The story of energy in our epoch is much like a sprawling Russian novel—an endless interplay of titanic ambition, ephemeral progress, and the ever-returning question: what, truly, is the role of mankind’s inventions? Within the churning machinery of the world’s markets, the drama of oil and sun reveals itself not merely as financial maneuvering but as an epic saga of continuity and revolution, yearning and resignation. An observer intent upon the state of things—not the facts alone, but their hidden meaning—cannot help but feel that, in deliberating over what to do with a modest $500, one becomes a minor participant in this grand enterprise.

The pursuit is not for novelty’s sake, nor simply for gain, but for a certain tranquility—a security, both in the pocket and in the soul, against the caprices of history. The market rewards those who choose with the patience of the Volga and the circumspection of a landowner’s steward. Let us, therefore, trace the destinies of three enterprises—each burdened by its inheritance, each restless with longing for tomorrow.

1. ExxonMobil: The Enduring Empire and Its Modern Ruminations

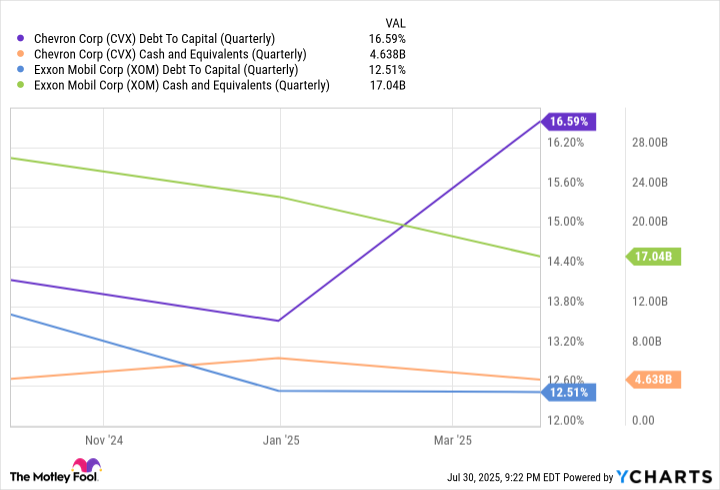

ExxonMobil (XOM) stands, like an aged noble family, fortified by generations of accumulated wealth and a reputation forged in the upwellings of oil fields. The world may whisper of change—indeed, temptation to decry the old order is fashionable in salons from London to New York—but the simple fact is that Exxon, with its tendrils snaking from refinery to distant filling station, exerts a gravity difficult to overcome. Here, the balance sheet sits as stolid and implacable as Prince Bolkonsky’s estate book: $18.5 billion in cash and a whisper-thin debt-to-capital ratio of 12%. Exxon’s leaders, well aware of both adulation and animosity, have learned that only adaptation ensures survival.

In December 2024, steered by the stern hand of its stewards, ExxonMobil pledged not just to persist but to reimagine itself: $140 billion summoned for grand projects, a third of which—$30 billion—set aside for the transient dreams of tomorrow: carbon capture; the ghostly promise of hydrogen; lithium, that silvery child of batteries and hope. Some cynics may deride these efforts as mere pageantry, but no house survives without at least a gesture to the times.

And so the dividend, a sacrament adhered to with the faithfulness of the liturgy, persists for 42 years uninterrupted, currently yielding near 3.5%. Here, Exxon’s shareholders resemble peasants at harvest: patient, enduring, rewarded—if only they wait and abide the cyclical change of weather. To invest in Exxon is less a wager than an alliance with the principle that the more things change, the more some must stay the same.

2. Enbridge: The Keeper of the Great Pipeline

In Canada’s wide and snowed expanses, Enbridge (ENB) forges itself as an enduring artery of commerce. Picture its 18,000-mile lattice of pipelines—not merely as infrastructure but as the infrastructure: silent, reliable, and, much like the network of relationships in a provincial town, utterly inescapable for those who depend on it. To own Enbridge is to grasp a source of strength that neither war nor peace, neither storm nor sunshine, has yet managed to disrupt.

Enbridge seduces investors not only with a dividend north of 6%—a yearly act of reassurance, dramatized for three decades without fail—but with an ambition to reconcile the majesty of yesterday’s fossil-fueled laurels with the inexorable march toward renewables. In this struggle, the company’s directors demonstrate both shrewdness and humility, investing in not one but many potential sources of future strength: extensions of the pipeline itself, yes, but also offshore winds and the quiet harvest of solar photons.

Their recent endeavor, the Clear Fork solar project—a $900 million pact tethered to Meta Platforms—conjures images of czars and industrialists, once isolated, now entangled in the same fate. That those earnings will flow as surely as the Neva melts in spring is a comfort to those possessing the stoic patience of a Petersburg bureaucrat amid the chronic uncertainty of energy markets.

3. NextEra Energy: The Faith of the Modern World

With NextEra Energy (NEE), we face the sort of phenomenon only the modern century could conjure—a company whose ambition is measured not in barrels or miles but in gigawatts and the purity of its conscience. NextEra, steward of Florida Power & Light and the world’s greatest wind and solar producer, invites its shareholders to participate not only in profit but in progress—if, indeed, such a thing bears scrutiny.

The heart of NextEra’s enterprise is not the quarterly result but its pipeline to the future: 3.2 gigawatts of new projects added in a single quarter, thirty in backlog—a number so prodigious it rivals in majesty the catalogues of Catherine the Great’s art collection. And yet, is it the promise of unending growth—6% to 8% in earnings yearly, 10% in dividends until 2026—that truly satisfies the weary investor’s soul? Or is it, perhaps, the sense of purpose one gleans from aligning one’s capital with the sun and wind?

A note of caution—always necessary where ideals masquerade as inevitabilities. The market, ever more sophisticated than its participants, blesses NextEra with a premium multiple. Here, as in so many Russian stories, the price exceeds the present value; but perhaps the heart, burdened as it is with belief, will not be daunted.

Reflections Beneath the Endless Sky

Oil, the sinew of old empires; pipelines, the blood vessels of the continent; the wind, the breath of what may come—these are the choices that unfold in the market’s shadowy theatre. To choose among them is less a matter of mathematics than of temperament and philosophy. Will the patient, dividend-seeking soul find solace in Exxon’s stony constancy or Enbridge’s inexorable flow? Or will the restless idealist cast his lot with NextEra, and in so doing, wager not merely upon returns, but upon the very future of human endeavor?

All investments, in the end, are confessions of faith. The wise observer does not dismiss doubt but recognizes it as implicit in every decision, as essential as the seasonal thaw to the Russian soil.

May your portfolio endure, and may your patience rival the steppe’s horizon. 🛢️

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- The Best Actors Who Have Played Hamlet, Ranked

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

2025-08-03 09:25