Okay, so last year I made a prediction – a bold one, if I do say so myself. I said Nvidia would outperform Amazon as a Dow stock. It felt a little like picking the robot over the delivery guy, but the numbers don’t lie. And, shockingly, I was right. It’s like predicting the winner of a reality TV show, except with significantly more spreadsheets. Now everyone’s asking, “Which ‘Magnificent Seven’ stock is the better bet for 2026?” Let’s unpack this, because frankly, my calendar is already booked with investor calls, and I need a concise answer.

Amazon, bless its heart, is basically running on AWS fumes. Seriously, 60% of their operating income? That’s like saying your entire personality is based on a really good hair day. It’s great while it lasts, but what happens when the cloud gets cloudy? They’re making a respectable 4.1% operating margin on everything except AWS, which is… a choice. It’s like building a luxury hotel on top of a slightly shaky foundation. And let’s be real, competition from Microsoft, Google, and even Oracle is heating up. It’s a digital Thunderdome out there.

The Rubin Effect: Nvidia’s Secret Weapon

Nvidia, on the other hand, is leaning into the future. They’re not just selling graphics cards; they’re selling the brain of the robot uprising. Their data center business is 90% of revenue, which is a terrifying and beautiful thing. And the new Rubin architecture? It’s not just an upgrade; it’s a complete reboot. They’re releasing it ahead of schedule, which is the corporate equivalent of showing up to a meeting five minutes early with a fully-formed solution. It’s almost rude. They’re going beyond GPUs, into networking, interconnections, and CPUs. It’s like they’re building the entire digital nervous system. Frankly, it’s a little unsettling, but in a good way.

Look, I’m not saying Amazon is doomed. They’re still the 800-pound gorilla in the e-commerce jungle. But Nvidia is building the jungle itself. They’re not just growing; they’re evolving. They’re defying the law of large numbers, which is something I thought only happened in rom-coms.

Value Proposition: Let’s Talk Numbers (Briefly)

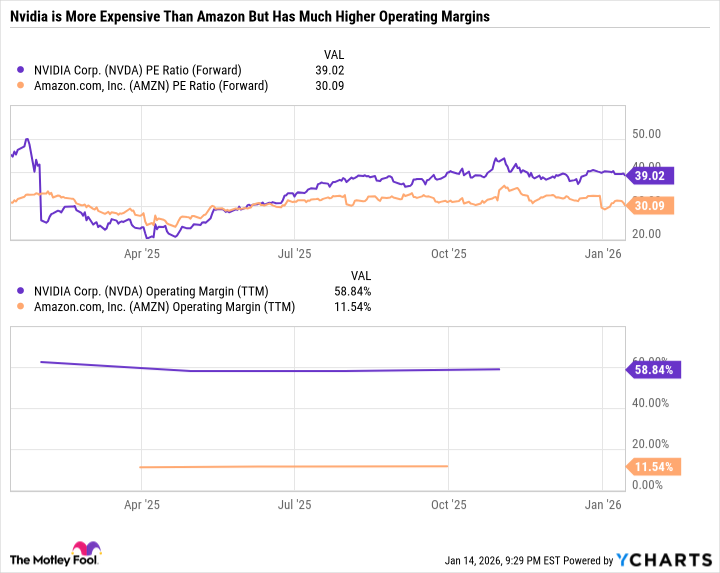

Okay, fine, let’s talk numbers. Amazon is cheaper, with a forward P/E ratio of 30.1 compared to Nvidia’s 39. But cheaper isn’t always better. It’s like choosing the discount airline versus the one that doesn’t require a hazmat suit. Nvidia’s growth potential justifies the higher valuation. They’re not just selling a product; they’re selling a future where robots do all our work and we finally have time to binge-watch everything. I’m in.

Amazon depends heavily on AWS, and there’s only so much margin expansion you can squeeze out of shipping boxes. Nvidia? They’ve got multiple avenues for growth. If the data center business cools off (and let’s be honest, everything eventually cools off), they can pivot to gaming, professional visualization, automation, robotics… the possibilities are endless. It’s like having a Swiss Army knife for the digital age.

So, for 2026, I’m sticking with Nvidia. It’s the better buy. Amazon is a solid company, don’t get me wrong, and it’s definitely gotten more attractive. But in a world increasingly powered by AI, you want to be with the brains, not the delivery service. Now, if you’ll excuse me, I have a conference call with a venture capitalist who thinks he can disrupt the disruption. Wish me luck.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-18 18:05