![]()

Well, gather ’round, folks, for a tale most ripe for our times! In days not far hence, just after the closing bell on that fateful Wednesday, August 27, the grand showman known as Nvidia (NVDA)-the illustrious forerunner of that curious creature we call artificial intelligence-will take to the stage to proffer its fiscal second-quarter results. This venerable company stands as a colossus atop Wall Street’s crowded landscape, one that’s been buzzing with the fervor of a beehive following a rainstorm.

Now, if you’ve been paying an iota of attention, you’d know AI is hotter than a griddle on a sunny July day. With bits and bytes strung together like pearls on a necklace, this technology promises to imbue our devices with a kind of intelligence that allows them to make decisions in the blink of an eye, and wouldn’t that be a marvel! According to the sage scribes of PwC in their tome Sizing the Prize, the golden goose of AI might just lay eggs worth a staggering $15.7 trillion by the dawn of 2030. Quite a haul, if I may be so bold!

Yet, dear reader, we must cling to our hats, for despite Nvidia’s stock soaring by an awe-inspiring 1,100% since the year’s bright beginning, one has to wonder if our gallant hero can truly dazzle the expectant crowd of Wall Street on that August day. The performance of the company may very well be set amidst a backdrop of sky-high hopes that could come crashing down like a house of cards at the first hint of a breeze.

Margins, My Dear Friend, Will Steal the Spotlights

When it comes to those marvelous AI-graphics processing units (GPUs), Nvidia is the undisputed leader of the pack, with their prized Hopper (H100) and Blackwell GPUs galloping ahead of the competition. Yet, what’s even more important than their flashy hardware is the ever-dwindling supply of AI-GPUs which, like a prized fish in a dry pond, are becoming increasingly rare.

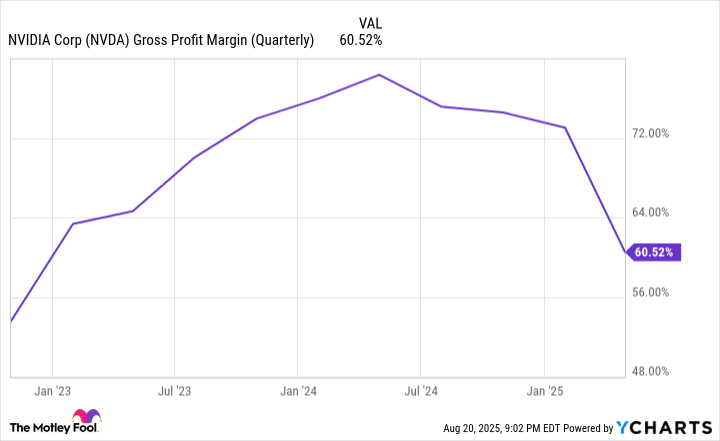

According to the laws of supply and demand-those age-old rules that, if they could be put on trial, might just plead guilty to causing havoc-when the thirst for a good or service outstrips its availability, prices are bound to rise faster than a prairie fire. Nvidia has managed to write its own ticket with a staggering GAAP gross margin of 78.4% in the first quarter of fiscal 2025, courtesy of this scarcity. But hark! This golden era may not last.

For lo and behold, the tides are turning! Advanced Micro Devices and the crafty chaps at Huawei are now nipping at Nvidia’s heels with their own data-center chips. And the real trouble may come not from without, but from the very heart of Nvidia’s empire.

Their biggest customers, the illustrious “Magnificent Seven,” are now pouring their resources into developing their own AI GPUs, thus threatening to siphon off Nvidia’s market empire. While these budget-friendly chips may not rival Nvidia’s might, they are sweet enough to lure a mighty number of buyers away, costing the kingpin valuable territory.

With the demand for these high-flying chips beginning to smooth out, Nvidia’s pricing strength may fade as surely as cotton candy at a county fair. Indeed, we may already be witnessing a slow bleed in margins that has persisted for more than a year now.

Valuation: An Uphill Climb for Our Hero

As we center our gaze on these margins, I assure you, dear reader, that Nvidia faces the Herculean task of justifying its lofty valuation amid a market that has turned as gaudy as a peacock in full display. You see, I reckon Nvidia truly deserves a premium-a fat slice of the pie-thanks to its monumental advantages. But one must ponder: how far can this premium stretch before it becomes a straw on the proverbial camel’s back?

History tells us that the favored ones, those heralds of the next big trends, find their valuations withering away quicker than a wildflower under a hot sun. Before the great dot-com bubble burst, titans like Cisco Systems, Microsoft, and Amazon found their P/S ratios bouncing faster than the hare in the famous race. Save for the oddball Palantir Technologies, no giant has maintained such lofty valuations for long.

In recent times, Nvidia’s P/S ratio hovered above 30-quite the luxury, I must say. Though projected sales growth of 53% may offer a breath of fresh air, it still finds itself lounging atop a figure that strains credulity.

Moreover, it is but a handful of these high-flyers-of which Nvidia is a prominent member-that have inflated the S&P 500‘s Shiller P/E ratio to dizzying heights, a treacherous spot to be in, as history often repeats itself with declines of 20% or more lurking around the corner.

Pardon the pun from earlier, but when margins are tight-there’s simply no room for error.

A Rattle in the Shackles of History

Now, let us turn our eyes to the panorama of history, where the shadows of past trends loom large over Nvidia’s present predicament. For three decades, the world has gazed in wonder at the bright and shiny next-big-thing, each one promising to be the golden ticket-that train to glory. And yet, time after time, these innovations have met their makers, leading not to everlasting prosperity, but often to bubbles bursting with a mighty bang.

Oh, how the euphoria runs wild! Investors, with their chins raised high, often miscalculate the devotion of businesses to truly harness these novelties. Take the internet, for instance-its revolutionary potential took many years to crystallize! With such heady expectations around artificial intelligence, it seems a tad premature to expect it to have matured within the blink of an eye.

The insatiable demand for AI infrastructure is delightfully promising, yet many enterprises remain ankle-deep, barely skimming the surface of AI’s potential, as profits remain an elusive ghost. Such signs spill forth the possibility that we might have once again overhyped what this fervent revolution may actually deliver, at least in these tender early stages.

Indeed, no company’s fate rests more closely on the whims of investor zeal than dear Nvidia, which over the last three years has seen its valuation swell by close to $4 trillion-an achievement as astounding as it is precarious. A mere hiccup in this grand performance could stir the pot and send this hype swirling into the abyss.

In conclusion, while we must not discount Nvidia’s robust standing and enduring legacy, let us remember, its road is far from straight, and perfection is a capricious mistress that Wall Street demands of its champions. 🏦

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-08-24 10:14