Welcome, ladies and gentlemen, to the wonderful world of Opendoor Technologies (OPEN)—where the dream of easy home selling meets the delicious unpredictability of the modern stock market! Allow me, your humble financial observer (a role only slightly less glamorous than “Royal Jester”), to guide you through this laugh riot masquerading as a Silicon Valley venture.

But First: What’s Opendoor’s Whole “Thing”?

Picture this: a knight rides up to your crumbling castle and shouts, “I’ll buy it!”—no questions, no fuss, all warts (and foundation cracks) included. That’s Opendoor, my friends, galloping through 50-odd markets, turning “as-is” homes into—well, hopefully, less “as-is” homes, using the magic scrolls (algorithms, they call them) to decide which dragons—I mean, houses—to slay. Do they then flip them for profit? That’s the playbook. ‘Tis house flipping, elevated from a local hobby to an industrial performance, and downright daring given every home is unique—like snowflakes, only with leaky attics.

Why make it easy on themselves? Traditional flippers wield hammers and dreams. Opendoor, meanwhile, amasses networks of contractors and techies, and shuffles an entire platform together. If this were medieval times, there’d be troubadours singing ballads about it (or, at a minimum, TikTokers making videos). But full disclosure: Gilded profits have not exactly materialized. Turns out, the real estate market likes to hibernate during autumn and winter, returning in the spring to see its shadow and—whoops!—dictate transaction volumes. Not easy for those who wager on steady returns and good weather.

Even should profits appear someday, expect them to behave like your favorite relative at the holidays: unpredictable, seasonal, and sometimes missing altogether. One good summer selling season and the celebration commences; a quiet fall, and suddenly the party’s over. Annual performance anxiety, anyone?

Stock Spikes: Market Genius or Meme Mirage?

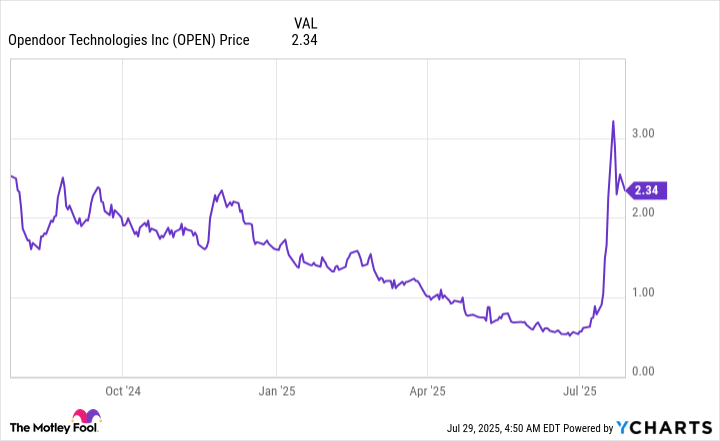

Now, just when you thought the plot couldn’t twist further, Opendoor’s stock recently did the financial equivalent of shooting through the roof—literally. Surely this is a sign the business is about to ascend to Valhalla, right? Don’t bet your suit of armor on it.

What we’re witnessing is a revival of meme-stock fever, the sort of spectacle you might expect at a medieval fair—only with fewer turkey legs and more Reddit threads. Opendoor was so concerned about its tumbling share price that it scheduled a whole reverse stock split pageant! For those playing along at home, that’s not a wizard casting a spell for prosperity. It’s more like an illusion: fewer shares at a higher price, but beneath the curtain, it’s still the same unprofitable business. Often, the only thing splitting is investor confidence.

Thanks to meme wizards and some speculative magic beans, the split has been shelved—for now. But before you leap onto this merry-go-round, remember: We’ve seen this dance before, and when the music stops, the chairs (and, sometimes, your portfolio) can vanish faster than you can say “Short Squeeze.”

I’ll level with you: Right now, what’s happening with Opendoor stock has a lot more in common with a late-night game of Monopoly than with any sober-minded investing. Booming one day, bust the next, held up by the gossamer threads of internet hype—that is a risky high-wire act, and nobody’s handing out safety nets.

Will Opendoor Make You a Millionaire? Take a Number, Get in Line

Let’s pull no punches: Some daring souls might make off like bandits riding the meme train—toot toot! But betting your retirement on volatile, profitless upstarts is like wagering your kingdom on a jester’s dice roll. The odds favor the house (literally), and you risk the classic fate of being the last to buy before the curtains drop, confetti flies, and everyone else scrambles for the exit.

If your goal is slow, steady wealth—the type built over years, not meme-fueled minutes—Opendoor is a show best watched from the cheap seats. Watch it, laugh at its pratfalls, marvel at its audacity, and wait until genuine, sustainable profits take the stage. Until then, keep your popcorn handy and your brokerage account out of reach.

🎭

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- The Weight of Choice: Chipotle and Dutch Bros

2025-08-03 08:19