Oh, splendid. Bitcoin’s once again hobbling along like a slightly tipsy debutante at a garden party, unable to decide if it’s going up, down, or for a long lie-down. Markets are quivering with fear, selling pressure is thicker than my aunt Mabel’s perfume, and not a single soul knows whether to hold, fold, or simply take up knitting instead.

Enter stage left: the illustrious BitcoinOG (a.k.a. 1011short, a name no doubt chosen for its complete lack of pretension), that enigmatic trader who once shorted the October 10 crash with all the precision of a vengeful ballerina. Now, according to the ever-watchful Lookonchain – which, I assume, holds its breath during market opens – this whale has decided to liven things up. Again. 🎩💥

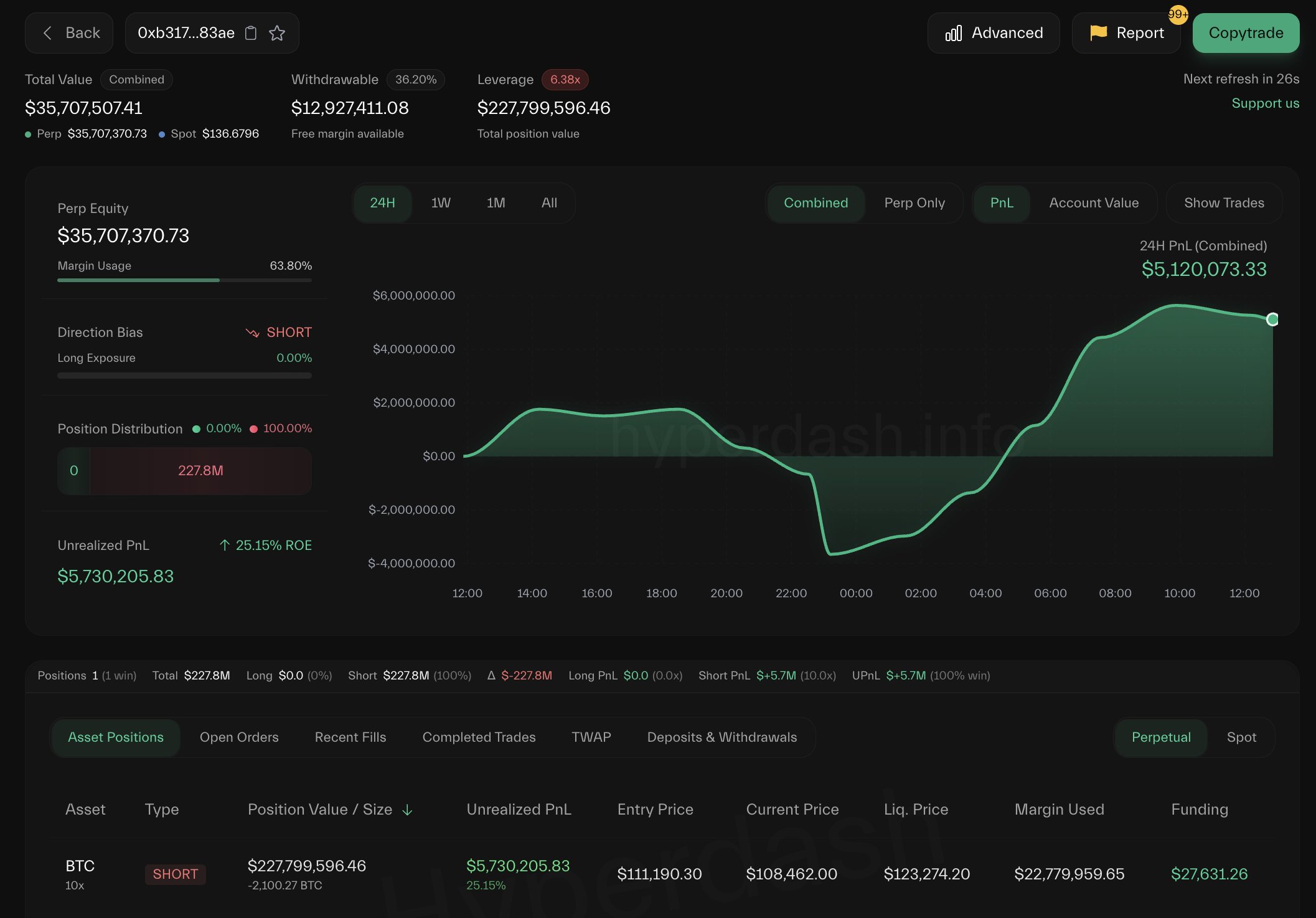

Because obviously, the world wasn’t chaotic enough already, the dear has deposited a smidge over 5,252 BTC – roughly £587 million of nonsense – straight into the gaping maws of Binance, Coinbase, and Hyperliquid. And just in case anyone missed the memo, they’ve also piled on a 2,100 BTC short, valued at a cool $227.8 million. Darling, is that hedging… or simply a cry for attention?

Naturally, the crypto commentariat has erupted into its usual chorus of “DOOM!” and “BUY THE DIP!” – sometimes simultaneously, like confused seagulls. Some insist this is the canary in the coal mine (a rather rich canary, I might add). Others, presumably the eternal optimists who still believe in love after three martinis, suggest this could be the last gasp of pain before another joyous ascent to the moon. 🌕🚀

But do let’s not forget – these are the same analysts who claimed BTC would hit $1 million by Christmas… last year. And the year before. And probably in 1987, had Bitcoin existed then and someone bothered to ask.

Whale Watch: When Your Wallet Weighs More Than a Mini Cooper

Yes, the BitcoinOG is moving about like a particularly agitated squirrel with a hoard of acorns – some may say nuts. Depositing BTC to exchanges? That usually spells “I might sell,” or “I need cash for my third yacht.” And layering on a massive short? Either genius-level foresight or a one-way ticket to financial purgatory. We’ll see.

Though, really, must we hang on every keystroke of some anonymous entity whose real name may well be Derek from Croydon? On-chain data, while thrilling to certain types of men who wear socks with sandals, only tells half the story. The rest could be tucked away in dark pools, OTC chats, or buried in a Swiss vault next to a Bond villain’s gold.

Still, retail investors – bless their cotton socks – will no doubt panic-sell their 0.005 BTC like it’s the last lifeboat on the Titanic. Meanwhile, the “smart money” sips champagne and wonders why everyone else is so bloody dramatic. 🥂🙄

Weekly Chart: A Tense Game of Musical Chairs

The weekly chart, bless its geometric heart, shows BTC teetering around the $108,000 mark – a level that’s apparently more significant than my third divorce. 🎻 It’s snuggling up to the 50-week moving average like a lost puppy, but just can’t summon the energy to break past that dreadfully persistent $117,500 resistance. Been there, done that, bought the volatile volatility.

If $108k cracks? Well, then, it’s off to the races – downhill. Next stop, $100,000, where the ghosts of past bulls still whisper sweet nothings to hopeful buyers. A break below that, and the orchestra will strike up the funeral march. 🎺⚰️

On the flip side, reclaiming $117.5k would be rather like a hero’s return – trumpets, confetti, the whole caboodle. Suddenly, $125k-$130k is back on the menu, and hope blooms eternal in the hearts of men who should really know better by now.

In sum? The trend remains cautiously bullish – much like my ex-wife’s opinion of me after two glasses of Chablis. But one more wobble, and the whole splendid façade could crumble like a poorly made soufflé.

So pour a drink, light a cigarette (do they still allow that somewhere?), and watch the whales dance. For they, not we, appear to hold the keys to this particular circus. 🎪🍸

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

2025-10-23 05:15