Nvidia. The name itself sounds like something out of a science fiction novel, doesn’t it? And in a way, it is. For the past few years, investing in Nvidia has felt less like picking stocks and more like witnessing a slow-motion miracle. They’ve been delivering returns that would make a Victorian railway speculator blush. Now, there’s a bit of chatter about an ‘AI bubble’ forming – a phrase that always strikes me as a bit dramatic, like someone expecting the entire tech sector to suddenly float away. But the reality is, practically every serious player in the AI game is planning to spend absolutely vast sums on computing power. And when it comes to providing that power, Nvidia is, shall we say, rather well-positioned. I suspect it will remain so for a good while yet, well beyond 2026.

I’ve identified five reasons why Nvidia looks like a good wager for the coming year, though I’m fairly certain there are a good many more lurking in the numbers. Let’s have a look, shall we?

1. Sold Out! (Seriously)

Nvidia recently announced, with what I imagine was a degree of quiet satisfaction, that they’ve essentially sold out of their cloud-based graphics processing units. This isn’t like finding the last jar of decent pickle relish on the shelf; we’re talking about a truly massive demand for their products. In the last quarter, they shifted $51.2 billion worth of data center kit. That’s… a lot. It’s enough to make one wonder if they’re considering a dedicated fleet of delivery drones.

When demand outstrips supply, the basic rules of economics kick in. Nvidia can, quite reasonably, charge a premium. This will, naturally, boost their margins and accelerate their earnings growth. They are, of course, working to increase production capacity, which is a sensible move, but for the moment, being sold out suggests a level of demand that isn’t going to disappear anytime soon.

2. A New Architecture on the Horizon

Nvidia isn’t resting on its laurels, you see. They’re developing a new chip architecture, dubbed ‘Rubin,’ which will build upon the already impressive ‘Blackwell.’ Apparently, Rubin will significantly improve performance – requiring a quarter of the GPUs to train an AI model and a tenth to run it. That’s a rather substantial leap forward. It’s like going from a horse-drawn carriage to a… well, to something considerably faster and more efficient.

Improvements like these will encourage customers to upgrade to the newer, more expensive GPUs, further boosting Nvidia’s revenue. If you can get four to ten times the performance for roughly double the cost, it’s a win-win for everyone involved. It’s simple arithmetic, really.

3. China is Back in the Game

For a time, shipments of GPUs to China were halted, which understandably created a rather noticeable dent in Nvidia’s sales. But things are looking brighter on that front. Nvidia will soon be allowed to resume sales, provided they meet certain export restrictions and pay a tax to the U.S. government.

How this will play out remains to be seen. Nvidia is likely to pass that tax on to its clients, which is perfectly logical. Reports suggest there are orders for around 2 million H200 GPU chips from Chinese firms. That translates to a potential $60 to $80 billion in revenue. To put that in perspective, Wall Street currently anticipates Nvidia will generate $213 billion in revenue this fiscal year. A return to the Chinese market, therefore, would be rather significant.

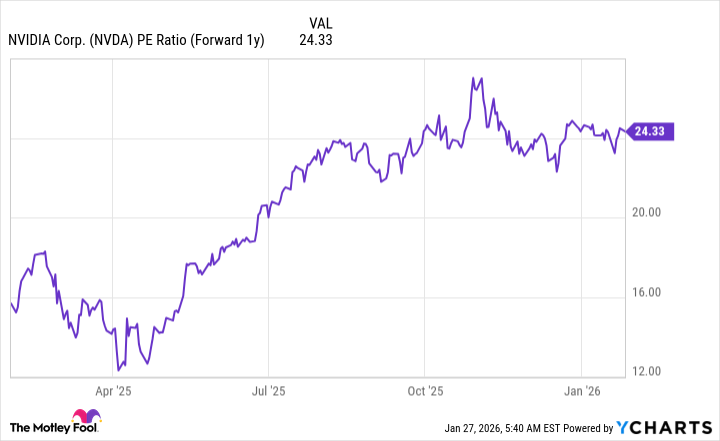

4. Not as Expensive as You Think

Somewhere along the line, Nvidia acquired the reputation of being an expensive, overvalued stock. This strikes me as a bit of a misconception. The reality is, Nvidia’s stock is actually quite reasonably priced compared to its big tech peers.

Currently trading at 24 times fiscal-year 2027 earnings, Nvidia is cheaper than many other large tech companies trading at 25 to 30 times forward earnings. That makes Nvidia a reasonably priced stock, and potentially a steal if its growth continues beyond 2026.

5. Winners Keep Winning

Nvidia has a proven track record of success. That’s not something easily replicated. When a stock has as much momentum as Nvidia, alongside strong growth rates, it’s a rather formidable force. I don’t like to bet against companies like this, and I’d prefer to invest alongside them. Its history of outperformance is just another solid reason to consider investing in the stock for 2026.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

2026-02-01 19:02