technologies (OPEN), once the financial equivalent of a faded aristocrat selling family silver, found itself resurrected by a chorus of retail investors chanting “100x” like a prayer. The spectacle was complete with short sellers fleeing like debt collectors from a bankrupt masquerade ball.

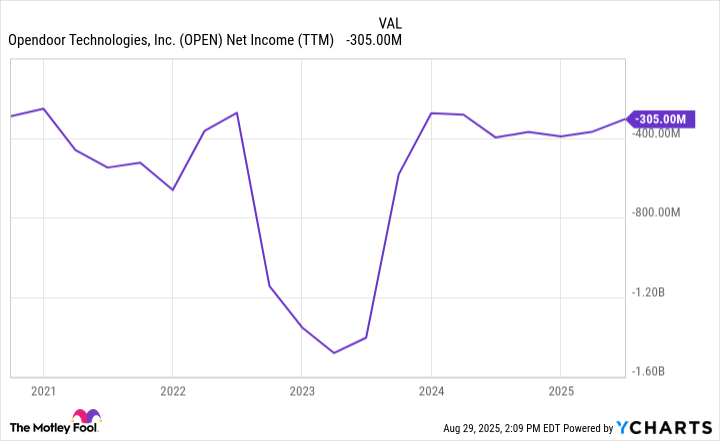

Yet let us not mistake resurrection for redemption. The company’s balance sheet remains a canvas of artistic losses-$300 million in annual deficits, a figure so poetic it borders on Shakespearean tragedy. To call this a “comeback” is to call a shipwreck a swimming lesson. The question lingers: does this phoenix truly rise, or merely combust more spectacularly?

New CEO and the Theater of Activism

In July, a financier named Eric Jackson, possessed of the optimism of a man who has never lost a fortune, declared Opendoor a “100x” opportunity at $1.00-a valuation so modest it might have purchased a single room in one of their unsold houses. The retail masses, ever eager for a carnival, obliged. The stock ascended to $5 with the momentum of a runaway carousel.

CEOs, like fashion, come and go. Carrie Wheeler departed, leaving the stage to Shrisha Radhakrishna, Chief Technology Officer and now interim leader. One wonders if Opendoor’s board seeks a permanent CEO or merely a skilled ringmaster for this financial menagerie.

Cash Plus: Alchemy or Illusion?

The company now touts Cash Plus-a financial parlor trick where sellers receive immediate liquidity, and the company, in a display of alchemy, transforms fixer-uppers into speculative gold. “Share in the profit,” they promise, as though dividing a pie that exists only in prospectus. The innovation is commendable, though one might question the wisdom of betting on a housing market’s recovery when the deck chairs remain half-sold.

Financially, the numbers themselves read like a satire of modern capitalism: $300 million in losses over twelve months, a record unblemished by even the faintest whisper of profitability. Gross margins hover at 8.2%, a figure so anemic it might shame a Victorian widow’s inheritance.

The Millionaire-Maker Mirage

A $3 billion market cap in a market that trades trillions is like a single rose in a desert-striking, yet insufficient to quench thirst. Even if Opendoor conquers this parched land, its debt-laden balance sheet devours 33% of gross profits in interest payments. To imagine profitability here is to imagine a teetotaler at a champagne fountain: theoretically possible, but against nature.

The company’s business model, reliant on holding inventory like a nervous heirloom collector, resembles a game of musical chairs where the music never stops. When the music pauses, as it inevitably must, someone will find themselves seated upon a very large, very expensive mortgage.

In summation: to call Opendoor a millionaire-maker is to call a fire a source of warmth-it may be true, but only for those who enjoy dancing too close to the flames. 🕯️

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- The Weight of First Steps

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-02 04:49