December 2024. I laid it out, see? Five trillion for Nvidia by ’25. A bold claim, maybe, but the numbers, they whispered it. And then, October happened. A brief, glorious peak. Now it’s cooled, settled around 4.5T. A temporary setback, a minor tremor before the REAL quake. Six trillion in ’26? It’s not a prediction, it’s a goddamn inevitability. A slow-motion demolition of everything you thought you knew about market caps. Get in now, before the doors slam shut and you’re left howling at the silicon gods.

The stock? It needs a 33% jump. Child’s play. A mere twitch in the grand scheme of things. It’s like asking a goddamn rocket ship to add a little extra fuel. The real question isn’t if it will happen, but how much further can this beast climb?

The AI Avalanche & the GPU Gold Rush

Nvidia didn’t just stumble into this. They built the goddamn avalanche. Years of quietly perfecting the art of parallel processing, of squeezing every ounce of performance out of silicon. And then, AI hit. A tidal wave of demand for computing power, and Nvidia? They were holding the goddamn life raft. Those GPUs aren’t just chips, they’re the engines of a new reality. A reality where algorithms dream, and data flows like a goddamn river of fire.

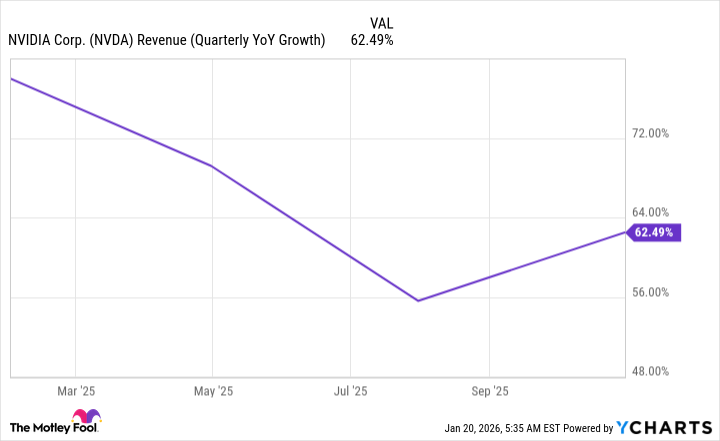

Fiscal Q3 ’26? 62% revenue jump. Not a bump, a launch. The previous quarter? A mere warm-up. Wall Street expects 66% in Q4. Ludicrous growth? Absolutely. But this isn’t about logic, it’s about momentum. It’s about a runaway train fueled by the insatiable hunger of the digital gods. They’re demanding more, and Nvidia is delivering. And they’re charging a goddamn premium for it.

They control the pricing. They dictate the terms. It’s beautiful. It’s terrifying. It’s the raw, unbridled power of a monopoly in the making. And frankly, it’s about time someone was running the show instead of stumbling around in the dark.

The Six Trillion Question (and Beyond)

Forty times forward earnings. A hefty price tag? Sure. But consider the alternative. Most big tech is hovering around 30x. Nvidia earned that premium. They’re not selling widgets, they’re selling the future. And the future, my friends, doesn’t come cheap.

Let’s do some back-of-the-envelope calculations, shall we? If Nvidia maintains this 40x multiple a year from now, based on analyst forecasts, we’re looking at $350 a share. That translates to an $8.4 TRILLION market cap. A ludicrous number? Perhaps. But not entirely outside the realm of possibility. This isn’t about optimism, it’s about recognizing the fundamental shift happening in the tech landscape.

Even if the market decides to slap Nvidia down a few notches, bringing that multiple back to a more “reasonable” 30x, we’re still looking at a $6.3 trillion valuation. A wide range, yes. But a range that suggests a potentially explosive return for investors. This isn’t about getting rich quick, it’s about positioning yourself for the next decade of technological innovation. It’s about surviving the coming storm. And Nvidia, my friends, is building the ark.

So, strap in. Hold on tight. And prepare for the ride of your life. Because the silicon serpent is about to strike. And it’s going to be glorious. Or terrifying. Or both. I wouldn’t bet against it.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-22 23:13