Now, Nvidia, you see, is a company that has been having a positively ripping good time of late. Not so long ago, one might have pegged them as merely purveyors of gizmos for the gaming chaps – a respectable enough trade, certainly, but hardly the stuff of titans. But dash it all, things have taken a turn for the spectacular!

The entire artificial intelligence kerfuffle, as it were, now seems to hinge on what Nvidia does with its quarterly reports. A most curious state of affairs, wouldn’t you agree? The transition, you ask how it happened? Well, it’s a story of rather clever chaps and even cleverer bits of kit.

Their graphics processing units, or GPUs as the moderns call them, have rather outgrown their original purpose. They’re no longer simply making the little pictures on the gaming screen look dashingly realistic; they’re the very backbone of this generative AI business. Every time a hyperscaler – those chaps who build enormous data centres, you know – contemplates a new venture, you can be sure Nvidia’s telephones are ringing off the hook. A positively frantic scene, I imagine.

Generative AI, you see, was merely the opening gambit. The rest of the decade, as I foresee it, will be defined by infrastructure. A solid foundation, if you will, upon which to build a truly magnificent edifice of technological advancement.

Let us explore, shall we, the numerous tailwinds that are likely to propel Nvidia forward over the next few years. Then, we shall delve into the valuation and determine, with a reasonable degree of certainty, how the company might reach a market capitalisation of ten trillion dollars by 2030. A rather ambitious target, perhaps, but not, I submit, entirely beyond the realm of possibility.

What a Jolly Good Show of Tailwinds Does Nvidia Have?

Nvidia, quite quietly, is transforming itself from a mere GPU designer into a complete end-to-end platform. Chips, software, networking gear – the whole shebang! They’ve forged alliances with a rather impressive roster of companies, including Anthropic, Intel, Groq, Palantir, Archer Aviation, and Nokia. Each of these partnerships serves the same purpose: to establish Nvidia as a complete, vertical solution for systems across the AI value chain. A most ingenious plan, wouldn’t you say?

With Anthropic relying so heavily on the cloud providers – Amazon Web Services, Microsoft Azure, and Google Cloud Platform – Nvidia is emerging as the biggest winner when it comes to AI capacity bottlenecks. These hyperscalers have, naturally, outfitted their data centres with clusters of Nvidia’s GPUs, giving the company an unparalleled level of lock-in as Anthropic and its peers train their next-generation models. A rather clever bit of positioning, I must say.

And smartly, Nvidia isn’t resting on its laurels. They’re making moves beyond merely training the models. Inference, you see, is the next challenge. Their new twenty-billion-dollar licensing deal with Groq serves a strategic purpose: to move inference internally, as a means to more swiftly and efficiently complement their existing infrastructure. A thoroughly sensible arrangement, wouldn’t you agree?

Many companies, of course, rely on Intel’s x86 CPUs. Through its collaboration with Intel, Nvidia is cleverly carving out its own niche in the CPU realm. The two semiconductor veterans are working on custom CPU designs that leverage Nvidia’s NVLink interconnects. This allows Nvidia to sell full-stack server racks without forcing companies to switch architectures. A most accommodating gesture, I must say.

Nvidia’s moat, if you will, is also strengthened by how its technology is being deployed across enterprise workflows. By teaming up with Palantir, Nvidia is becoming integrated into new environments across the private and public sectors. This is important, as the company is playing a critical role in how raw data is being fed into AI-powered operating systems. A thoroughly useful function, wouldn’t you say?

Lastly, the company’s partnerships with Nokia, Archer, and a number of autonomous systems developers underscore how Nvidia is moving beyond data centre infrastructure and into the world of physical AI. A most enterprising endeavour, I must say.

Taken together, Nvidia has a number of both near- and long-term opportunities that should position the company for sustained, durable revenue and profits for the remainder of the decade – and beyond – as these markets expand. A positively dazzling prospect, wouldn’t you agree?

Nvidia Has a Legitimate Path to Ten Trillion, By Jove!

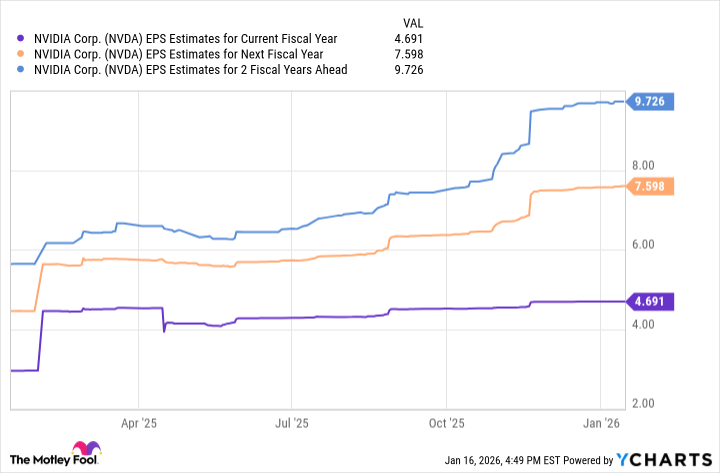

The chart below illustrates consensus estimates among analysts for Nvidia’s earnings per share over the next couple of years. One point that strikes me is that analysts are modelling a significant slowdown in earnings growth between 2026 and 2027.

I suspect these figures could prove to be conservative, as it is, at present, nigh impossible to forecast how the opportunities detailed above will impact revenue and profit margins.

For the sake of my analysis, I shall assume Nvidia’s EPS growth plateaus to around twenty percent following 2027. This would make the company’s implied earnings roughly seventeen dollars per share by 2030.

If I apply Nvidia’s current forward price-to-earnings multiple of twenty-four to my 2030 projection, then I arrive at an implied share price of about four hundred dollars. This suggests a hundred and seventeen percent upside from Nvidia’s current stock price. Against this backdrop, Nvidia’s implied market cap could be nine point seven trillion dollars by 2030.

Here’s the big picture: I’m not forecasting egregious, compounding growth from Nvidia’s new partnerships and expanding market opportunities. Instead, I’m illustrating how the company could rather easily close in on a ten-trillion-dollar valuation even with a slowing, more mature profitability profile and the market no longer assigning a premium multiple.

In reality, I think Nvidia’s evolution from chip designer to a diversified platform player will turn out to be massively accretive – fueling robust acceleration across the top and bottom lines. As such, I think Nvidia is more realistically set up for meaningful valuation expansion and will be worth at least ten trillion dollars by the beginning of the next decade.

For these reasons, I see Nvidia as a no-brainer buy right now for investors with a long time horizon. To me, the company is one of the most compelling opportunities positioned to continue dominating the AI realm for years to come. A positively ripping good investment, wouldn’t you agree?

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-22 08:03