The stock of NuScale Power, a name whispered in the hush of speculative markets, once climbed to a summit of $51.67, a height few dared to imagine. It began its journey from the lowly price of $10.70, a seed planted in the soil of a merger with a special purpose acquisition company. Yet, the wind of fortune turned, and the stock fell nearly thirty percent, leaving many to wonder if the climb was worth the fall.

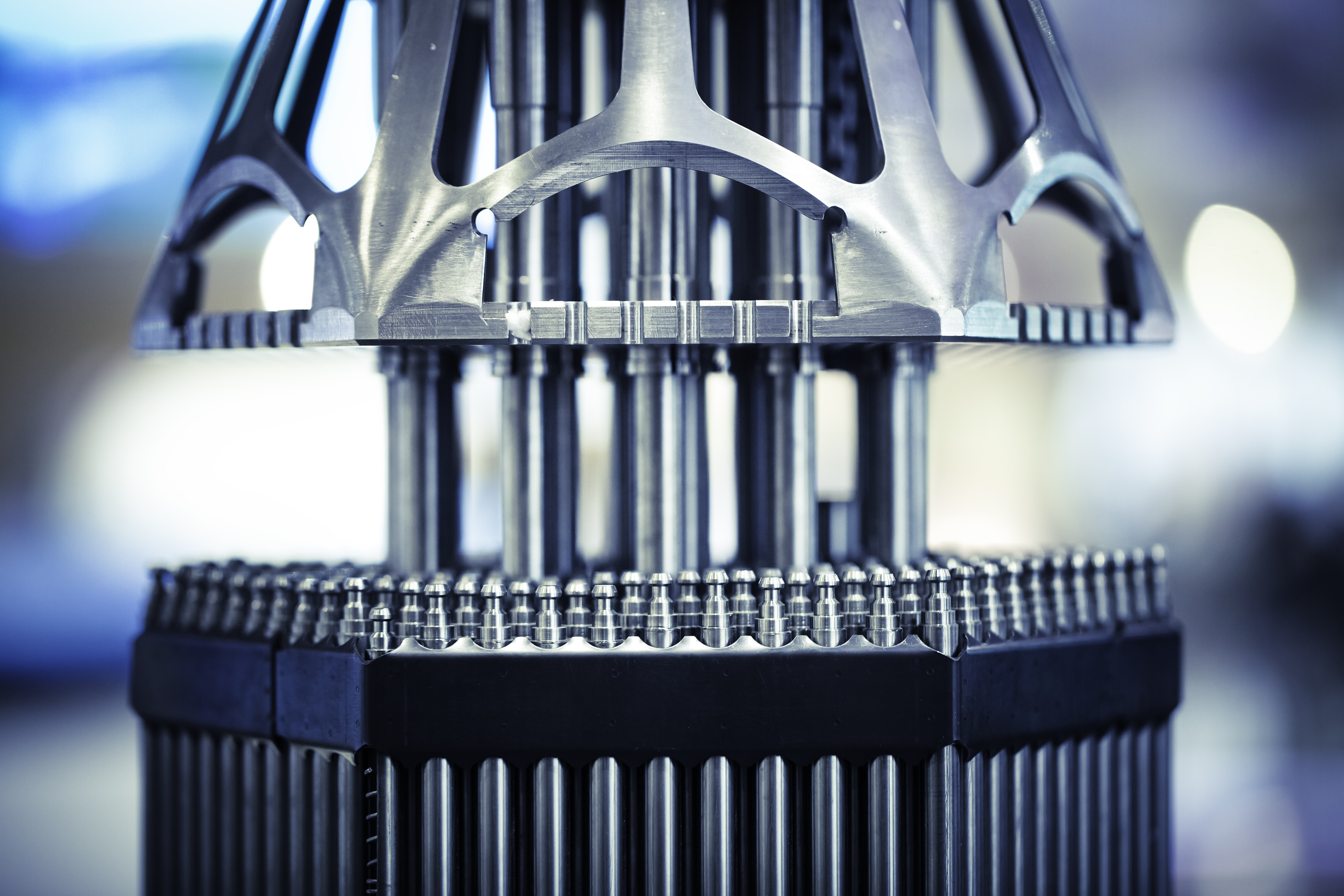

What drives this company, this flicker of hope in the dark? NuScale seeks to reshape the nuclear landscape with small modular reactors, compact machines that could fit in the corner of a field, yet wield the power of giants. These reactors, built in factories and shipped like cargo, promise to bring energy to places where the old behemoths could not. But the path is strewn with the debris of ambition, as dreams of a 462-MW plant in Idaho crumbled under the weight of cost and uncertainty.

How does NuScale plan to disrupt the nuclear energy industry?

NuScale’s vision is a quiet rebellion against the titans of energy. Its reactors, no larger than a shipping container, are designed to be assembled on-site, a testament to the ingenuity of those who dare to think small. The U.S. Nuclear Regulatory Commission, that gatekeeper of safety, has given its blessing to two designs, a rare triumph in a world where approval is as elusive as gold. Yet, even with this validation, the company walks a tightrope, balancing innovation with the cold arithmetic of the market.

The 77-megawatt design, a marvel of efficiency, could power the digital age’s insatiable hunger, yet the road to deployment is long. A project in Romania, once a beacon of promise, now lingers in the shadows of feasibility studies. The Tennessee Valley Authority’s agreement, though grand, is a distant dream, its plants not expected to rise until 2032. For now, NuScale survives as a subcontractor, its revenue a trickle compared to the mountain of its valuation.

The numbers are stark: a market cap of $5.23 billion, yet revenue projections for 2025 hover around $48 million. This disparity is a chasm, a gap between the fever dreams of investors and the sober reality of a company still in its infancy. Yet, insiders, those who know the terrain best, have bought more shares than they have sold, a silent vote of confidence in the face of doubt.

Can NuScale grow into its sky-high valuations?

The question lingers like a storm on the horizon. NuScale’s growth hinges on the fragile threads of foreign contracts and domestic projects, each a gamble in a world where failure is as common as hope. The company’s expansion depends on the final investment decision in Romania and the slow march of its TVA program, both distant promises that may never materialize.

Yet, in the face of this uncertainty, there is a certain beauty. NuScale’s story is not just one of numbers and shares, but of human endeavor, of small players striving to carve a place in a world dominated by giants. Its journey mirrors the struggles of the farmer, the miner, the worker-those who toil in the dust of progress, hoping for a harvest that may never come.

For the cautious investor, NuScale is a tempest, a stock that could be dashed to pieces in a market crash. But for those who see the glimmer of a new era, it is a beacon, a chance to ride the tide of innovation. The price may fall again, but so too may it rise, a pendulum swinging between despair and hope.

🚀

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-09-22 18:01