Over the past month, I’ve witnessed a remarkable surge in the value of Opendoor Technologies (OPEN) shares. This rapid rise seems to be fueled by enthusiastic investors sharing their decisions to invest in this penny stock online. As a result, it has skyrocketed an impressive 325%, with a significant portion of those gains occurring within just the past week.

There’s a surge of investors buying shares in Opendoor, causing its stock price to rise significantly. This relatively small company has drawn attention because many believe it could potentially offer returns of 100 times the investment – a prospect some are calling the next “100-bagger.

While the fundamental nature of the real estate platform’s business model remains unaltered, here’s my take on potential future developments for the firm following its impressive 325% surge in value.

Traders are piling in

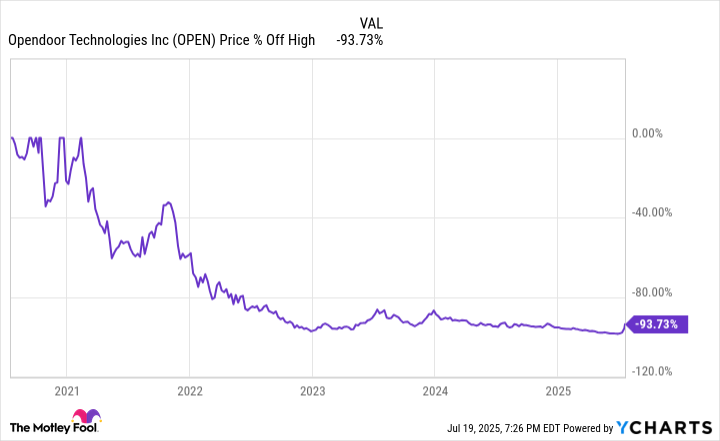

In early June, Opendoor’s stock had plummeted nearly 98% from its peak during the frenzied pandemic market surge, with the share value hovering below $1. To keep the stock from being removed from trading due to a low price, the company suggested implementing a reverse stock split.

In simpler terms, the large iBuying company was struggling due to challenging circumstances. Stalled property deals and increased interest rates hampered its expansion opportunities, while its high-risk business approach also took a toll on it.

A iBuyer refers to an online real estate service that purchases houses directly from sellers and then resells them to buyers, aiming to make a profit in the process. This is essentially large-scale house flipping, financed by loans and investments from venture capitalists who aim to revolutionize the conventional home buying experience.

Due to the high home prices in 2022, Opendoor has faced significant challenges and has been compelled to reduce its home buying activities. Previously, it was purchasing approximately 50,000 homes every year over a period of twelve months. However, this rate has now dropped significantly, with purchases falling below 15,000 per year.

In spite of its challenges, online traders are steadily purchasing its stocks. Given that it’s a small-cap firm with limited shares available (low float), the surge in trading activity caused the iBuyer’s stock to skyrocket, explaining why it has seen such rapid gains.

What’s the future business model?

In their latest quarterly report, the management emphasized that their business model is changing, now collaborating with real estate agents to direct potential house sellers towards Opendoor for quick, all-cash offers. With a stagnant housing market where affordability issues caused by high property prices and rising mortgage rates are limiting demand, the company seeks as much demand as possible to boost home purchases once more, thereby increasing revenue.

This represents a significant shift in their business strategy, yet it doesn’t address the two persistent issues the company faces. The first challenge is the narrow profit margin they have when comparing the acquisition cost to the sale price of their real estate stock.

As an avid follower of the real estate market, I’ve got to say, Opendoor’s gross margin hovering around the 8% mark is quite typical. It rarely surpasses the 10% threshold. This isn’t surprising when you consider that flipping a home doesn’t usually result in a whopping 50% return just by holding onto it for a month! Instead, it’s all about smart investments and strategic timing.

The second problem with their business model is managing liquidity and obtaining financing for debt. When they buy homes, they don’t sell them right away, keeping them on their books. If they speed up their home buying pace, they require funds to finance these purchases.

As Opendoor’s revenue increased, so did its debt financing requirements. High interest costs have been a significant challenge for the company. With slim gross margins, this explains why the firm has yet to report a profit.

My prediction for Opendoor stock

The fact that the stock has recovered or the involvement of real estate agents in promoting the platform isn’t significant. What truly counts is the company’s lack of profitability and the problems inherent in its house-flipping business strategy.

As a fervent admirer of the market, I’d like to share some insights about a particular company that has caught my attention. Despite its impressive 300%-plus growth in recent times, it’s essential to delve deeper into its financial history. This company, unfortunately, has never managed to generate a profit, and its growth seems to rely heavily on accumulating debt.

Moreover, even during the unprecedented surge of home prices from 2020 to 2022, a period that saw the fastest rise in history, this company struggled to turn a net income with home-flipping. For any investor contemplating an investment post its recent surge, this should undoubtedly raise some concerns. Let’s tread carefully!

As an ardent observer of market trends, I must admit that while the recent surge in Opendoor’s stock has been thrilling, I remain skeptical about its long-term sustainability. The truth is, the share price is still a staggering 94% below its all-time high, and for valid reasons. If the company continues to bleed money over the next few years, as it seems to be doing currently, I foresee a return to its downward spiral. Therefore, I urge caution when considering an investment in Opendoor’s stock today.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Top 15 Insanely Popular Android Games

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-07-22 21:09