One always encounters those who lament missed opportunities. A rather tiresome habit, really. I daresay most investors can recall a stock they should have acquired – or, more sensibly, sold – at a particular juncture. Nvidia, naturally, springs to mind. A gain of nearly 27,000% over the last decade? Quite extraordinary. Though frankly, dwelling on what might have been is terribly vulgar.

A modest ten thousand invested a decade ago would now be a perfectly agreeable $2.7 million. Life-altering, some might say. Though I suspect most would simply find a more comfortable chaise lounge. The point is, while replicating that exact return is… ambitious, to put it mildly, dismissing Nvidia now would be spectacularly shortsighted. It’s not about chasing miracles; it’s about identifying enduring value.

A Most Persistent Growth

Nvidia’s ascent isn’t merely a technological triumph; it’s a rather compelling narrative of demand exceeding supply. The current frenzy surrounding AI infrastructure is, of course, the catalyst. These ‘hyperscalers’ – a ghastly term, really – are throwing money at anything that promises computational power, and Nvidia’s GPUs are, undeniably, the most coveted trinkets. A bit vulgar, perhaps, but undeniably effective.

Wall Street, in its infinite wisdom, anticipates a 57% revenue increase for fiscal 2026, accelerating to 65% the following year. One can’t help but raise an eyebrow at such optimism, but the capital expenditure plans of these hyperscalers – a collective $650 billion, if you please – rather support the notion. And, delightfully, a resumption of sales into the Chinese market is on the horizon. A most promising development.

Nvidia itself projects that global data center spending will balloon to $3-4 trillion annually by 2030. Similar projections abound. If these forecasts prove accurate – and one suspects they might – the party, as they say, is only just beginning. One trusts you have secured an invitation.

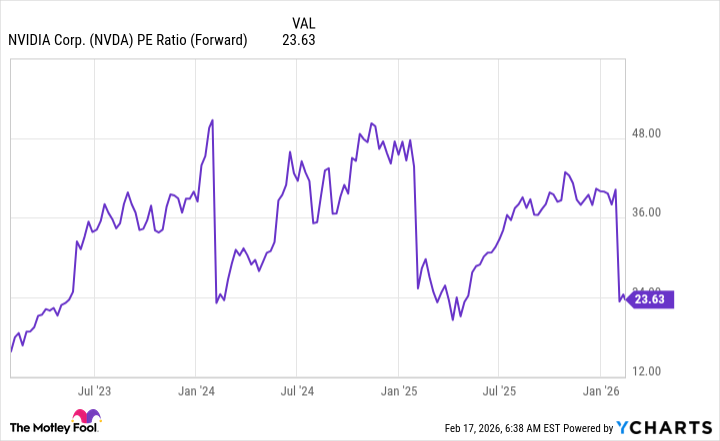

And despite this rather breathless outlook, the valuation remains… sensible. At under 24 times forward earnings, Nvidia appears to be a rather astute acquisition at present. One ought to capitalize on such opportunities, wouldn’t you agree? Though do hurry, as the earnings report on February 25th promises to be… eventful. A touch of drama is always stimulating, but one prefers to be comfortably positioned beforehand.

Naturally, one isn’t suggesting a reckless plunge. A measured approach, informed by due diligence, is always advisable. But to ignore Nvidia’s potential – and, frankly, its consistent delivery – would be a rather glaring oversight. One simply must have a little something for a rainy day… or, in this case, a rather profitable one.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Where to Change Hair Color in Where Winds Meet

2026-02-21 09:43