ON Semiconductor (ON), a manufacturer of chips for automobiles and industry, has been subjected to the bureaucratic whims of a market that oscillates between frenzied optimism and paralyzing despair. Its recent 24% decline is not a punishment but a ritual, a tariff imposed by an unseen authority that demands submission before granting absolution. Yet, for the patient, the numbers whisper of a paradox: a growth stock shackled to the chains of a value investor’s delusion.

This is not a stock to be understood, but to be endured. Its end markets, like bureaucratic departments, operate on schedules known only to themselves. Management, with the diligence of a clerk in a Kafkaesque office, prepares for a future that may or may not arrive. The company’s current state is a ledger of contradictions-a growth story trapped in a value shell, a promise buried under layers of red tape.

The Absurd Valuation

Wall Street analysts, those architects of arbitrary logic, have assigned ON Semiconductor a 2025 earnings multiple of 21. A number that seems excessive, yet reasonable when viewed through the distorted lens of a trough year. For in 2026, they predict a 29% earnings growth, a figure that may as well be a bureaucratic formality, a number plucked from the void to satisfy the demands of a system that requires answers but has no use for truth.

CFO Thad Trent, in a statement as dry as the archives of a forgotten ministry, reports free cash flow margins of 19% year-to-date, with a promise of 25% by year-end. At $6 billion in revenue, this implies $1.5 billion in free cash flow-a sum that seems absurdly modest for a company with a $19.5 billion market cap. It is as if the market has priced ON Semiconductor not for its potential, but for a crime it has yet to commit.

The Market’s Unseen Hand

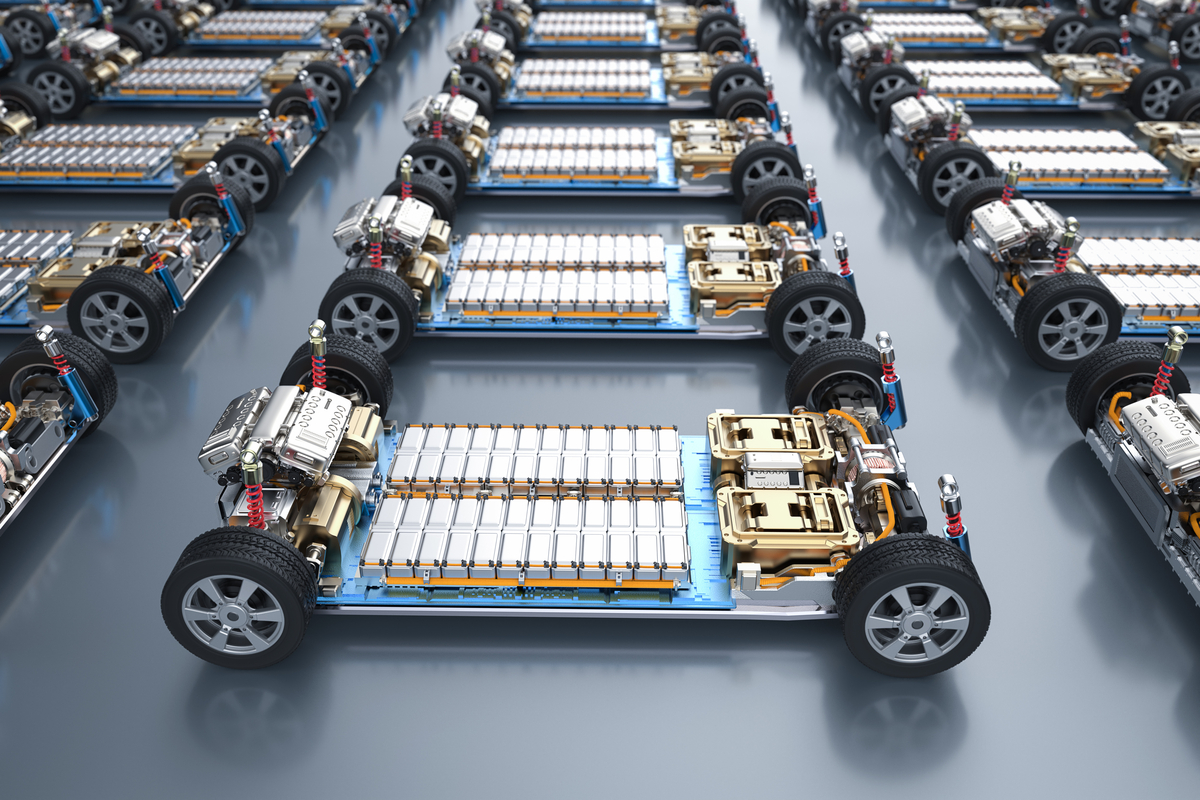

The current undervaluation is not a mistake but a design flaw in the system. Management has chosen to focus on automotive and industrial sectors, two departments within the vast bureaucracy of global markets. These sectors, however, have been mired in a slowdown that feels less like a recession and more like a bureaucratic delay-an endless queue with no visible counter.

The automotive sector, particularly electric vehicles, has been hit by a dual curse: the premature expiration of tax credits and the lingering effects of a lockdown-era investment surge. Industrial markets, too, are in retreat, their contraction a mirror of the automotive sector’s descent. The Institute for Supply Management reports a sixth consecutive month of manufacturing contraction, a statistic that might as well be a memo filed away in a drawer never to be opened.

Signs of a Stabilization?

CEO Hassane El-Khoury, in a statement that could be mistaken for a bureaucratic reassurance, notes “signs of stabilization” in end markets. Sequential improvements in industrial revenue, driven by a doubling of AI data center revenue, suggest a glimmer of hope. Yet the market remains blind to Onsemi’s partnership with Nvidia, a collaboration that feels like a secret buried under layers of paperwork.

El-Khoury predicts sequential growth in automotive revenue for Q3, a forecast that reads like a bureaucratic prediction: certain, yet impossible to verify. The first quarter, it seems, marked a low point, a temporary setback in a system where lows are merely precursors to more lows.

The Rationalization of Chaos

Management continues to rationalize its portfolio, exiting non-core businesses with the precision of a clerk destroying obsolete files. This rationalization, however, has the unintended consequence of weakening near-term results. By 2026, 5% of 2025 revenue will vanish, a sacrifice to the bureaucratic gods of margin improvement. Silicon carbide chips, once a beacon of promise, are now lower-margin due to underutilized capacity-a consequence of the EV market’s stagnation.

Yet, as the EV market eventually recovers, margins will rise, a promise written in the same ink as all bureaucratic assurances: faint, smudged, and easily forgotten.

The Secular Mandates

ON Semiconductor’s end markets are driven by secular mandates: the energy transition, smart factories, and AI data centers. These are not trends but decrees from a higher authority, mandates that must be fulfilled regardless of the cost. The energy transition, in particular, is a bureaucratic edict that cannot be ignored, a process that will unfold with the inevitability of a clock’s hands.

While near-term disappointment is inevitable, the valuation and long-term prospects render this stock a compelling addition to a growth investor’s portfolio. It is a paradox, a bureaucratic anomaly that rewards those who persist in the face of absurdity. And so, the investor endures, navigating the labyrinth of numbers and narratives, hoping for an exit that may never come. 🌀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

2025-09-08 15:30