In the labyrinth of capital, Oaktree Capital Management etched a new path, acquiring 6.4 million shares of Core Scientific (CORZ 7.79%) in the third quarter-a move valued at $114.8 million, as recorded in the archives of the SEC.

The Labyrinth of Acquisition

According to the cryptic scrolls of the Securities and Exchange Commission, Oaktree initiated a new position in Core Scientific during the third quarter. The fund, in its infinite quest for value, purchased 6.4 million shares, their worth estimated at $114.8 million as of September 30. This addition swelled Oaktree’s collection of 13F reportable positions to 62, each a fragment of a larger, unknowable tapestry.

The Library of Holdings

The volumes of Oaktree’s portfolio, post-filing, include:

- NASDAQ:TRMD: $834.6 million (17.6% of AUM)

- NASDAQ:EXE: $537.8 million (11.3% of AUM)

- NASDAQ:GTX: $434.4 million (9.2% of AUM)

- NYSE:AU: $294.3 million (6.2% of AUM)

- NASDAQ:VNOM: $240.2 million (3.7% of AUM)

As of Thursday, Core Scientific’s shares languish at $15.16, a descent of 6% over the past year, outpaced by the S&P 500’s ascent of nearly 15%. A mirror of the market’s capriciousness.

The Catalog of Metrics

| Metric | Value |

|---|---|

| Price (as of market close Thursday) | $15.16 |

| Market Capitalization | $4.7 billion |

| Revenue (TTM) | $334.2 million |

| Net Income (TTM) | $-768.3 million |

The Fragment of a Fictional Encyclopedia

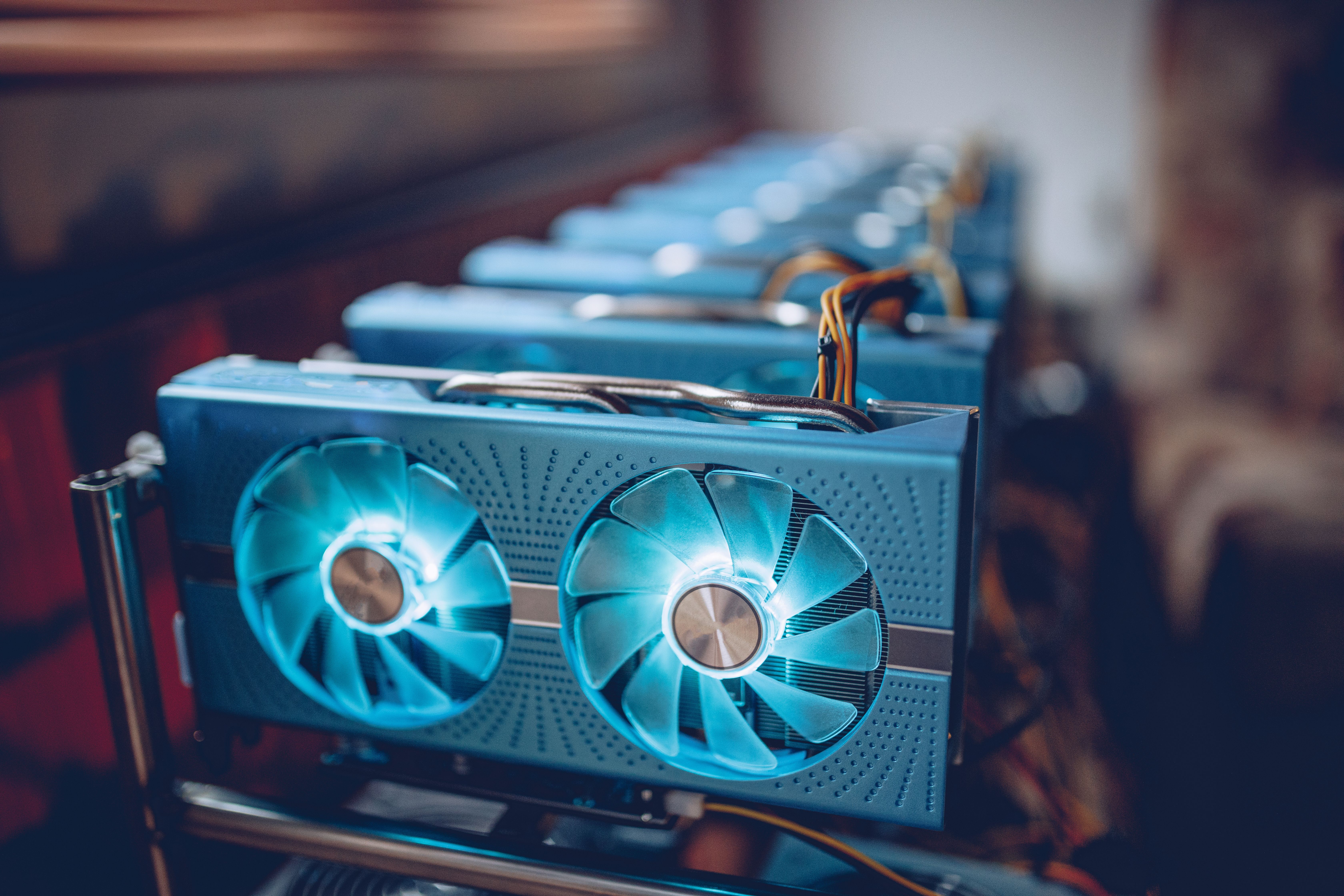

- Core Scientific, Inc. operates within the infinite library of blockchain, offering digital asset mining, infrastructure, and colocation services. Its revenue flows from both self-mined assets and third-party contracts.

- The company, a custodian of datacenter facilities, processes blockchain transactions, earning fees from institutional patrons.

- Its primary clients are titans of digital mining and enterprises seeking secure, high-performance infrastructure in North America.

Core Scientific, a specter in the labyrinth of digital finance, leverages proprietary technology and vast datacenter operations to serve institutional clients. Its dual revenue model-self-mining and hosting-aims to harness the infinite demand for scalable blockchain solutions. Yet, its competitive edge lies in scale, expertise, and a client base as enigmatic as the market itself.

The Apocryphal Take

Oaktree’s $115 million wager on Core Scientific, a gesture of faith in the crypto-miner, coincided with the stock’s precipitous 34% fall since early November, following the collapse of a proposed merger with CoreWeave. The third-quarter filing reveals Oaktree’s acquisition of 6.4 million shares, a significant entry in its portfolio. Yet, the timing mirrors the market’s eternal dance with volatility.

