Ah, Onyxcoin (XCN), that cheeky little rascal! Over the past month, it has taken a nosedive, losing a staggering 42% of its value. One might say it’s gone from being the belle of the ball to the wallflower in the corner, desperately hoping for a dance partner. 💃🕺

But hold your horses! Despite its newfound status as the underdog, the on-chain metrics are whispering ominously that the downward spiral may not have reached its final act. 🎭

Onyxcoin: A Buy Signal or Just a Siren’s Call?

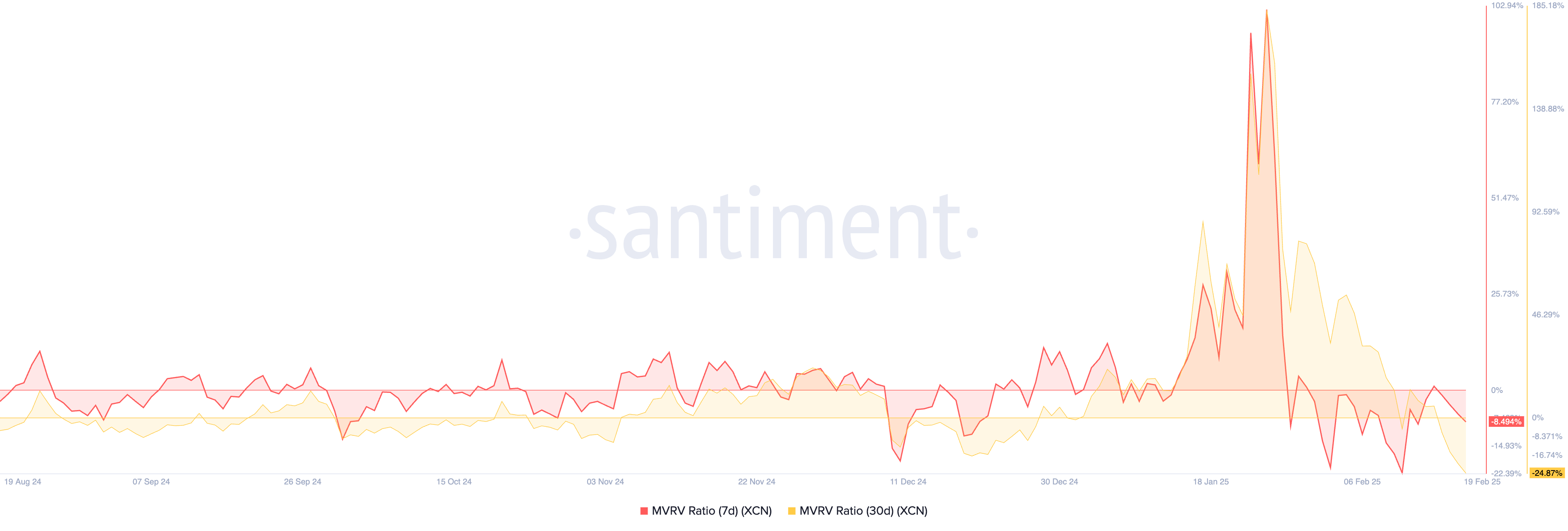

According to the esteemed BeInCrypto, the analysis of XCN’s market value to realized value (MVRV) ratio—based on a 7-day and 30-day moving average—confirms that our dear token is currently undervalued. Santiment’s data, bless its heart, shows these metrics at a rather dismal -8.49% and -24.87%, respectively. 📉

Now, the MVRV ratio is a rather clever little tool that measures whether an asset is overvalued or undervalued. When it’s positive, it’s like a peacock strutting its stuff, suggesting it’s overvalued. But alas, when it’s negative, as with our dear XCN, it’s more like a sad puppy, indicating it’s undervalued compared to what traders originally forked over. 🐶

Historically, such negative MVRV ratios have been seen as buy signals. However, XCN’s steady decline has left many holders feeling as gloomy as a rainy day in London, with bets now placed on further losses. ☔️

