It is a truth universally acknowledged, that a company in possession of considerable fortune must be in want of a proper valuation. And yet, in the bustling marketplace of speculation, one observes a curious reluctance to bestow due credit upon Nvidia. To suggest that this establishment, so prominent in its field, is presently undervalued, may appear, to some, a most impertinent observation. Nevertheless, a discerning eye will readily perceive the merit in such a claim.

The present price, one ventures to suggest, does not adequately reflect the vigour and promise of Nvidia’s performance. Indeed, it presents an opportunity, not often encountered, for a prudent investor to secure a share in a venture exhibiting such robust prospects. One might almost deem it…advantageous.

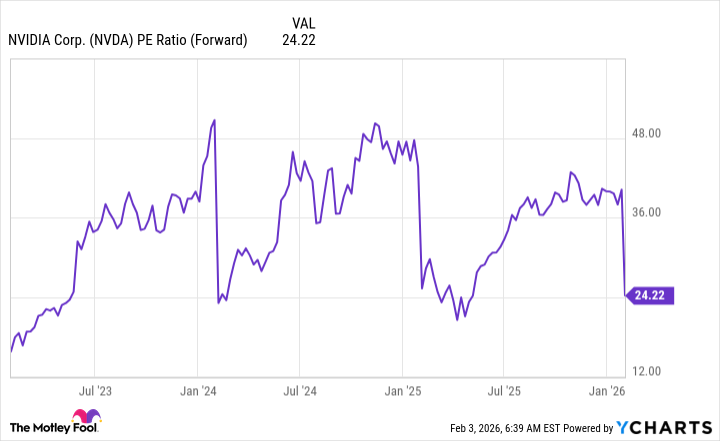

A Valuation Most Moderate

Should one present a company anticipating revenue growth exceeding fifty percent within the year, yet priced at a level comparable to the broader market – as measured by the S&P 500 – the eagerness with which investors would flock to acquire its shares is easily imagined. Such, precisely, is the position of Nvidia. It is a circumstance which, while gratifying to observe, does invite a degree of cautious inquiry.

The consensus amongst those who profess knowledge of such matters anticipates a revenue increase of fifty-two percent for the fiscal year 2027. This expectation is, of course, predicated upon the continued and substantial investment in artificial intelligence, for which Nvidia’s processing units are, at present, indispensable. There are further possibilities, too – the introduction of their next-generation architecture, and a renewed access to the Chinese market – which could contribute to an even more favourable outcome. To anticipate such success, however, is not merely optimism, but a reasoned assessment of the prevailing circumstances.

While projections vary – from $226 billion to $412 billion – the range itself is indicative of a certain…hesitation within the market. A degree of scepticism, perhaps, tempered by a hopeful anticipation of future gains. It is a delicate balance, and one which the astute observer will note with interest.

Nvidia rarely presents itself at such a modest valuation, and when it does, it is generally a signal for those with capital to deploy it with judiciousness. The S&P 500, trading at twenty-two times forward earnings, demands a slight premium, yet Nvidia, despite its considerably faster growth prospects, remains, comparatively, a most eligible purchase.

Estimates suggest that investment in artificial intelligence will continue to accelerate for years to come, and thus, to concern oneself with what lies beyond 2026 seems, at present, a somewhat premature exercise. One may, therefore, confidently recommend the acquisition of Nvidia shares, with the intention of holding them for a considerable period. It is a venture requiring little deliberation, and one which, in the current climate, appears remarkably secure. To overthink the matter, one suspects, would be a most unnecessary complication.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-08 17:12