The globe, that ever-turning bauble of flame and folly, now glows with new fervor. Nations, drunk on ambition, have clasped paws to triple nuclear might by 2050-a pact inked in haste and hubris. Multibillion coffers, their contents glinting like church pennants, now flow toward reactors and reactors alone, as though Union Jacks of energy could be sewn from neutron threads. Oklo, this upstart with a name like a sneaky whisper in a wine cellar, proclaims itself heir to the throne of power. But let us not mistake the rattle of its tiny atomic nest for the thunder of destiny. Is OKLO stock a millennial fortune’s yellow brick road? Perhaps. But first, let us prance through the mire of its grand design.

Oklo’s Long-Term Opportunity: A Dragon’s Hoard or a Peacock’s Feather?

Electricity, that modern sorcerer’s elixir, will swell in appetite like a dethroned monarch consuming the world’s moonlight. By 2050, the global thirst for it will have swelled 78%-a number that tastes of both triumph and delirium. Here, in this fog of figures, Oklo’s Aurora reactors, those mechanical leviathans, puff their metallic lungs. Designed by scholars once cloaked in moth-eaten sashes at Argonne, their nuclear nectar is to be sold not as hardware, but as sugar-dusted steam to data centers and defense barns. The company’s ledger of net-zero gold is written in non-binding handshakes, its total-14 gigawatts-enough to make St. Petersburg’s tsars weep with envy. Yet beneath the parchment lies a riddle: will these signatures outlive the ink, or vanish like smoke from a chimney in winter?

The plan is simple as it is mad: sell electrons, not steel. Power purchase agreements bloom like tulips in a seventeenth-century craze. Recurring revenue-sure! Profitability-yes! But what of the ants in the engine? What of the sentinel demons that guard the HALEU gates, those serpentine paperwork kings? High-assay low-enriched uranium, this nuclear alchemy’s xanadu, is hoarded by nations like sweetmeats by a glutton’s babushka. Oklo’s first fuel is secured, but the ones to come? Ah, that is a tale of permits and permissions, of labyrinthine corridors where time is chewed like dry straw and spat into contracts barring the light.

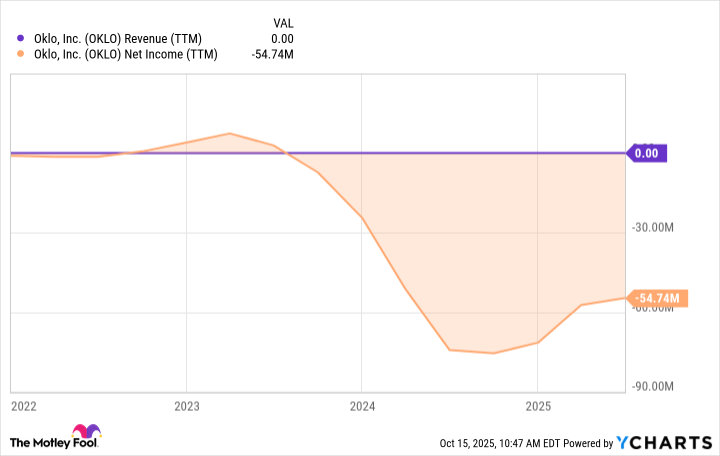

Make no mistake-the Trumpian decree aglow with nuclear huzzahs is a glimmer, not a guarantee. The ADVANCE Act and its cousins, those legislative jokers in jester-red tunics, promise to smooth roads that were never paths to begin with. Yet in the heart of it all beats Oklo’s core truth: it is a child still in its cradle of losses, a phoenix not yet flapping its wings. Its first reactor, that delayed prodigy in Idaho, will bloom in 2027 or 28-years adrift in the storm of capital’s impatience. What mortal investor may wait so long without licking the curdled milk of doubt?

A Question of Fortunes, or the Fool and His Ten Thousand?

If you cast ten thousand dollars at Oklo’s wall of fate-and should it rebound with the cynic’s luck, 25% a year for two decades-your nest egg might flutter up to $867,000. A tidy sum for a dream tailor’d in neutrons. But dreams, you see, are fickle. The SMR kingdom is crowded, its competitors many, its thrones hoisted on quicksand. Oklo’s risen on a gallop of 1,927% in a year-a farcical sprint that leaves nary a pebble unturned. Yet today, the shares shimmer with the sheen of a mirror house: dazzling, but dangerous to tread. For the investor is now not courtier to a babe, but gambler at a roulette where the wheel is greased by the hands of fate.

Is this stock the golden goose, or the goose with one feather, plucked raw by time? Let the market’s puppetmasters ponder, while we blink at the light and laugh slyly. After all, fortune’s wheel is as capricious as a Wagnerian opera, and Oklo’s tale-is more a symphony in minor than a sonata of surety. 🧼

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

2025-10-20 04:11