Nvidia, a name now spoken with a certain reverence, or perhaps a weary expectation. It has, undeniably, been a fortunate ascent, fueled by the current preoccupation with artificial intelligence. One recalls a time when such dominance seemed… improbable. Now, a thousand dollars invested three years ago yields a sum just shy of eight and a half thousand. A tidy return, certainly, though one wonders if the bloom will hold.

The share price, presently around one hundred and eighty-three, has settled into a quietude. A flatness, if you will. It lags, one observes, behind the broader semiconductor sector. A curious detail. It prompts the question, doesn’t it? Has the momentum truly exhausted itself? Or is this merely a pause, a gathering of strength before another advance?

A Promise of Further Gains, Perhaps

The company is due to report its fourth-quarter results next month. The early indications are… favorable. Earnings for the first nine months of the fiscal year are up by fifty percent. Analysts predict a final figure of four dollars and sixty-nine cents per share. A substantial increase, though projections, as we know, are often more optimistic than reality. One hopes, for the sake of shareholders, that this particular forecast proves accurate.

There have been murmurs, of course, of margin pressure. The ramp-up in production of the Blackwell processors has been… demanding. A necessary strain, they assure us, to meet the appetite of the market. It’s a familiar story, isn’t it? The pursuit of volume often comes at a cost. They speak of improved cost structures, of efficiencies to be realized. One can only hope they are correct. The backlog, they say, is expanding. More orders, more demands. It’s a relentless cycle.

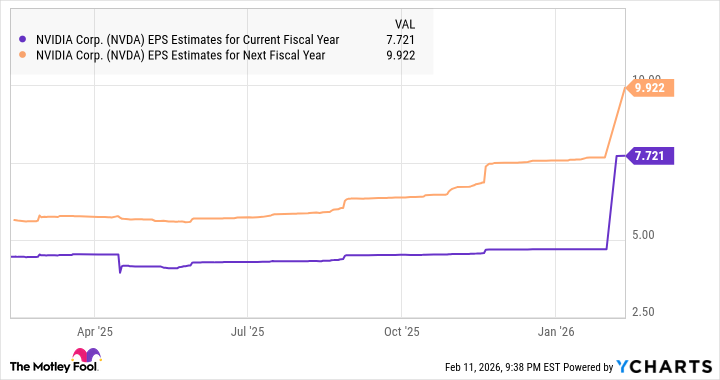

Management believes they can maintain gross margins in the mid-seventies. A commendable ambition. They aim for improvement in the next fiscal year. Analysts, predictably, are forecasting further gains. Sixty-five percent, they say, in the coming year, followed by a twenty-eight percent increase thereafter. These numbers, of course, are merely… estimates. The market, as we all know, is rarely so accommodating.

There is talk, naturally, of the Vera Rubin processors. The next generation. They promise exponential improvements. A tantalizing prospect. One anticipates considerable customer interest. Though one also remembers the countless promises of technological marvels that ultimately fell short of expectations. It’s a pattern, isn’t it? The gap between aspiration and achievement.

A Price of Three Hundred? A Question for the Ages

The projections suggest earnings of nearly ten dollars per share by fiscal 2028. If Nvidia were to trade at thirty times earnings—a modest multiple, by current standards—the share price could approach three hundred. It’s a plausible scenario, certainly. Though one suspects the market may have other ideas. It rarely conforms to neat calculations.

There remains, then, a possibility of further upside. A lingering hope. For those inclined to speculate, it may still be a worthwhile endeavor. Though one should approach it with a certain… detachment. The market is a fickle mistress. It offers rewards, but demands a price. And often, the price is measured in sleepless nights and quiet anxieties.

One can continue to hold the stock, perhaps. Or one can simply observe, with a wry smile, as the story unfolds. It’s a market, after all. And the market, like life, simply goes on.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-02-16 18:32