Right, settle in, folks. We’re talking energy stocks. Yes, energy. In 2026. Still a thing, surprisingly. The sector’s up 12.9% year-to-date as of this writing. Which, let’s be honest, is practically a Roman triumph in the world of finance. Beats materials, though. Poor materials. Always getting overshadowed. It’s like the understudy who never gets the lead.

Now, you investors, you lovely, eager beavers, are looking for high-yield stocks. Good for you! I approve. And I, your humble guide through the swirling mists of the market, have two for you. Two titans. Two…well, they drill holes in the ground. But they do it profitably. Behold, ConocoPhillips and Kinder Morgan! They’re not exactly the Flying Circus, but they’ll add a jolt to your passive income stream. A jolt, I tell you!

ConocoPhillips: The Aristocrats of Oil

ConocoPhillips. The biggest U.S. exploration and production company by market capitalization. Third-largest overall, behind ExxonMobil and Chevron. These are the guys who practically invented digging. Okay, maybe not. But they’re good at it. A few years back, they ditched their variable dividend. A bit dramatic, really. Like a diva throwing a tantrum. But they did it to focus on growing their ordinary quarterly dividend. Sensible, if you ask me. They aim for top-quartile dividend growth relative to the S&P 500. Which means they want to raise that payout, and do it fast. Like a cheetah chasing a…well, you get the idea.

They can do this because they’re efficient. Like a Swiss watchmaker, but with oil rigs. They plan to lower their free cash flow breakeven level to around $30 a barrel by the end of the decade. WTI crude is in the mid-$60s right now. Not bad. Even during the oil crash of 2020, it averaged $39.16. A disaster for some, a bargain for others. And it hasn’t averaged below $30 since 2002. That’s a long time to avoid a financial pratfall! They’re combining tech, efficiency, and smart plays. Not just drilling everywhere like a caffeinated badger.

With a 3.3% dividend yield, ConocoPhillips is the best upstream oil and gas stock to buy now. A solid investment. A dependable friend. A…well, you get the idea. It’s the kind of stock your grandmother would approve of, if your grandmother was a ruthless oil baroness.

Kinder Morgan: Back in Business (and Growth Mode!)

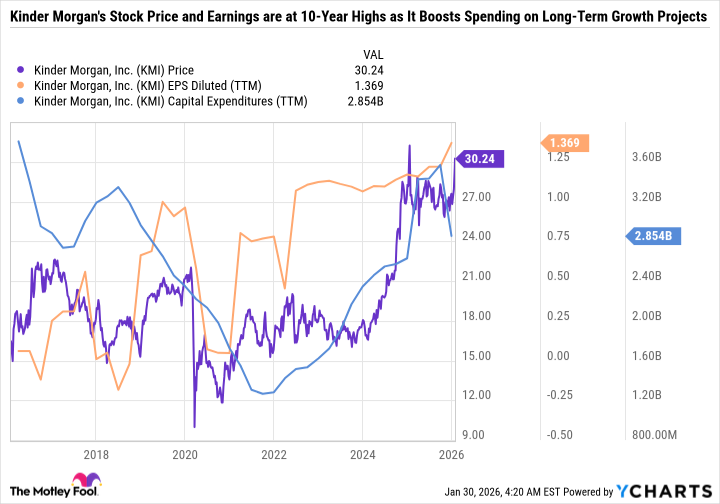

Kinder Morgan is hovering around a 10-year high after releasing their 2025 results. They’re predicting a 5% increase in adjusted net income for 2026. And a 5% increase in earnings per share. Not exactly a rocket launch, but it’s progress. They’re able to predict earnings with accuracy because 70% of their cash flows are “take-or-pay” or hedged. Take-or-pay means customers book pipeline capacity, even if they don’t use it. It’s like buying a front-row seat to a play you don’t intend to watch. But hey, that’s business!

Their growth forecast may seem mediocre, but remember, they’re coming off their highest earnings in a decade. It’s like a marathon runner who’s already run 25 miles. They might not be sprinting, but they’re still moving forward!

As you can see in the chart, capital expenditures have been rising since 2022. Initially, it was a recovery from the pandemic. But there are long-term catalysts at play. Artificial intelligence is driving grid expansion, natural gas remains the largest contributor to U.S. power generation, and the U.S. is now the biggest liquefied natural gas exporter. Kinder Morgan plays a key role in the LNG industry, transporting gas from places like West Texas to liquefaction facilities on the Gulf Coast. It’s a complex operation. Like a Rube Goldberg machine, but with pipelines.

Unlike in years past, when Wall Street pressured companies to focus on lean operations, Kinder Morgan now has the green light to invest in long-term projects. This shift should support higher free cash flow, and in turn, larger dividends. It’s a good time to be in the energy infrastructure business. A very good time.

With a 3.9% dividend yield, Kinder Morgan is an excellent high-yield stock to pair with ConocoPhillips in 2026. A dynamic duo. A power couple. A…well, you get the idea. Now, if you’ll excuse me, I have a pipeline to oversee. And a dividend to collect.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- Gay Actors Who Are Notoriously Private About Their Lives

2026-02-02 23:43