Behold, gentle investors, a spectacle most curious! Nvidia, a name whispered with increasing reverence (and, dare I say, a touch of frenzy), has ascended to a valuation previously reserved for kingdoms and empires. It has, in the space of a few short years, surpassed the venerable Apple and Microsoft, those long-reigning monarchs of the market. A most astonishing turn of events, wouldn’t you agree? The cause? A feverish enthusiasm for this ‘artificial intelligence’ – a phantom, it seems, capable of conjuring profits from thin air.

Nvidia, you see, fashions the very engines of this digital sorcery – chips of prodigious power, eagerly snatched up by those who would build cathedrals to the algorithm. And investors, ever susceptible to the allure of the new and the glittering, have piled upon the shares, convinced that this AI bubble shall not, like so many before it, ultimately burst. A most diverting delusion, if I may be permitted the observation.

As we enter this new year, the prognosticators are, naturally, abuzz. My own modest prediction? That Nvidia shall, before the year is out, become the first company to breach the six-trillion-dollar mark. Let us, with a touch of skepticism and a dash of amusement, examine how this might unfold.

The Ascent to Four Trillions: A Brief History of Folly

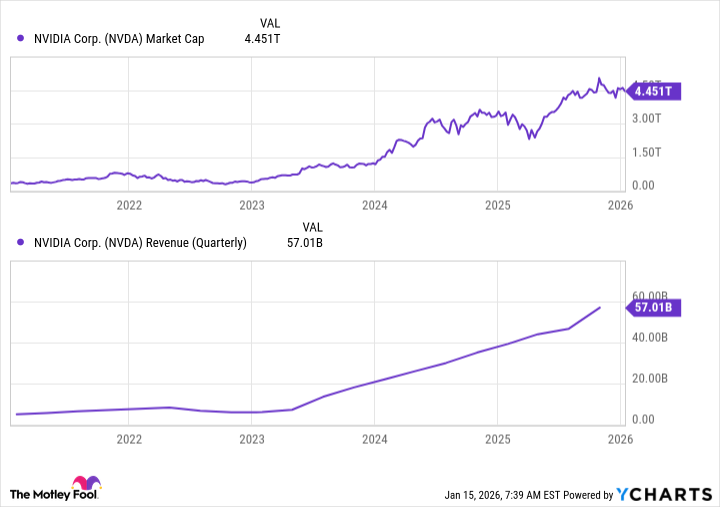

It was but a fleeting moment ago (in the grand scheme of things, of course) that Nvidia stood at a mere trillion dollars. Its value, like a pampered pet, has grown with alarming speed, fueled by revenue and, shall we say, a rather enthusiastic public imagination.

This, as you may have surmised, is owing to Nvidia’s dominance in the aforementioned AI market, and the investors’ insatiable appetite for what appears to be a rather promising, yet utterly speculative, technology. Nvidia, naturally, has positioned itself as the obvious beneficiary, reaping the rewards of its market position and demonstrating a remarkable talent for converting dreams into dividends. Indeed, recent reports reveal a revenue climb of 62% to $57 billion, and a net income advance of 65% to $31 billion. A most impressive feat, though one cannot help but wonder if such growth is sustainable, or merely a temporary madness. The company also boasts a substantial cash reserve of $60 billion, presumably to fund further innovations, or perhaps to build a truly magnificent folly.

And speaking of innovation, Nvidia continues to promise new chips annually – the Rubin system being the latest offering, a potential catalyst for earnings and stock performance. One might suspect that this constant stream of ‘newness’ is designed to keep the investors perpetually distracted, like a magician with a never-ending supply of rabbits.

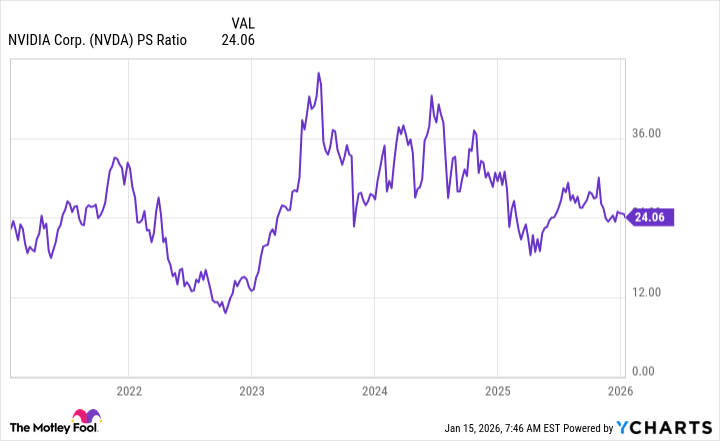

Now, let us consider the path to six trillions. Currently, Nvidia trades at 24 times its sales, but a glance at the historical data reveals that the market has, on occasion, supported even higher valuations.

Considering Wall Street’s average estimate of $213 billion in annual revenue for 2026, a six-trillion-dollar market value would necessitate a price-to-sales ratio of 28 – a figure that, for Nvidia, is quite reasonable. For the stock price, this implies a 34% gain from today’s level, a feat certainly within reach for a company that appears to be operating in a realm of pure imagination.

Predicting Continued Enthusiasm: A Comedy of Demand

From a purely mathematical perspective, Nvidia could indeed reach six trillions this year. But beyond the numbers, there are also indications from the company itself, and from the broader market, that suggest continued enthusiasm. Nvidia’s chief financial officer, Colette Kress, recently declared that demand is strong, and that AI product orders are exceeding expectations. Even Taiwan Semiconductor Manufacturing, a rival chipmaker, has spoken of high demand.

This suggests that Nvidia’s earnings will continue to grow, potentially accelerated by the release of the Rubin system. One might suspect that this is all part of a carefully orchestrated performance, designed to keep the investors captivated.

Of course, this rosy scenario is not without its potential pitfalls. Disappointing economic data, political decisions, or even a sudden resurgence of common sense could all upset the balance. Last year, for example, the announcement of import tariffs briefly dampened Nvidia’s stock price. And there is always the risk that investors will eventually realize that they have been chasing a phantom. Any of these factors could introduce volatility and create a rather unpleasant scene.

However, if we set aside these external risks, I remain optimistic about Nvidia’s prospects. And that is why I predict that this top AI player will become the first six-trillion-dollar company in 2026. A most diverting spectacle, indeed. Let us observe with amusement, and perhaps a touch of pity, as the drama unfolds.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Gold Rate Forecast

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR TRY PREDICTION

2026-01-17 14:13