Behold! Nvidia, that most imperious of actors, now occupies the stage with a market capitalization exceeding $4.5 trillion. One might imagine it in the role of a tragic hero, had not the script read ah!-a farce. The curtain rises on a world where artificial intelligence reigns, yet the spotlight falls solely upon Nvidia’s chips, their shareholders’ greed and the customer’s deluded hopes entwined in a dance most absurd.

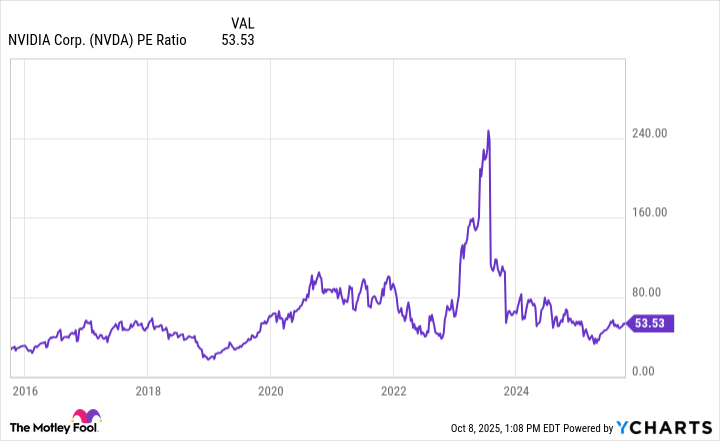

Yet, as the P/E ratio soars to celestial heights, one must ask: Is this Æschylus of technology now Butus the Fool? For investing in unbridled euphoria often ends in Greek tragedy. Let us dissect the numbers with scalpel and wit, lest we be seen applauding a fundamentally flawed performance.

An OpenAI Partnership: A Wedlock of Hubris

OpenAI, that Pygmalion of algorithms, recently married Nvidia in a union of mutual grandiosity. Alas, it is the kind where both parties promise riches yet know not the source. Some $100 billion-yes, that is 1 followed by 11 zeroes-shall be spent on Nvidia’s wares to fuel OpenAI’s sans khí data centers. “Rubin chips,” they call them, as if bestowing birth upon a Tech sensory phantom. Thus, the investor is left to wonder: Will this alliance birth innovation or merely inflate egos

For the portfolio manager, this parlay is an ode to calculated folly. Nvidia invests to sell; OpenAI sells to grow. Their chips, their wealth-circular like the theater of fools. Should the audience of Microsoft and Amazon find their seats on this stage, perhaps the curtain shall fall harder.

The Customer as Rival: A Turkish Folly

While OpenAI dances with Nvidia, greater rivals loom-Alphabet, Amazon, Microsoft,Meta Platforms. These are no mere patrons in the audience. Nolens volens, they shall take up the role of challengers. Custom chips they fashion, though their

Alphabet, forsooth, possesses its TPU-venerable in its decade of existence, yet as relevant as Tartuffe to the modern stage. Efficient it may be in its domain, but a plaything compared to Nvidia‘s Rubicon of data processing. Thus, one may yet sigh and admit: Even Google cannot yet dismantle the stage set by Nvidia alone.

Still, the investor must watch this subplot with the careful eye of Molière, for any playwright knows that the audience’s patience grows thin for a singular star for too long.

Where the Curtain May Fall (Or Rise)

Five years hence, shall our redoubtable Nvidia still reign atop this peak

At a P/E ratio of 53, the action is penned in gold and trembling hands. The scenario most assured is a gilded stasis-revenue unchanged, market cap mirrored. Or perhaps the plot thickens further: demand for AI software falters as data centers chase ghosts, and the great man finds but a fraction of his fortune.

Thus, the portfolio manager dare not rush in, hat in hand, to prop up Nvidia‘s crown when it may yet storm. Let others fall in love with the art of the flashy illusion; in the world of investing, the wise observer empties the theater quietly, seeking seats unlit by the sun’s errant rays.

For the farce of the future may yet end with a crash… or worse, with applause. 🎭

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- The Weight of First Steps

- Opendoor’s Stock Takes a Nose Dive (Again)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-10-13 04:03