Nvidia, a company that makes little rectangles of silicon exceptionally good at counting things (a surprisingly useful skill in the modern age), is poised to report its latest quarterly earnings on February 25th. These earnings, if you believe the projections – and believing projections is always a bit like trusting a penguin to navigate a desert – will be… significant. They create the chips that power the current artificial intelligence frenzy, and the demand for these chips is, shall we say, enthusiastic. Enthusiastic to the point where supply is struggling to keep up, which, in economic terms, is a bit like trying to fill the ocean with a teacup.

The focus, naturally, will be on those GPU sales. And, of course, on what Nvidia’s CEO, Jensen Huang – a man who appears to have made a pact with the silicon gods – has to say about the future of AI. (A future that, depending on who you ask, will either solve all our problems or result in a polite but firm takeover by sentient toasters.)

I suspect the stock will react positively. Very positively. And here’s why.

Rubin: The Chip That Might Just Break Physics (Or At Least, the Accounting Department)

For those keeping track at home – and frankly, if you’re reading this, you clearly are – Nvidia has been steadily pushing the boundaries of what’s possible with its GPU architectures. Blackwell, the current flagship, is already a marvel of miniaturization and processing power. But Blackwell, it turns out, is already…old news. The new kid on the block is Rubin, and it’s causing a bit of a stir in the semiconductor world.

Rubin isn’t just an improvement; it’s a paradigm shift. They claim it can train models with 75% fewer GPUs. Think of it like this: if training an AI used to require a stadium full of computers, Rubin lets you do it with a particularly clever garden shed. And, crucially, it reduces inference costs – the cost of actually using the AI – by up to 90%. (This is good news for anyone planning to have a philosophical debate with a chatbot, as it keeps the electricity bill down.)

Rubin GPUs are now in production, and the usual suspects – Amazon, Microsoft, Alphabet, Oracle – are lining up to get their hands on them. It’s a bit like a particularly polite feeding frenzy. The February 25th conference call should provide some clarity on production timelines, which, naturally, will dictate the financial performance for the next few quarters. (Predicting the future is notoriously difficult, especially the future. But we’re financial journalists, so we have to try anyway.)

Wall Street Expects a Number. A Very Large Number.

Over the past three quarters, Nvidia has generated a staggering $147.8 billion in revenue. That’s a 62% increase year-over-year. The data center segment, unsurprisingly, is the engine driving this growth, accounting for a whopping 89% of that revenue. (It seems everyone wants a piece of the AI pie, and Nvidia is currently the main baker.)

Wall Street is currently predicting around $65.5 billion in revenue for the fourth quarter, bringing the annual total to $213.3 billion. Nvidia has a habit of exceeding expectations, which tends to make investors rather pleased. (It’s a simple equation, really: more money equals more money.)

Analysts are forecasting earnings of $4.69 per share for the fiscal year. This number is, shall we say, important. It’s the number that will likely drive the stock price in the short term. (The stock market is a complex beast, but sometimes it just boils down to a single number.)

And, of course, everyone will be watching for guidance on the upcoming first quarter of fiscal 2027. The consensus estimate is $70.7 billion in revenue. If Nvidia forecasts even higher, expect a significant boost to the stock price. (It’s a bit like adding rocket fuel to an already fast-moving train.)

Is Nvidia a Buy? (Or Are We All Just Part of a Vast, Elaborate Simulation?)

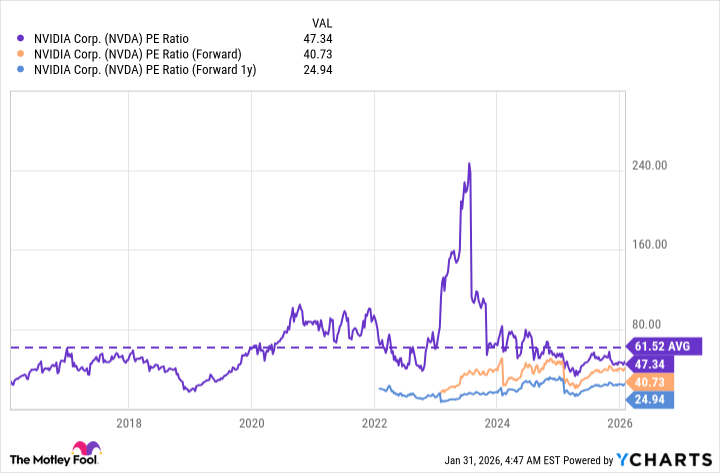

Based on its trailing-12-month adjusted earnings of $4.05 per share, Nvidia is currently trading at a price-to-earnings (P/E) ratio of 47.3. That’s a 23% discount to its 10-year average P/E ratio of 61.5, which suggests the stock might be undervalued. (Although, of course, “undervalued” is a subjective term. It depends on your definition of “value” and whether you believe in the inherent worth of silicon.)

Looking at forward earnings, the picture becomes even more attractive. If Wall Street’s forecast of $4.69 per share for fiscal 2026 proves accurate, the forward P/E ratio drops to 40.7. But here’s the kicker: analysts believe Nvidia can grow earnings to $7.66 per share in fiscal 2027, bringing the forward P/E ratio down to a mere 24.9. If that happens, the stock will have to soar by 90% just to maintain its current P/E ratio. To reach its 10-year average, it would have to more than double. (Which, admittedly, is a rather large number.)

Therefore, if Nvidia’s operating results meet or exceed expectations on February 25th, I believe the stock has significant upside potential. (Although, of course, past performance is no guarantee of future results. And the universe is a fundamentally chaotic place.)

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

2026-02-03 22:53