The year has unfolded as a tempestuous odyssey for the semiconductor luminary, Nvidia (NVDA), its stock oscillating between celestial heights and subterranean depths. A crescendo of volatility, fueled by tariffs’ siren song, inflation’s relentless march, and the enigmatic dance of chip sales to the Middle Kingdom, rendered 2025 a year of fiscal chiaroscuro.

Yet, the shadows of doubt now recede, at least temporarily. Nvidia’s stock, a mere 4% shy of its apotheosis, teeters on the precipice of a new ascent, its trajectory poised to mirror the capricious whims of a fickle fortune.

Whispers of a new dawn emerged this week, a rumor as tantalizing as a half-remembered melody, hinting at the long-awaited catalyst for Nvidia’s investors.

An Answer to the China Conundrum

The specter of AI chip sales to the Middle Kingdom loomed like a shadow over Nvidia’s ledger. Earlier this year, the U.S. government, in a fit of regulatory caprice, suspended the H20 chips-those paragons of computational might-leaving the company to grapple with a $4.5 billion fiscal albatross. These GPUs, engineered to circumvent export restrictions while channeling the raw power of AI, had generated $17 billion in sales during fiscal 2025, a 13% slice of Nvidia’s pie. Wall Street’s projections, a labyrinth of optimism, foresaw a potential $26 billion gash in revenue.

Yet, Huang, that astute strategist, wove a tapestry of persuasion. A 15% revenue-sharing pact with the U.S. government, a Faustian bargain, allowed the H20 to resume its journey to Chinese shores. While margins may wane, the door to a lucrative market remains ajar, though the narrative harbors further intrigue.

Meet the B30A

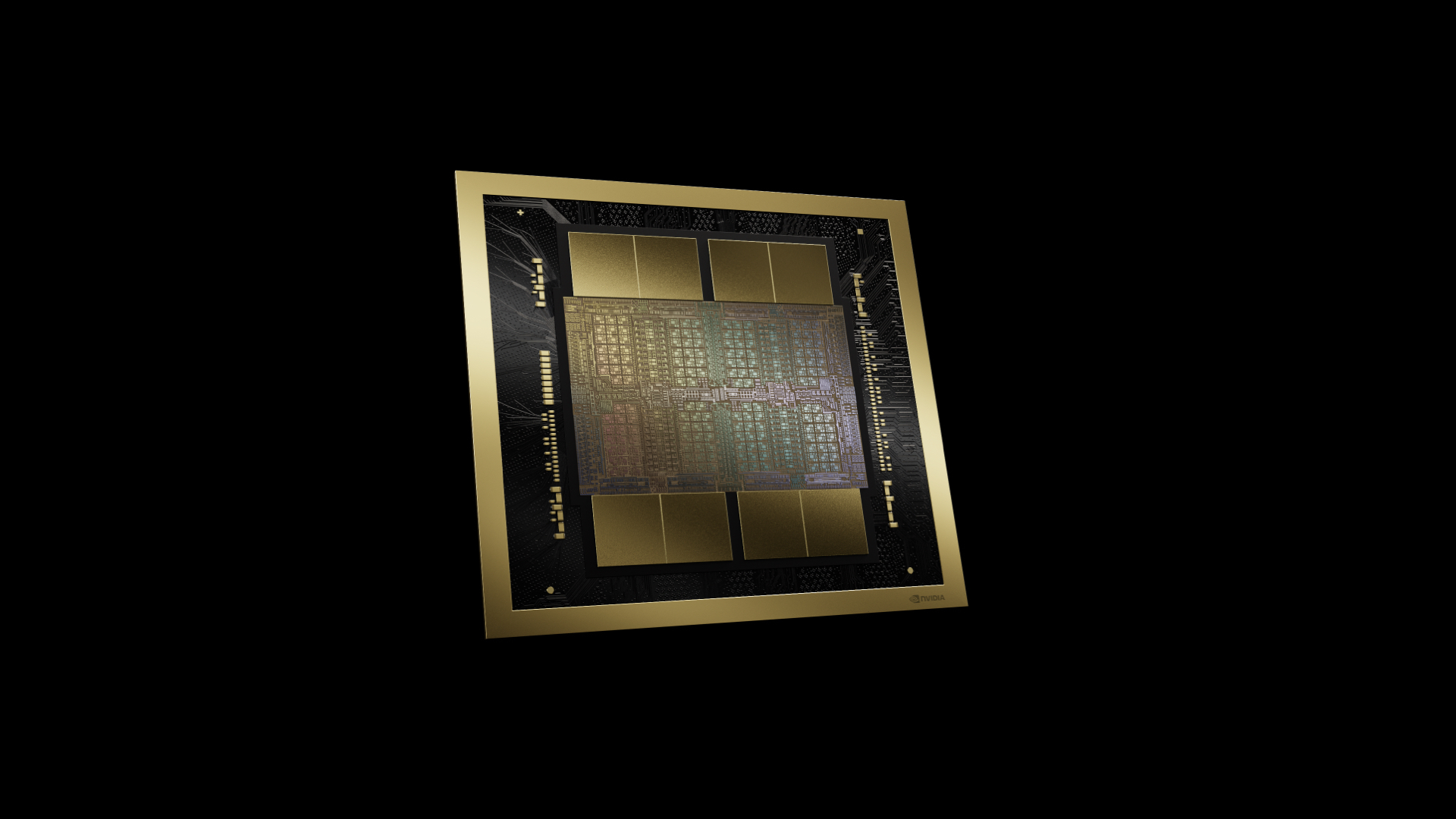

A whisper from Reuters, citing “two well-informed souls,” speaks of a new AI chip, the B30A, rooted in the Blackwell architecture. This enigmatic processor, purportedly half the might of the B300, mirrors a curious symmetry. During a recent press conference, Trump, that arch-architect of paradox, mused on a “somewhat enhanced-negatively-Blackwell,” a phrase as enigmatic as a Zen koan. “Take 30% to 50% [of the computing power] off of it,” he mused, a sentiment as cryptic as a riddle.

Nvidia, ever the enigma, clings to its secrets. “We evaluate a variety of products for our roadmap,” the company intoned, “prepared to compete within the bounds of governmental allowance.” Yet, should a deal materialize with the Trump administration, a windfall may yet bloom.

The Implications for Nvidia Investors

In May, Huang, that oracle of foresight, posited a $50 billion annual market for AI chips in China, a figure as tantalizing as a mirage. Wall Street’s forecasts, a tapestry of ambition, envision $200 billion in fiscal 2026, escalating to $302 billion by 2028. With China’s 13% share, the potential revenue could swell to $99 billion over three years, a sum that may yet elude current models.

Even a scaled-down Blackwell, a truncated titan, would command a premium from Chinese buyers, its price a testament to the enduring allure of innovation. The exit of fair-weather investors, once spurred by the specter of exclusion, now gives way to a rekindled optimism. At a valuation beneath 30 times projected sales, Nvidia’s stock, a siren song to the discerning, beckons with the allure of a well-timed bet.

Thus, the tale of Nvidia, a saga of resilience and recalibration, unfolds-a testament to the interplay of geopolitics, ingenuity, and the ever-shifting tides of capital. 🚀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-08-22 10:08