This year has been an emotional roller coaster for shareholders of Nvidia (NVDA). Following the news of new tariffs, in combination with intensifying competition in China, the company’s shares plummeted by as much as 30% earlier this year, wiping out nearly $1 trillion in market value.

One might have thought the curtain had fallen on Nvidia’s grand performance, but the stock’s recent antics suggest otherwise. A curious spectacle, this rebound.

As of Aug. 7, it had rebounded by 93% from its 2025 lows and now has a market capitalization of $4.4 trillion, making it the most valuable company in the world. A triumph of optimism, or perhaps a well-timed illusion.

With such strong momentum fueling the stock to new highs, is it too late to invest in Nvidia? A question as old as the markets themselves, and yet, one must ask: who needs a crystal ball when you have a spreadsheet?

Big tech is spending big bucks on Nvidia’s chips

Nvidia’s largest source of revenue is its computing and networking business. This segment comprises the company’s data center services and highly coveted graphics processing units (GPUs).

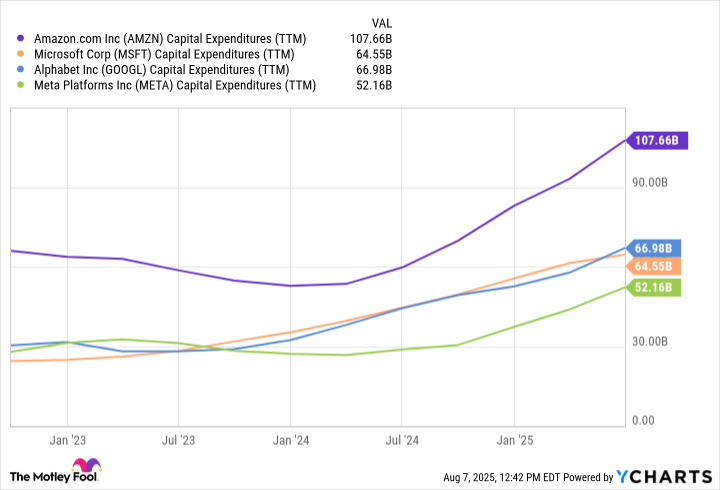

A good way to gauge the health of its business is to look at spending on artificial intelligence (AI). The chart below illustrates capital expenditures over the last three years for cloud hyperscalers Amazon, Microsoft, and Alphabet, along with social media company Meta Platforms.

The so-called Magnificent Seven prove that accelerating AI infrastructure spending is a powerful tailwind for Nvidia’s chip empire. Or perhaps, a case of the tail wagging the dog.

Beyond the usual tech titan suspects, rising adoption of cloud infrastructure services from Oracle as well as neocloud platforms such as Nebius Group and CoreWeave offer another source for GPU demand, especially for Nvidia’s latest Blackwell architecture. Neoclouds are gaining interest at the moment as they offer flexible software-hardware stacks in the form of high-performance computing (HPC) services and access to GPU clusters via cloud-based infrastructures.

New opportunities are emerging

Over the last few years, investors have repeatedly heard pundits chirp about the importance of data centers in powering generative AI development. This point is valid, but I think many investors are missing the broader picture when it comes to the evolution of AI infrastructure spending.

A new phase of AI adoption involves sophisticated workloads across robotics, autonomous driving, and quantum computing. Companies such as Alphabet and Tesla are beginning to monetize their autonomous vehicles, while Microsoft, Alphabet, and Amazon are all developing their own custom quantum computing chips.

Nvidia has just started to scale up its chips and CUDA software platform across these emerging opportunities. Given the company’s existing deep integration with big tech, I’m optimistic that its product suite will still be crucial in future, more-advanced AI development. Or perhaps, it’s merely the latest in a long line of industry fads.

What will Nvidia stock be worth by the end of 2025?

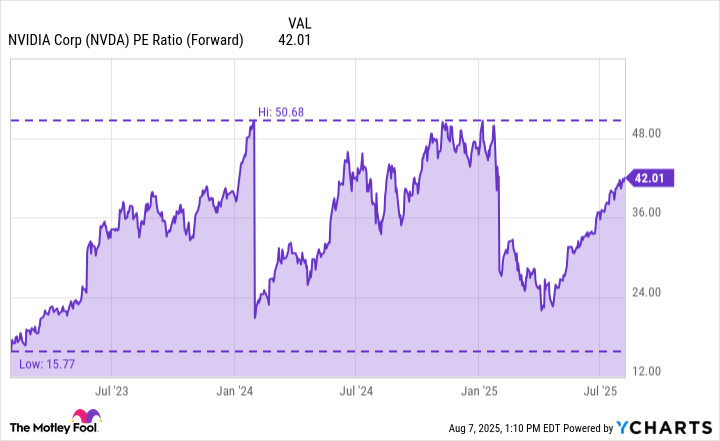

The chart below illustrates the company’s forward price-to-earnings (P/E) multiple throughout the AI revolution.

Given the trends cited above, the forward P/E range between 24 and 30 could be seen as a support zone or valuation floor for Nvidia. Each time its forward P/E dipped into this range, the stock has rebounded strongly. To me, this suggests that investors still see robust long-term growth for the company despite occasional fleeting periods of souring sentiment.

I think these valuation trends subtly imply that the market could be underestimating the full breadth of Nvidia’s ubiquitous platform. Despite the company’s influence across AI infrastructure, many investors still view it purely through the lens of a semiconductor business. As these new opportunities are realized, I think the stock is well positioned for a prolonged breakout similar to the initial wave of AI-driven enthusiasm a couple of years ago.

Although its forward P/E is fast-approaching prior highs, I think there is a solid case to be made that the company is positioned for further valuation expansion and could reach or exceed historical levels. My logic is that the monetization potential of future opportunities in robotics, autonomous vehicles, and quantum computing is still taking shape and not yet fully priced into the stock by investors.

If Nvidia’s current forward P/E expands to levels congruent with prior highs by the end of the year, the stock could blow past the $200 price point and reach closer to $220 implying an increase between 10% and 20% over current price levels. For this reason, I think Nvidia stock will be trading significantly higher by the end of the year than where it is today.

One might say the future is bright, or at least, profitable. 🚀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-13 04:26