In the grand theater of finance, where the actors are often masked in the shadows of inefficiency, Ondo emerges as a bold protagonist. With a market cap that pirouettes past $600 million, this titan of tokenized real-world assets (RWAs) is not merely a player; it’s a revolution on blockchain rails. Who knew finance could be so… dramatic? 🎭

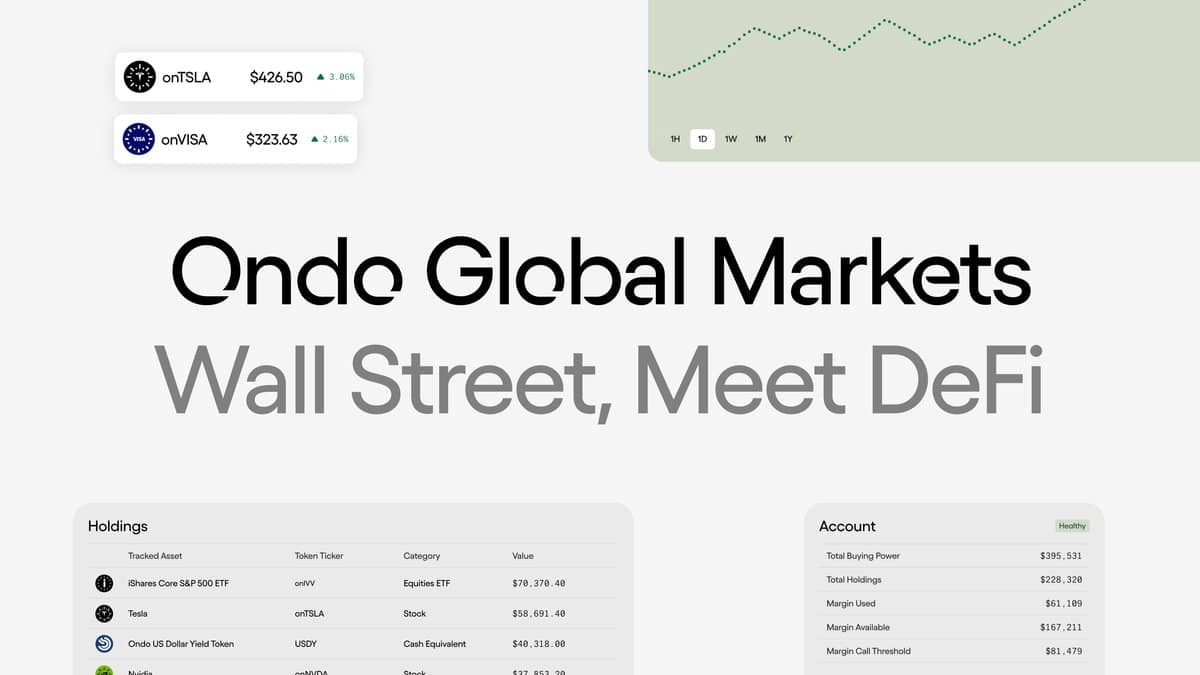

With the launch of Ondo GM, the company aims to shatter the glass ceilings of an investment ecosystem riddled with high fees and limited access. It’s like trying to enter a fancy club without the right shoes—frustrating, isn’t it? By tokenizing traditional financial instruments, Ondo seeks to craft a more accessible, transparent, and efficient system. Cheers to that! 🥂

Tokenization with Compliance Controls

While Ondo keeps its cards close to its chest regarding which stocks, bonds, or ETFs will grace its platform, it promises a model akin to stablecoin liquidity. Imagine minting tokens linked to traditional assets, but with compliance controls tighter than your grandma’s hug. Who can buy, sell, or even look at these tokens? Only time will tell! ⏳

“We are leveraging blockchain to bring institutional-grade financial markets onchain, making them more efficient and widely accessible,” Ondo declared, as if announcing the arrival of a new season of a hit show. 📺

This move signals a thrilling trend of blockchain-based financial infrastructure elbowing out the old guard. Ondo is on a mission to smooth out the wrinkles in capital markets, creating a landscape that is both open and fluid—like a well-oiled machine, or perhaps a well-mixed cocktail? 🍹

As the industry shifts toward blockchain-enabled finance, Ondo GM could be the golden ticket to mainstream adoption. Who wouldn’t want a piece of that pie? 🥧

Ondo Finance Brings $185M Tokenized Treasuries to XRP Ledger, Strengthening Institutional Adoption

The tokenization of RWAs is picking up speed, and Ondo Finance is all in. Last month, they announced the arrival of their $185 million U.S. Treasury-backed token, OUSG, to Ripple’s XRP Ledger (XRPL). It’s like bringing a fancy dish to a potluck—everyone wants a taste! 🍽️

A Strategic Integration: OUSG on XRPL

The Ondo Short-Term US Government Treasuries (OUSG) token, backed by BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), allows qualified investors to mint and redeem tokens faster than you can say “blockchain.” The XRPL deployment is set to go live in six months—mark your calendars! 📅

To kickstart liquidity, both Ripple and Ondo Finance have thrown in some seed investments, though the exact amounts are as mysterious as a magician’s trick. 🎩

Why This Matters: The Growing RWA Market

The tokenization of RWAs—including bonds, credit instruments, and investment funds—is reshaping the financial landscape. It’s like giving a makeover to a tired old building—out with the old, in with the new! 🏗️

Tokenized U.S. Treasury products are leading the charge, quadrupling in size over the past year to a whopping $3.5 billion. Talk about a glow-up! 💰

Markus Infanger, Senior Vice President of RippleX, emphasized the disruptive potential of blockchain-based treasuries: “The 24/7 intraday settlement enabled by tokenized assets like OUSG represents a transformative shift in capital flow management.” Sounds fancy, right? It’s like giving finance a caffeine boost! ☕

He highlighted the benefits of low-risk, high-quality liquidity solutions, enhancing accessibility for institutional investors and bringing greater stability to blockchain finance. Stability? In finance? Now that’s a plot twist! 📈

XRPL: The Institutional Blockchain for RWA Tokenization

For Ripple and XRP enthusiasts, this is a major win! The XRP Ledger was designed to support institutional finance, making it the perfect stage for

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-02-05 22:04