Now, listen closely. For a good long while, if you wanted a slice of the Artificial Intelligence pie – a particularly scrumptious pie, mind you – you’d head straight for Nvidia. That’s NVDA, if you’re the type who likes little codes. They’re the chaps who make the brain-boxes for all the clever machines, and for years, they’ve been scooping up the profits like a greedy badger raiding a honey pot. Every quarter, the numbers went up and up, and the message was always the same: everyone wanted their bits and bobs, so much so that they couldn’t make them fast enough.

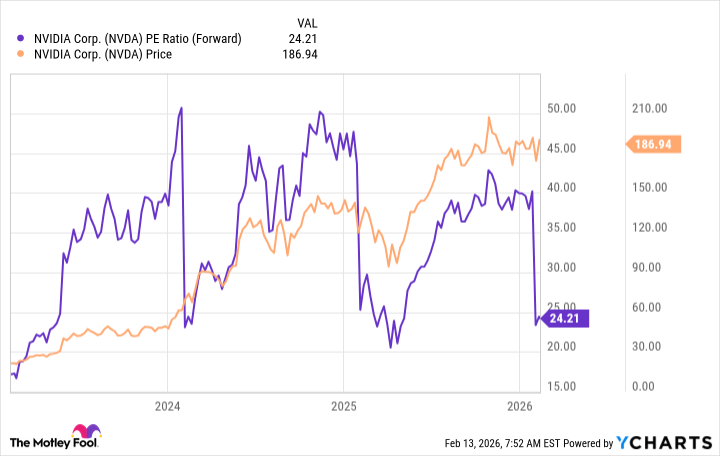

This, naturally, sent the share price soaring. Five years ago, a handful of pennies, now a proper mountain of money. But recently, things have been a bit… wobbly. Investors, those fussy folk with their noses in the numbers, started getting twitchy. They worried the AI pie might not be as big as everyone thought, and that these AI companies were inflating like overripe balloons. Any little sniffle from the market, any tiny bit of bad news, sent shivers through Nvidia’s share price.

And that brings us to the curious thing. Nvidia’s stock did something it hasn’t done in a year. It stumbled. A most undignified wobble for a company so used to striding confidently forward. And history, you see, has a rather predictable habit of repeating itself.

The News That Gave Nvidia a Nudge

Let’s unwrap the little package of bother that caused this wobble. The worry about an AI bubble, you see, has been hanging around like a persistent cough. Investors began to eye the amount of money flowing into AI with suspicion. They wanted to see if the investment would actually grow the pie, or just make it look bigger for a bit.

Then came a bit of a kerfuffle. The Wall Street Journal – a newspaper filled with very important, and often very boring, numbers – reported that Nvidia’s plan to pour a colossal amount of money – as much as 100 billion dollars! – into OpenAI, the clever chaps making all those chat-bots, had hit a snag. Now, Nvidia’s boss, Jensen Huang, insisted everything was tickety-boo, but the market doesn’t always listen to bosses, does it? OpenAI is a very important customer, so any trouble there makes investors nervous.

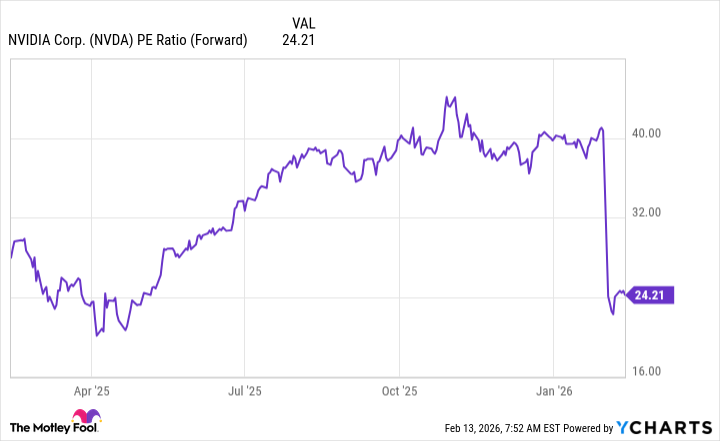

And so, Nvidia’s stock reached a rather low valuation – a bit like being the shortest giant in the land.

Now, here’s the peculiar part. Every time, over the last three years, Nvidia’s valuation has dipped like this, the share price has bounced back like a rubber ball. A rather convenient pattern, wouldn’t you say?

What Might Happen Next?

History suggests, and history is rarely wrong, that Nvidia won’t stay cheap for long. Investors, those greedy creatures, will pile in, and the share price will start climbing again. It’s a rather predictable game, really.

But, a word of caution. History isn’t a crystal ball. It’s more like a slightly smudged photograph. And the world is a bit different now than it was a year or two ago. Investors are a bit more cautious, a bit less willing to throw money at anything shiny. That might slow things down a bit.

Is Nvidia a Buy?

Does this mean you should avoid Nvidia? Absolutely not! This little dip in the share price is a golden opportunity. Nvidia is still the king of the chip market, the boss of the brain-boxes. Even if other companies start making their own chips, or buying from elsewhere, most of them will still need Nvidia’s chips at the heart of their systems.

And Nvidia isn’t resting on its laurels. They promise to update their chips every year, and they’re planning a new platform, called Rubin, later this year. If their previous releases are anything to go by, it’ll be a roaring success. Blackwell and Blackwell Ultra both caused quite a stir.

The long-term story hasn’t changed. Analysts predict a trillion-dollar AI market in a few years. And Nvidia is perfectly positioned to gobble up a large slice of that pie.

So, even if Nvidia doesn’t follow the historical pattern and bounce back immediately, it’s still a solid investment. It’s a bargain buy on the dip today, a chance to get in on the ground floor of a rather magnificent machine. And that, my friends, is a very good thing indeed.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Wuthering Waves – Galbrena build and materials guide

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- 📢 New Prestige Skin – Hedonist Liberta

- The Most Anticipated Anime of 2026

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-15 21:12