Core Scientific’s October 24 earnings report revealed $81.1 million in quarterly revenue, a decline from $95.4 million the prior year. While net loss narrowed to $146.7 million from $455.3 million, margins remained taut, and adjusted EBITDA turned negative. On October 30, the failed merger with CoreWeave-its votes insufficient-cast shadows over the company’s execution. CoreWeave’s CEO, when questioned about data center delays linked to Core Scientific, evaded, triggering a 10% plunge in shares. A riddle without resolution.

Oaktree’s maneuver aligns with its strategy of energy and infrastructure, alongside holdings in Viper Energy and AngloGold Ashanti. Yet, the stock’s volatility underscores the labyrinth’s unpredictability. Long-term investors, like seekers of the infinite, must ponder whether Core Scientific can stabilize its path and transcend the failed merger’s echoes before reimagining its growth narrative.

The Glossary of Shadows

13F reportable assets: The archives of institutional investment managers, disclosed quarterly to the SEC, revealing their equity holdings.

Assets under management (AUM): The total market value of investments managed on behalf of clients, a measure of a fund’s reach.

Position: The amount of a particular security held by an investor, a fragment in the labyrinth.

Trailing twelve months (TTM): The 12-month period ending with the most recent quarterly report, a temporal mirror.

Colocation hosting: A service where businesses rent space in a third-party datacenter, a temporary refuge.

Digital asset mining: The process of validating blockchain transactions, earning rewards in digital assets, a pursuit of the infinite.

Blockchain infrastructure: The hardware, software, and facilities sustaining blockchain networks, a library of code.

Proprietary mining: Mining digital assets for one’s own account, a solitary endeavor.

Hosting contracts: Agreements providing space, power, and maintenance for clients’ computing equipment, a pact of mutual reliance.

Institutional clients: Large organizations investing at scale, titans of capital.

Market value: The current total value of a security, a fleeting reflection.

Datacenter facilities: Specialized buildings housing computer servers, a cathedral of computation.

🌀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Superman Still Lost Money Theatrically Despite ‘Strong Performance’ in WB’s Q3 Earnings

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-11-14 17:30