Artificial intelligence has become the modern-day gold rush, where fortunes are made and lost faster than you can say “deep learning.” At the heart of this frenzy stands Nvidia (NVDA), a semiconductor colossus that recently became the first company to touch $4 trillion in market value-a number so large it makes my head spin like a roulette wheel at a Las Vegas casino. Meanwhile, IonQ (IONQ), a plucky newcomer with quantum computing ambitions, has declared itself the “Nvidia of the future,” which feels a bit like a child announcing they’ll build a better Eiffel Tower using LEGO bricks. Let’s unpack this.

Nvidia: The AI Maestro Conducting a Symphony of Growth

If Nvidia were a character in a Dickens novel, it would be Ebenezer Scrooge-except instead of hoarding gold, it’s gobbling up market share. Last fiscal year, sales jumped 114% to $130.5 billion, a figure so staggering it could make even Warren Buffett raise an eyebrow. And the momentum shows no sign of slowing: First-half revenue for 2026 already sits at $90.8 billion, up from $56.1 billion the year before. Operating income? A gaudy $50.1 billion, up over 40%. It’s like watching a steamroller roll over a bag of cash.

But here’s the twist: The AI party is entering its second act. For years, tech giants have been training models like overzealous grad students cramming for exams. Now comes “inference”-the part where AI actually applies what it’s learned, akin to a student finally graduating and getting a job. Nvidia’s new Blackwell platform is being hailed as the AI equivalent of a Swiss Army knife, with governments and OpenAI itself lining up to buy millions of chips. The British government alone wants 120,000 of these digital marvels. One wonders if they’ll need a warehouse the size of Buckingham Palace.

IonQ: Quantum Dreams in a Classical World

If Nvidia is the seasoned explorer charting known territories, IonQ is the starry-eyed adventurer convinced there’s a hidden continent beyond the horizon. The company claims its quantum computers can turbocharge AI inference while sipping energy like a hummingbird at a teacup. Their research suggests quantum-trained models outperform traditional ones when data is scarce-a problem as old as time, or at least as old as my attempts to assemble IKEA furniture without instructions.

IonQ’s growth numbers are eye-catching: Revenue nearly doubled to $43.1 million in 2024, with projections to hit $100 million next year. But let’s not forget this is a business burning through cash like a California wildfire. Operating losses ballooned to $160.6 million last quarter, and while they’ve stockpiled $1.7 billion in cash (no debt, mind you), it’s a bit like having a life raft in a hurricane. Their tech might be revolutionary, but quantum computing feels like buying tickets to a rocket launch-you might witness history, or just a really expensive firework.

The Investor’s Crossroads: Prudence vs. Possibility

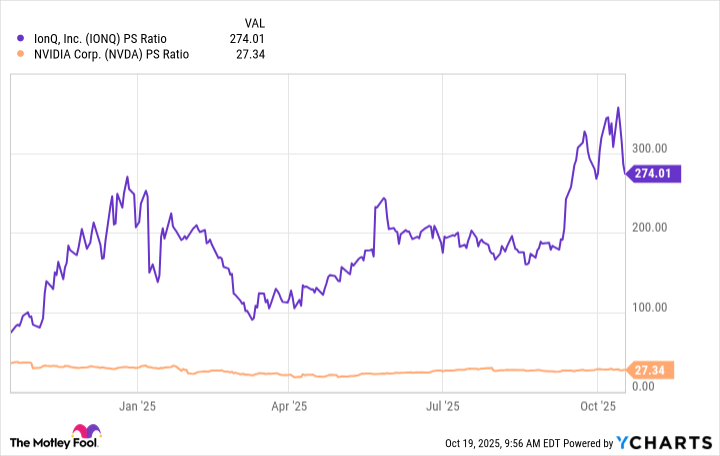

So here we are, standing at the intersection of proven dominance and speculative promise. Nvidia trades at a reasonable price-to-sales ratio, like a well-maintained vintage car that still turns heads. IonQ? Its valuation has skyrocketed 370% in a year-a trajectory more suited to a SpaceX capsule than a stock. The numbers whisper that Nvidia is the value investor’s pick: profitable, entrenched, and backed by giants like OpenAI.

IonQ’s vision is tantalizing, but quantum computing remains a “someday” technology, much like fusion energy or my dream of finding socks that don’t disappear in the laundry. For now, Nvidia offers the thrill of participation in AI’s golden age without the queasy feeling of gambling your savings on a lab experiment. As the old adage goes: “The best time to plant a tree was 20 years ago. The second-best time? Now.” 🌱

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- USD PHP PREDICTION

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-10-20 12:38