As a seasoned analyst with over two decades of experience under my belt, I must admit that I am thoroughly impressed by Nvidia Corporation’s stellar performance in Q3 2024. The company’s revenue surge, coupled with its strategic expansion into emerging markets like humanoid robotics, is nothing short of remarkable.

On Wednesday, Nvidia Corporation reported an impressive 95% rise in revenue for the third quarter of 2024, amounting to a staggering $35.1 billion, exceeding earlier forecasts.

For the fourth quarter, Nvidia projects revenue of $37.5 billion.

Nvidia Q3 Revenue Reflects Strong Demand for AI

Last year’s performance saw the Data Center segment of our company surge ahead with a substantial 111% growth, reaching an impressive $30.8 billion. Additionally, the Gaming, Professional Visualization, and Automotive segments all experienced gains, registering increases of 14%, 16%, and 72%, respectively.

As a researcher, I’ve noticed an impressive surge in Nvidia’s stock prices, with a remarkable 30% increase during Q3 alone. Remarkably, this year’s growth has been even more noteworthy, reaching almost 200%. This extraordinary performance seems to be fueled by the robust demand for Bitcoin mining and Artificial Intelligence (AI), both of which are key areas where Nvidia excels.

According to a statement by Jensen Huang, the founder and CEO, the era of artificial intelligence (AI) is moving rapidly forward, driving a worldwide transition towards NVIDIA’s computing technology.

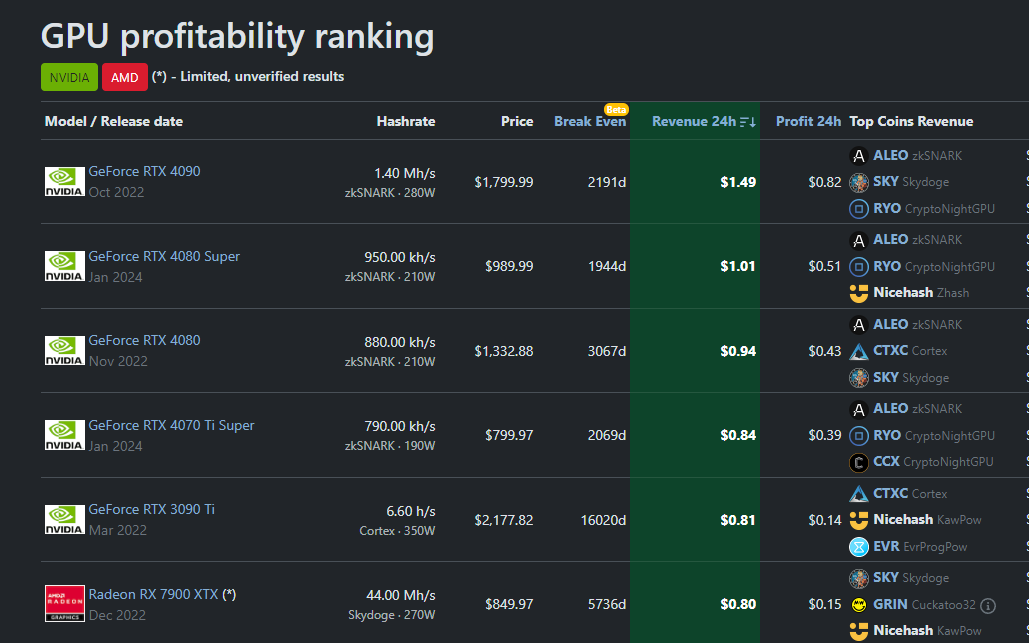

Additionally, the company maintains a leading position in the GPU mining market. Recent findings show that their RTX series consistently surpasses all other products in terms of profitability when it comes to GPU mining.

Exploring Other Business Avenues

Throughout the year, Nvidia has been exploring potential new markets as its income continues to rise. Recently, they have expressed interest in the field of humanoid robotics. Their goal is to provide developers with resources for teaching robots by utilizing data obtained from human interactions.

Back in the early part of this year, I found myself astounded as Nvidia’s market value soared past the collective worth of all Russell 2000 stocks by an impressive $10 billion. This remarkable achievement accounted for roughly 43% of the S&P 500’s overall growth. As a crypto investor, it’s moments like these that remind me of the potential impact a single company can have on the broader market landscape.

On the other hand, the firm encounters difficulties from regulators because of its close ties to cryptocurrency mining. Recently, the Department of Justice (DOJ) served a subpoena during an antitrust inquiry in September.

Reports suggest that the investigation centers around the possibility that Nvidia’s business methods may be curbing competition within areas such as cryptocurrency and artificial intelligence.

Most recently, the Supreme Court indicated that it may issue a narrow ruling in a shareholder lawsuit. The lawsuit accuses Nvidia of misrepresenting its dependence on crypto mining revenue to investors.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2024-11-21 03:35