Darling, apparently Wall Street is having a collective swoon, absolutely *certain* the Federal Reserve is about to indulge them with a spot of interest rate reduction. How utterly predictable. But a few terribly sensible people – experts, you know – are pointing out that the actual figures paint a rather different picture. Honestly, believing everything the market whispers is rather like trusting a politician. 🙄

And as for Bitcoin (BTC), attempting a recovery, darling, after a bit of a wobble earlier in the week. Reaching a rather impressive $111,000, one hears. One hopes it doesn’t get too carried away.

Why A Cut Now Might Be…Unwise, Don’t You Think?

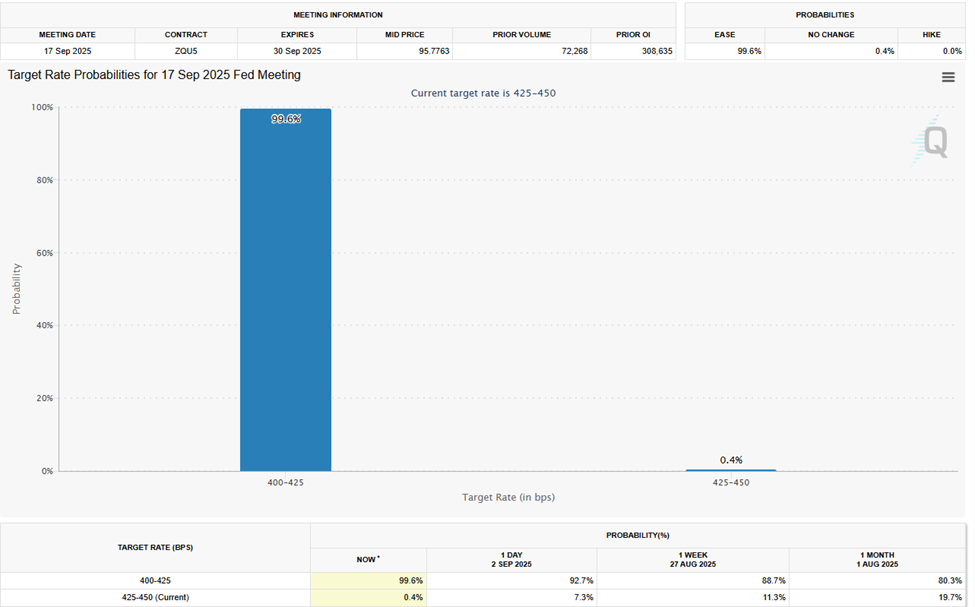

The CME FedWatch Tool, bless its statistical heart, suggests a positively staggering 99.6% chance of a rate cut in September. Practically a foregone conclusion, frightfully boring. Traders are simply *itching* for more easy money, hoping to ignite another dizzying round of asset rallies. Honestly, the naiveté is quite charming.

However, analysts – ever the spoilsports – are warning that this cheerfulness is based more on wishful thinking than cold, hard facts. Sentiment surveys, you see, are terribly unreliable things. People will *always* complain about prices, won’t they? It’s practically a national pastime.

Facts are Stubborn Things

Justin D’Ercole, a clever fellow at ISO-MTS Capital Management, apparently told some terribly serious financial journalists that the data *screams* against any rate cuts.

He fears our policymakers might be bamboozled by a rather fanciful narrative! Consumer frustration, he says, does not equate to a booming economy. How very true.

“The economy is growing at potential, stock valuations are extreme, inflation is running at 3%, and unemployment remains historically low,” The Financial Times reported, citing D’Ercole. Quite. One should think it would be obvious.

Apparently, income is going up rather nicely, and those dreadful credit card delinquencies are down. Even commercial real estate, which everyone thought was about to collapse dramatically, is actually…improving! The world is a perplexing place, isn’t it? 🤷♀️

The Market Wants What It Wants (Naturally)

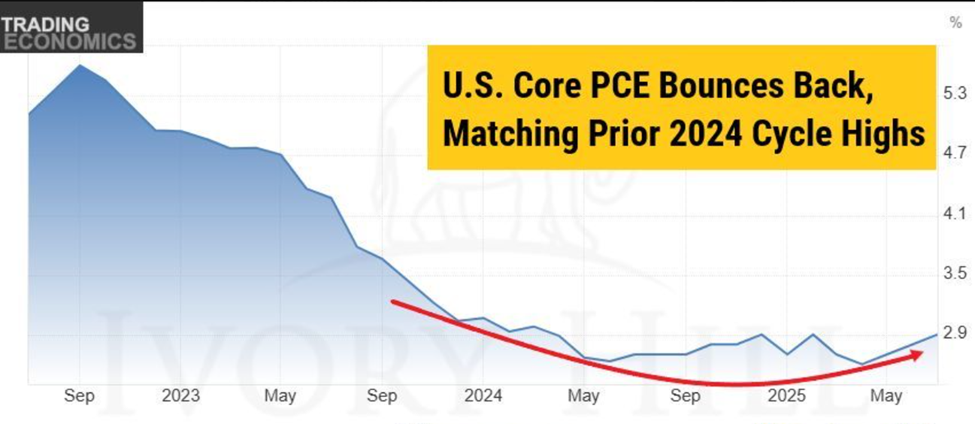

Kurt S. Altrichter, a rather astute chap from Ivory Hill, is echoing this sensible sentiment. He pointed out this dreadful PCE (Personal Consumption Expenditure) inflation data on X (formerly Twitter, how terribly modern).

“Core PCE is back at 2.9%. Inflation isn’t dead, it’s re-accelerating. GDP just printed 3.3%. That’s not a backdrop for rate cuts. If the Fed forces the cut through, it’s likely the only cut before Powell’s term ends on May 15, 2026. Remember: the market wants a rate-cutting cycle. The data says no,” Altrichter articulated. Such a pity when reality clashes with expectations.

The risk, he cautions, is that the Fed will give in to market pressure, and rather ruin its reputation in the process. A devastating prospect, naturally.

Other observers have noticed a disturbing pattern. A fellow named Ted compares the current situation to September 2024. Last year’s surprise cut briefly delighted the crypto markets before… well, let’s just say it didn’t end well.

“September 2024 Fed cut rates, and #Altcoin MCap pumped 109% in just 3 months. After that, $BTC dumped 30%, while alts crashed 60%-80%. In September 2025, the Fed will cut rates again and commit to more cuts. It seems like history will repeat itself. First, a pump for 1-2 months and then a major crash,” wrote Ted. How dreadfully predictable.

It all comes down to a charming little dilemma: credibility versus a temporary reprieve. A rate cut might ease the burden on those rather overextended households and businesses, but it also risks unleashing inflation, bubbles, and general instability. A difficult choice, wouldn’t you say?

“Is saving more marginal jobs in the US economy now more important than maintaining inflation-fighting credibility and financial stability for all consumers?” D’Ercole pondered. A perfectly reasonable question.

So, the Fed faces a terribly taxing test, darling. Will they listen to the data, or will they succumb to the whims of the crowd? One shudders to think. 🍸

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Gold Rate Forecast

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2025-09-04 09:34