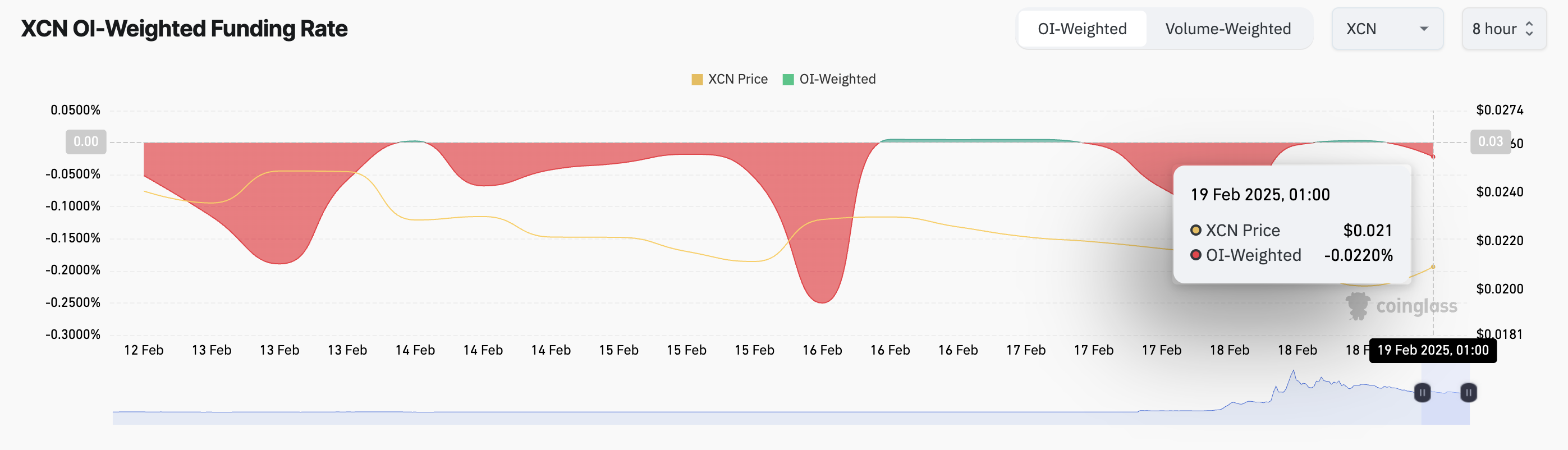

This has created a rather unfortunate feedback loop, leading to continued sell-offs and adding more downward pressure on the coin’s price. The coin’s persistent negative funding rate, currently at -0.022%, is a testament to this bearish sentiment. 🐻

The funding rate, dear reader, is the periodic payment exchanged between long and short traders in perpetual futures markets. When it’s negative, short traders are paying long traders, indicating that more traders are betting on a price drop. Quite the pickle, isn’t it? 🥒

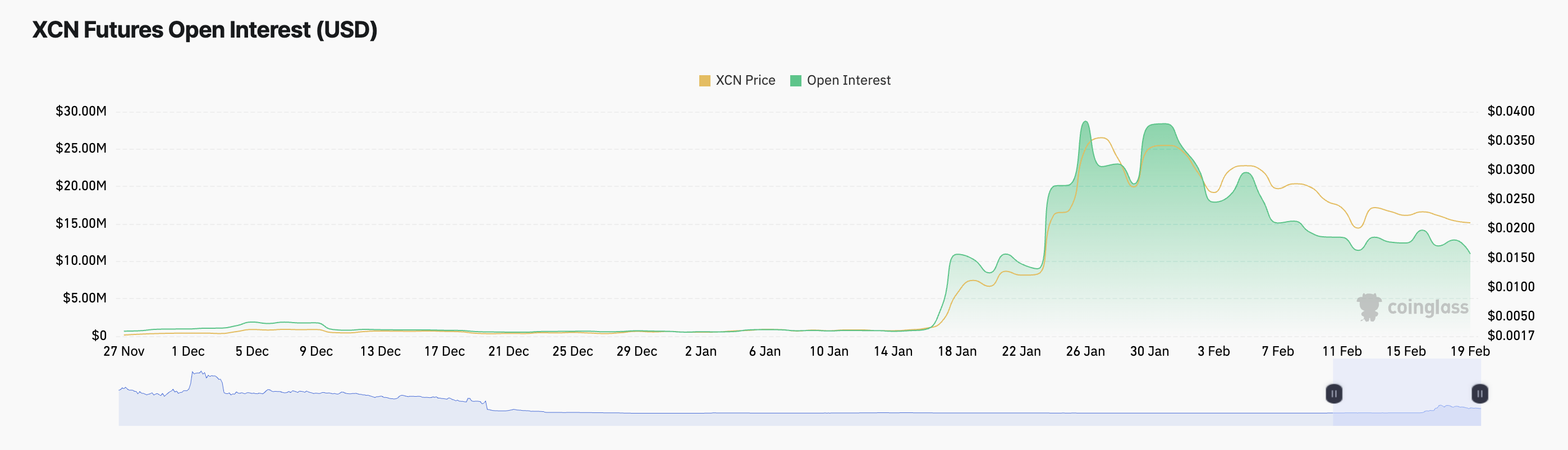

Moreover, XCN’s plummeting open interest confirms the waning demand for this altcoin. As of this writing, the metric stands at a paltry $11 million, having fallen 14% in the past 24 hours alone. Talk about a dramatic exit! 🎭

Open interest measures the total number of outstanding derivative contracts that have not been settled. A decline here suggests traders are closing their positions, hinting at a potential price decline. It’s like watching a slow-motion train wreck! 🚂💥

XCN Price Prediction: A Rebound or a Further Plunge?

On the daily chart, XCN’s Relative Strength Index (RSI) is waving a white flag, highlighting the falling demand for our beleaguered altcoin. Currently, it’s below the 50-neutral line and trending downwards at 45.55. 🏳️

The RSI measures overbought and oversold market conditions, ranging from 0 to 100. Values above 70 suggest overbought conditions, while those below 30 indicate oversold conditions. XCN’s RSI at 45.55 suggests that sellers are tightening their grip. If this continues, we might see the token’s price plunge to a disheartening $0.011. 😱

However, should a resurgence in demand occur, it could invalidate this bearish outlook, and XCN’s price might just rally to its year-to-date high of $0.049. Fingers crossed, eh? 🤞

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-02-19 13:44