It is a truth universally acknowledged, that a company in possession of good fortune, must be in want of continued growth. Indeed, the recent performances of certain prominent concerns – Nvidia, Alphabet, Apple, Microsoft, Amazon, Meta Platforms, and even Tesla – have been such as to command the attention of all observing minds. Their collective influence upon the market, exceeding a third of the entire S&P 500, is a circumstance not to be dismissed lightly.

These five, the most substantial of the ‘Magnificent Seven’ as they are rather fancifully termed, have matured beyond mere revenue accumulation. They have become, one might say, comfortably established, generating profits with an ease that invites both admiration and, perhaps, a degree of cautious scrutiny.

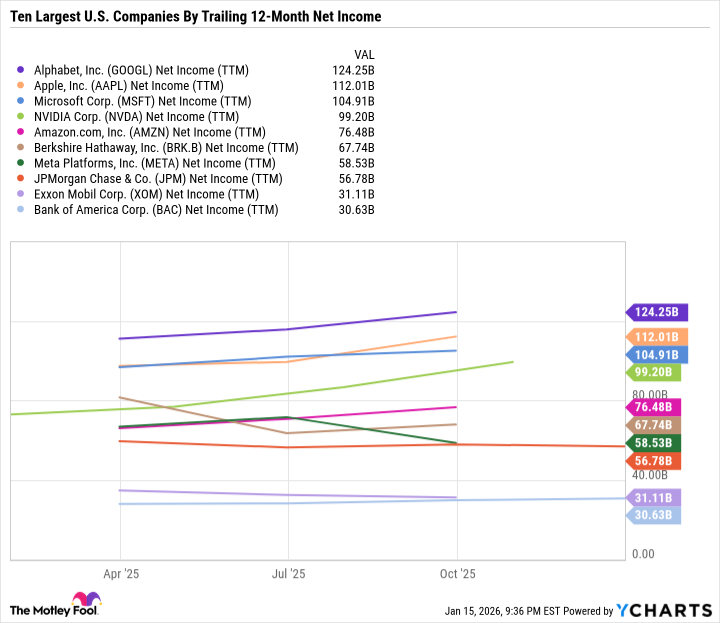

Nvidia, currently holding the fourth position in terms of profitability, appears poised to challenge the established order. A most remarkable prospect, and one which, upon closer examination, reveals itself to be not entirely improbable. Within the next two years, it is conceivable that Nvidia may surpass Microsoft, Apple, and Alphabet in net income, a circumstance which would undoubtedly provoke considerable discussion within the financial circles.

Nvidia’s Rising Fortunes

Three years past, Nvidia concluded the year with a share price of a modest $14.61. A circumstance which, in retrospect, appears almost quaint. By the close of the subsequent period, the value had ascended to $186.50, accompanied by a market capitalization of $4.5 trillion. A prodigious increase, to be sure, and one which might, in less discerning hands, be viewed with alarm. Yet, a closer inspection reveals a transformation, not merely of figures, but of the very fabric of the company.

Nvidia now demonstrates a level of profitability most enviable, generating free cash flow with an agreeable abundance, and maintaining margins of a decidedly pleasing height. The judicious repurchase of stock, exceeding the dilution from stock-based compensation – a circumstance of no small consequence – further reinforces the impression of a company managed with prudence and foresight. Indeed, the conversion of revenue into after-tax profit, exceeding fifty percent, and the generation of over $2 million in net profit per employee, suggest an efficiency that is, to say the least, commendable.

A Challenge to Established Powers

It is anticipated that Nvidia will, within the current or ensuing year, overtake Alphabet as the most profitable company. Nvidia’s current earnings of $99.2 billion, trailing twelve months, are drawing ever closer to Alphabet’s $124.3 billion. Though one must acknowledge the presence of Saudi Arabian Oil, with its fluctuating fortunes between $106 and $161 billion, it is the sustained, technology-driven growth of Nvidia that commands the greater attention, particularly for those with a longer-term perspective.

The addition of over $4 trillion in market capitalization within three years is a circumstance rarely witnessed. Yet, it is the transformation from a company earning less than $15 billion to one poised to become the most profitable publicly traded concern – a span of merely five years – that truly distinguishes Nvidia’s trajectory. It is a narrative of ambition, innovation, and, one might venture, a certain degree of fortunate timing.

Rubin and the Sustenance of Advantage

Nvidia possesses several advantages that suggest continued success. Chief amongst these are its remarkably high operating margins, a circumstance that allows for both investment in future growth and the distribution of value to shareholders. Some have expressed concerns that a slowdown in demand or increased competition might erode these margins. However, the introduction of Rubin, the successor to the Blackwell semiconductor architecture, suggests a means of sustaining – and indeed, enhancing – this advantage.

Rubin represents a considerable advancement in technology, promising improvements in efficiency that will allow customers to process data with unprecedented speed and reduce costs. This technological superiority allows Nvidia to justify its premium pricing, converting a larger proportion of revenue into earnings. The company’s recent announcement at CES, exceeding prior estimates of $500 billion in Blackwell and Rubin orders, outlines a clear path for fiscal 2027 earnings, solidifying its position for continued growth.

With a conversion rate of over fifty percent of revenue into net income, the $500 billion revenue projection suggests a potential of $250 billion in net income. While this may not materialize in a single fiscal year, it paints a compelling picture of Nvidia’s potential to surpass Alphabet within the next two years.

A Prudent Investment for 2026

At a valuation of approximately 40 times forward earnings, Nvidia appears, for a company of such rapid growth, to be a most agreeable value. Should the stock price remain subdued, the valuation could decrease further as the company converts its order backlog into realized earnings.

Thus, Nvidia remains one of the most promising growth stocks in the artificial intelligence sector, a prudent investment for long-term investors to acquire in 2026 and hold for years to come. It is a company that, with its ambition, innovation, and prudent management, appears well-positioned to navigate the complexities of the market and secure its place amongst the most successful concerns of our time.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-20 17:53