The experts gathered in their little podcast room, voices bouncing off the drywall like echoes in a miner’s canyon, and they spoke of the old order – that tired dollar system, humming along since Nixon nixed gold in ’73. Matthew Pines, a man with eyes that had seen too many economic charts, leaned forward and let slip that the bones of the system hadn’t shifted an inch since bell-bottoms were in fashion. Oh, there was evolution, crises, even a few fistfights behind the Federal Reserve, but the structure? Firm as Grandma’s bread recipe, until, perhaps, now.

Enter China, flexing its muscles, industrial and otherwise, making the old folks at the Treasury sweat under their blue suits. “The dollar’s being challenged,” said Pines, like a man admitting his tractor leaks oil. And his companion Zach Shapiro, hair probably mussed from too many policy briefings, dropped words like “trust” and “reserve asset,” which, if you squint, sound downright poetic for D.C.

Shapiro reckoned some central bankers, scared after the States froze Russia’s couch-cushion Treasuries, had been hoarding gold like it was Halloween candy. The talk turned to how Bitcoin might shoulder its way onto the reserve bench, especially if Trump came swinging with a chunk of the federal balance sheet and a Twitter announcement. Wouldn’t that rattle some chains?

Then came the killer twist, fit for those with a taste for monetary alchemy: marking gold to market, letting America’s secret gold stash be re-priced from $42 an ounce—the sort of figure that says, “I haven’t checked my portfolio since disco died”—to the real world number that makes hedge fund managers weep. This pile of imaginary surplus? Shapiro mused you could swap it for Bitcoin and, *bingo*, add a trillion dollars to Uncle Sam’s balance sheet. But why, and why now? Questions floated in the air like dust in a sunbeam, and all anyone could do was shrug and reach for more coffee.

Pines grew philosophical, maybe because the good bourbon was gone. The tension with China wasn’t just about tariffs or who had the shiniest semiconductors; it was about “monetary assets.” Gold. Bitcoin. Maybe collectible Beanie Babies next, who knows.

The White House, never one to skip an acronym or a dramatic executive order, cooked up something called a Strategic Bitcoin Reserve and demanded—yes, *demanded*—the government count up all its stray crypto from old law enforcement busts, and audit it like a grandma with her jam jars. “You’ve got thirty days!” barked the order, which is about as effective as telling your teenager to clean their room by sundown.

But the how-to of buying Bitcoin without borrowing your neighbor’s lawnmower or bankrupting the Defense Department? That’s where things get stickier than a pie-eating contest in July. Budget neutral, they said. Sell old assets. Maybe raise tariffs—because who needs cheap avocados, anyway?

Should the administration get a wild hair and actually buy a mountain of Bitcoin, well, Shapiro reckons the price would rocket so fast, even Elon Musk might look jealous. “A million dollars a coin,” he declared, as if he was pricing apples at the county fair. The rest of the world would, presumably, have kittens.

But even in this wild tale, with Bitcoins raining from the sky (or at least CNBC talking heads losing their ties about it), the aftershocks would spill far beyond zeroes on a chart. Nation-states would twitch, gold might start looking old and tired, and somewhere, a podcaster would sigh into another microphone, ready for next week’s episode of “How the World Got Weirder.”

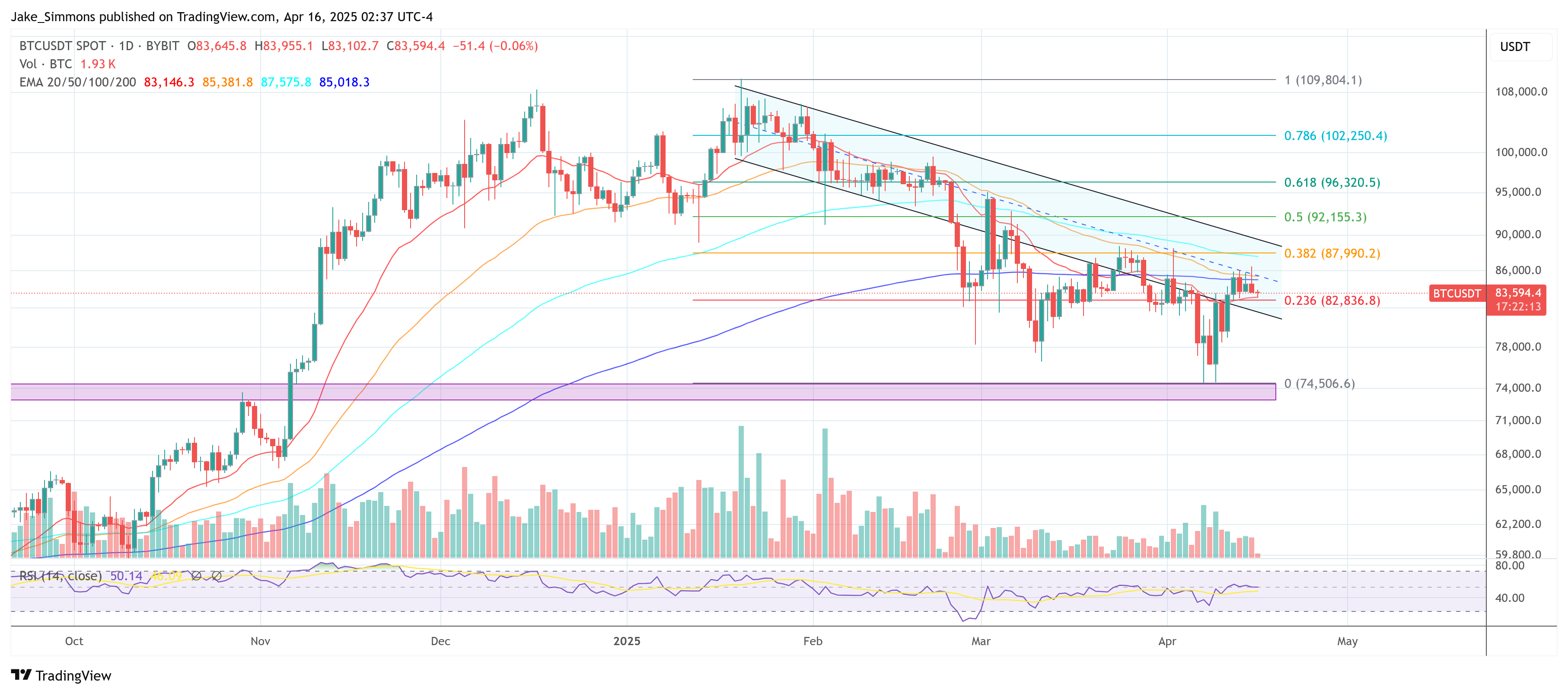

And for those counting, Bitcoin’s sitting at $83,594. For now. 🍿

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-16 16:23