Ah, Onyxcoin (XCN), the darling of January, where it danced from a humble $70 million to a staggering $1 billion by the 26th! But alas, like a fleeting romance, it has now plummeted by 23% in the last month. How tragic!

As the Relative Strength Index (RSI) languishes at 42, and the Average Directional Index (ADX) whispers of a downtrend that is losing its grip, we find ourselves pondering: is this the beginning of a consolidation phase or merely a prelude to further despair? Should XCN falter at its crucial support of $0.0145, it may tumble to a disheartening $0.0075. Yet, should fortune smile upon it, we might see it flirt with resistances at $0.0229, $0.033, and perhaps even $0.040. Oh, the drama!

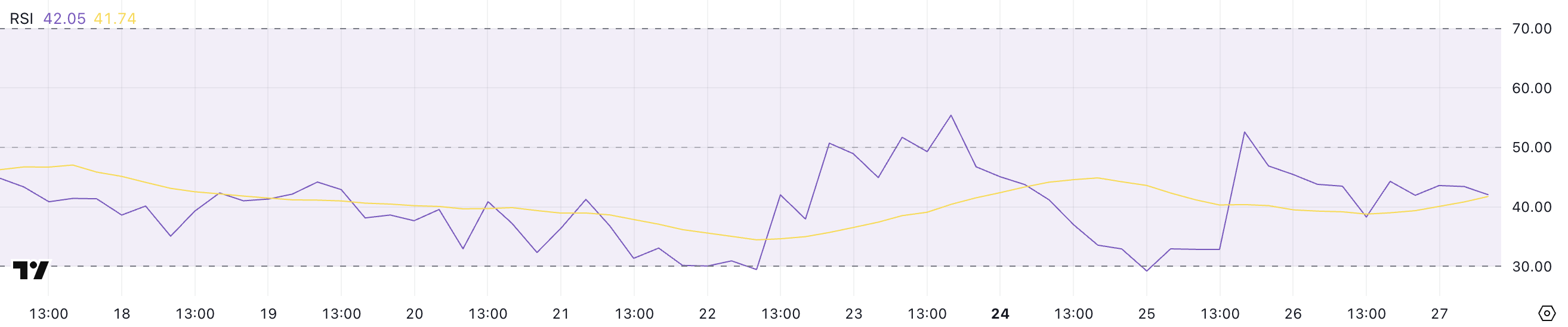

Onyxcoin’s RSI: A Tale of Weakness

Currently, the RSI sits at a dismal 42, a far cry from its previous high of 52.6 just two days prior, having once soared from a mere 29.2.

The RSI, that fickle momentum oscillator, measures the speed and change of price movements, ranging from 0 to 100. Values above 70 scream “overbought!” while those below 30 whisper “oversold!” An RSI nestled between 30 and 70 typically indicates a neutral trend, devoid of strong directional bias.

Alas, XCN’s RSI has been unable to breach the 60 mark since January 30, a clear sign of waning bullish momentum. The recent descent from 52.6 to 42 suggests that buying pressure is evaporating, leaving the altcoin vulnerable to further declines. If the RSI does not muster the strength to rise above 50 soon, we may be staring down the barrel of a bearish trend.

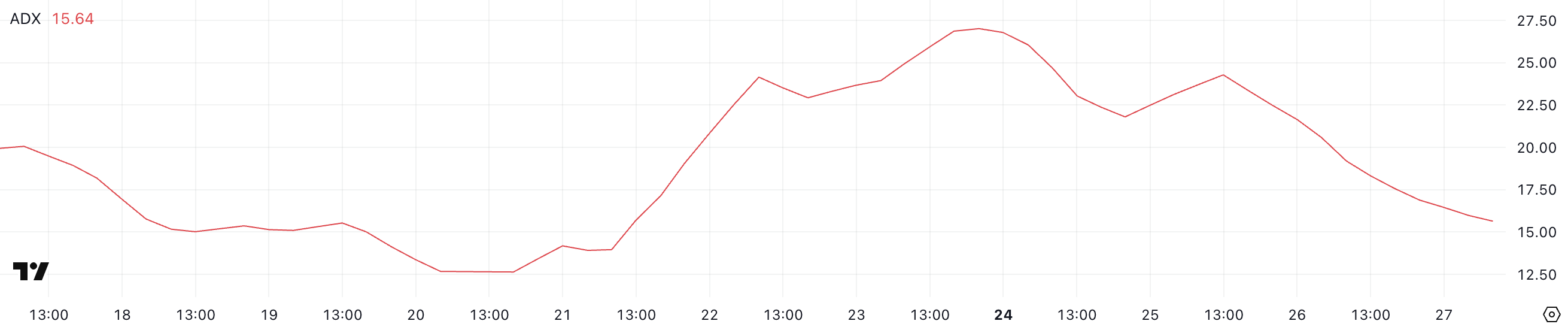

XCN’s ADX: The Downtrend’s Slow Farewell

At present, Onyxcoin’s ADX languishes at 15.6, a drop from 24.2 just two days ago. The ADX, that enigmatic trend strength indicator, measures the intensity of a trend without revealing its direction.

With values soaring above 25 indicating a strong trend, and those below 20 suggesting a market that is as lively as a sloth, we find ourselves in a rather uninspired state. An ADX below 20 hints at price movements that are likely to be as exciting as watching paint dry.

XCN’s ADX, now at 15.6, suggests that the downtrend is losing its grip. In a downtrend, a declining ADX reflects reduced selling pressure and market indecision, increasing the likelihood of price stagnation. However, without a rise in ADX or a directional shift, XCN may continue to drift aimlessly, like a ship without a captain.

Onyxcoin: A Potential 51% Plunge Awaits

The fading downtrend combined with a declining RSI suggests that our dear altcoin may be entering a consolidation phase.

Currently, it clings to a support level of around $0.0145, which, if breached, could lead to a disheartening descent toward $0.0075.

Conversely, should an uptrend emerge, XCN might rise to test the $0.0229 resistance level. If this barrier crumbles, and Onyxcoin regains the momentum of yesteryears, it could continue its ascent, testing $0.033 or even $0.040.

This would represent a potential 154% upside from current levels. However, for this optimistic scenario to unfold, XCN must rekindle its buying momentum and navigate through the treacherous waters of key resistance zones. Oh, the suspense!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-28 02:42