The S&P 500 and Nasdaq Composite flutter about their all-time highs like debutantes at a ball, their gowns stitched with threads of artificial intelligence euphoria and the whisper of forthcoming rate cuts. How delightfully modern – the market now dances to algorithms rather than symphonies.

Yet let us not forget, dear reader, that beneath this masquerade of macroeconomic flirtations lies the eternal truth: earnings are the only currency that survives revolutions. Even revolutions in silicon valleys.

Nvidia (NVDA) – that most improbable of tragic heroes – shall unveil its quarterly parchment on Aug. 27. The anticipation? Positively Shakespearean. But then, what is a stock market if not the modern Globe Theatre, where fortunes rise and fall faster than Hamlet’s sanity?

The Semiconductor Siren’s Spell

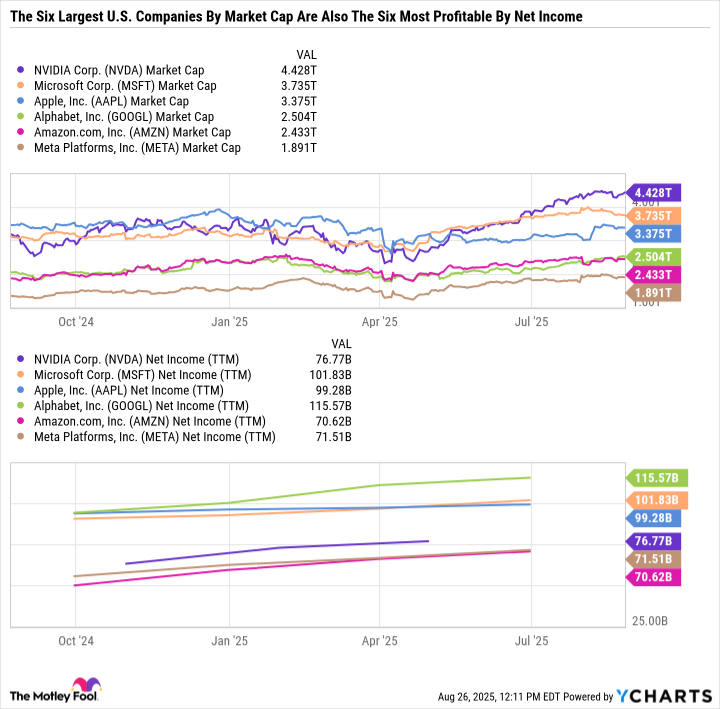

The “Ten Titans” – those gilded giants composing 38% of the S&P 500 – have transformed the index into a gilded cabinet of curiosities. Nvidia, darling of the algorithmic age, claims prime position with 7.5% weighting. One might say the index wears its heart on its motherboard.

Joining this mechanical pantheon: Microsoft, Apple, Amazon, Alphabet, Meta Platforms, Broadcom, Tesla, Oracle, and Netflix. Together, they form a digital divina commedia – though whether Dante would recognize their profits as divine remains questionable.

Since 2023, Nvidia has conjured $4 trillion in market cap and $70 billion in net income. To put this in perspective: its earnings growth could make Midas blush at the comparative poverty of mere golden touchery.

Earnings: The New Alchemy

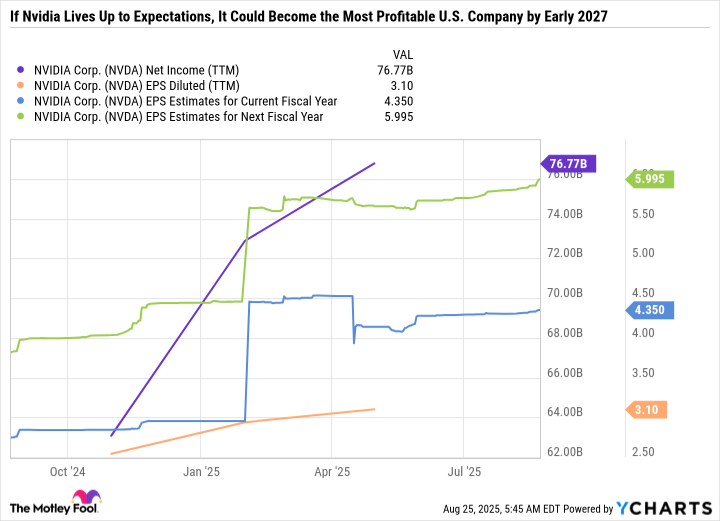

Analysts once stumbled after Nvidia like suitors after a particularly elusive coquette. Now they pen sonnets to its future: $4.35 EPS for fiscal 2026, with a 37.8% growth spasm anticipated for 2027. By then, its projected $148.5 billion net income would make Rockefeller’s fortune seem the petty cash of a dilettante.

Yet herein lies the rub: should Nvidia’s patrons – those four unnamed hyperscalers – falter in their AI orgies, the emperor’s new chips might suddenly appear rather scantily clad.

The Capex Conundrum

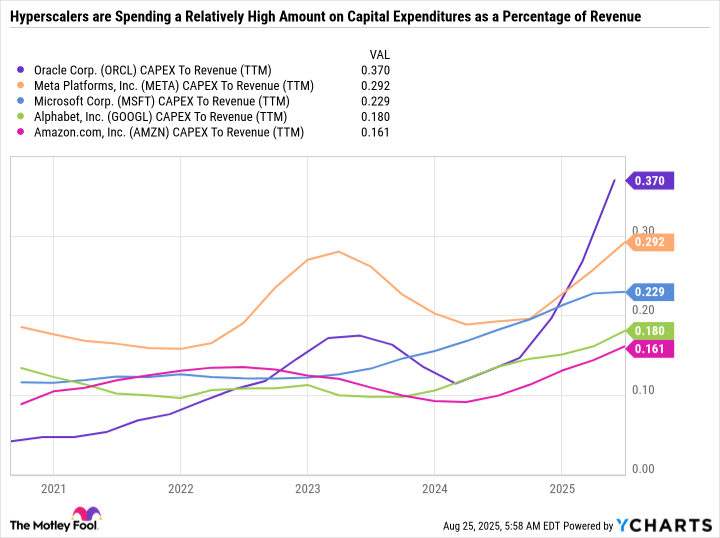

These modern titans spend on AI like dandies on champagne – 54% of Nvidia’s revenue flows from four customers presumably guzzling innovation through golden straws. But as any seasoned aesthete knows, the true test lies not in the spending, but in the digestion.

When shall we see AI’s banquet transformed into profits, rather than mere crumbs of capex? The market’s patience, like a fin de siècle opera audience, grows ever more demanding of spectacle.

The Dandy’s Dilemma

To invest in Nvidia is to waltz with a partner whose every step might create a symphony or a stock collapse. Its fortunes hang upon AI’s promise like Oscar Wilde’s reputation upon a well-turned phrase.

Shall the Titans continue their pirouette toward market domination? Or will the music stop, leaving shareholders clutching empty champagne flutes? The answer lies not in our stars, but in our spreadsheets.

Approach with measured elegance, dear investor. For as I always say: “To speculate in tech is human, but to hodl with style – ah! That’s divine.” 🎩⚡

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-08-26 23:06