Right, so Opendoor Technologies (OPEN 2.41%). Last year? A rocket ship! Up 264%! I tell ya, folks, the stock market is like a vaudeville show. One minute you’re headlining, the next you’re being chased off stage by a disgruntled stagehand. They soared, briefly, on a wave of retail enthusiasm – fueled, naturally, by Reddit and that little bird site formerly known as Twitter. It was a frenzy! A beautiful, terrifying frenzy. Like watching pigeons fight over a stale bagel.

Now, they’re in the real estate business. Which, let’s be honest, is already a bit of a comedy. People paying a fortune for…boxes. But with better plumbing. And the Federal Reserve, bless their hearts, started hacking away at interest rates. Six times! A little optimism, they say. A little. It’s like offering a Band-Aid to a guy who’s fallen off a cliff. But hey, a gesture is a gesture, right?

But here’s the thing. This company…it’s got issues. Structural issues. Like trying to build a skyscraper on quicksand. They’ve got a new CEO, Kaz Nejatian – a Shopify, PayPal, LinkedIn veteran. Good pedigree. He’s got a plan. Everyone has a plan until the market punches them in the face.

Opendoor’s Business Model: A History of Bad Ideas

Selling a house is a headache. A monumental, soul-crushing headache. That’s why people hire agents. Professionals who can navigate the paperwork, the inspections, the emotional meltdowns. But even they can’t guarantee a sale. It’s a waiting game. A slow, agonizing wait.

Opendoor says, “Forget that! We’ll buy your house! Cash! In two weeks!” It’s…efficient. Like a robot home-buying service. You enter your address, they spit out a number, you sign, and poof! Money in the bank. What could go wrong? Plenty, my friends, plenty.

They flip the houses. Buy low, sell high. Simple, right? Except when prices are falling, it’s less “flipping” and more “flailing.” Zillow and Redfin tried this little game a while back. They lost. Spectacularly. Zillow was bleeding money so fast, it threatened the entire company. It was like watching a leaky faucet destroy a mansion. A very expensive mansion.

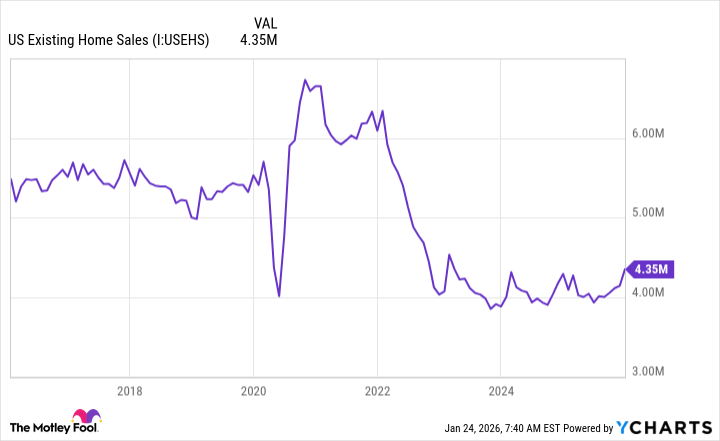

And the market right now? Let’s just say it’s not exactly a seller’s paradise. Existing home sales are near a five-year low. And there are more sellers than buyers. More! It’s like a desperate singles night at a lighthouse. Hard to make a deal when everyone’s trying to get out.

Okay, okay, the Fed is cutting rates. And President Trump is…encouraging Fannie Mae and Freddie Mac to intervene. It’s a complicated situation. A very, very complicated situation. But anything that gets people buying houses is good for Opendoor. It’s like giving a drowning man a life raft…made of gold bullion.

Opendoor Continues to Lose Money (No Surprise There)

They sold 9,813 homes last year, bringing in $3.6 billion. Not bad. But they only bought 6,535. They’re deliberately shrinking their inventory. It’s like a magician running out of rabbits. They’re trying to manage the decline. Bless their hearts.

And the bottom line? A $204 million loss. Ouch. Even after adjusting for all the accounting mumbo-jumbo, they’re still down $133 million. It’s like trying to fill a swimming pool with a teaspoon. They have $962 million in cash, which buys them some time. A little breathing room. But time is running out.

That new CEO, Kaz Nejatian, has a plan. Artificial intelligence! He wants to use AI to speed up the selling process. Faster flips! Less exposure to market swings! It’s…ambitious. Zillow tried that too, you know. They had all the technology in the world. It didn’t help.

Proceed with Caution (Seriously)

The Fed might cut rates a couple more times next year. That’s good news. But remember, Zillow and Redfin exited this business when rates were near historic lows. So don’t expect a miracle. It’s like expecting a snowman to survive a heatwave.

The stock is already down 46% from its peak. And I suspect it could fall further. Remember GameStop and AMC? Social media fueled those stocks to ridiculous heights. Then the bubble burst. And the investors were left holding the bag. I suspect the same fate awaits Opendoor.

So, there you have it. Opendoor. A house of cards…and maybe some AI. Invest at your own risk. And remember, folks, in the stock market, as in life, sometimes the best thing to do is just…walk away.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- All weapons in Wuchang Fallen Feathers

- Where to Change Hair Color in Where Winds Meet

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

2026-01-27 13:12