Now, one observes a certain buzz in the financial ether regarding Artificial Intelligence. A frightfully clever bit of kit, to be sure, but possessing an appetite for electrical current that would make even the most robust power grid blush. It appears the demand is escalating at a pace that would give a seasoned bookmaker pause, and existing infrastructure is, shall we say, rather less than up to the task. A spot of bother, what?

The figures, when one gets down to brass tacks, are positively staggering. The International Energy Agency, those diligent chaps, estimate that data centers alone could be gobbling up nearly a thousand terawatt-hours by 2030. A quantity that, frankly, leaves one reaching for the smelling salts. The United States, therefore, finds itself in the position of a gentleman desperately in need of a larger waistcoat – a prodigious amount of power is required, and with some haste.

Numerous bright sparks have been tinkering with solutions – fuel cells and the like – but one company, Oklo (OKLO +3.83%), appears to have a particularly ingenious scheme brewing. They’re not merely offering a patch for the problem; they’re proposing a complete overhaul of the electrical plumbing, if you will.

Oklo’s Big Idea: Miniature Powerhouses

If Oklo hasn’t yet graced your investment radar, allow me to enlighten you. They are, in essence, building remarkably compact nuclear reactors – they call them “Aurora powerhouses,” a rather dashing name, don’t you think? – and with a rather clever bit of recycling thrown in for good measure. From the artist’s renderings, they resemble a charming country cottage crossed with a cathedral, a most unexpected combination.

These compact wonders are designed to provide a continuous, round-the-clock supply of power directly to industrial clients, data centers being a prime example. They can operate for a decade before needing a refill, and they aren’t fussy about their fuel, happily accepting either fresh HALEU or recycled material. A truly versatile arrangement. The company claims each Aurora can deliver up to 75 megawatts, enough to keep even the most demanding data center humming along quite nicely.

Now, here’s where things get interesting. Unlike the traditional reactor builders, who typically sell their creations to utility companies, Oklo intends to own these powerhouses and sell the electricity they generate. A rather bold move, but one that, if successful, could transform them into a sort of utility company with a remarkably predictable income stream.

Commercially, they haven’t actually built an Aurora powerhouse just yet – a minor detail, naturally. But they’ve forged tentative agreements with key players in the data center world, including Equinix (EQIX 0.01%) and Switch. Even more promising, they’ve partnered with Meta (META 0.04%) to develop a 1.2 gigawatt power campus in Ohio, designed to keep Meta’s data centers happily powered. A most encouraging sign.

The Slightest of Hiccups: Revenue, Naturally

On paper, Oklo appears to be a rather splendid solution to the impending energy crisis. However, there’s a small matter of regulatory approval. They haven’t quite secured the green light to operate their reactors commercially, you see. A dashedly irritating delay, naturally.

Fortunately, they’re making progress with the Nuclear Regulatory Commission, and have even received support from the White House – President Trump, it seems, is rather keen on rebuilding America’s nuclear capacity. They’re also participating in Department of Energy pilot programs, which should help them demonstrate their technology and, hopefully, expedite the licensing process.

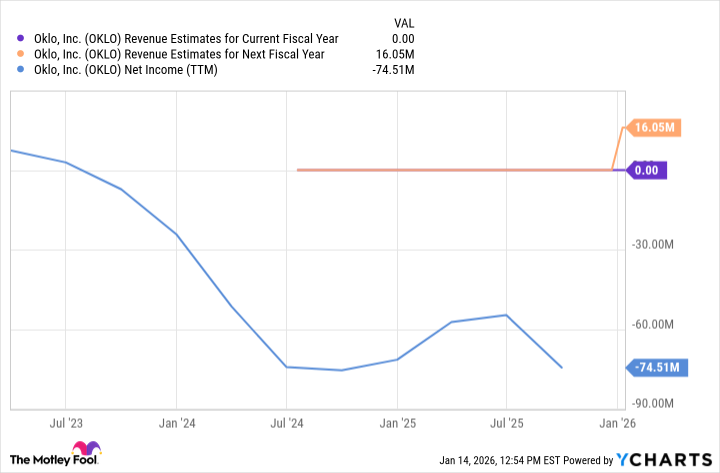

The timeline, however, remains a touch vague. Oklo is currently aiming for a launch date for their first commercial plant sometime between late 2027 and early 2028. This means investors may have to exercise a modicum of patience – perhaps two years or more – before they see any meaningful revenue flowing in.

Naturally, a start-up of this nature is experiencing losses – a third-quarter operating loss of around $36 million, to be precise. This is perfectly normal, of course, given the heavy investment in research and development. Fortunately, Oklo appears to be in a reasonably sound financial position, with around $1.2 billion in cash and marketable securities.

Nevertheless, Oklo still has a considerable journey ahead of it, and it remains to be seen whether their reactors will perform as expected outside the laboratory. While the technology has some precedent – a similar fast reactor design was demonstrated in Idaho in the 1990s – scaling up production is never a simple undertaking. There are bound to be a few technical challenges along the way.

The company has the backing of influential figures like Sam Altman and the U.S. government, which puts them in rather rarified air. However, if you’re looking for an energy company that’s already supplying power to AI today, you might want to consider Constellation Energy (CEG 9.81%). It could be a few years before Oklo’s reactors are fully operational. But for investors with a long-term outlook and a tolerance for a bit of risk, this could be a most promising investment indeed.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2026-01-18 21:53