The AI boom has cranked up the heat on data centers, and the world’s thirst for reliable power has cracked the door open for nuclear’s comeback. NuScale and Oklo aren’t just playing the long game-they’re playing it with a loaded gun and a timer. The question isn’t whether they’ll win. It’s whether they’ll blow up first.

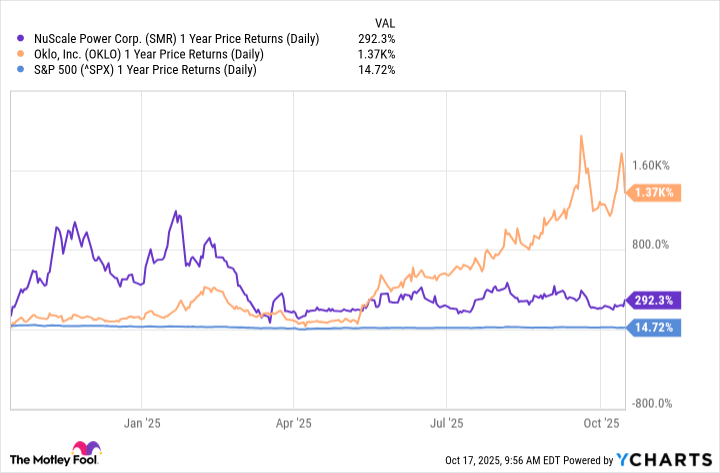

Oklo’s 1,370% surge isn’t just a rally; it’s a Wall Street conga line with a hangover waiting to happen. NuScale’s 290% climb? A cautious tiptoe through a minefield. Both are bets on a future that might not arrive before their cash reserves evaporate.

But here’s the cold truth: past performance is a ghost that haunts the living. These companies are still digging out of the hole they’ve been burrowing for years. The real fight is whether they’ll ever flip the switch on a reactor-or just keep burning through capital like it’s kindling.

NuScale’s Sales and Earnings Outlook

NuScale’s balance sheet looks like a boxer in the 12th round-still standing, but bleeding from every pore. $56 million in revenue against $124 million in losses? That’s not a business. It’s a dare. Ten out of twelve quarters missed estimates. A P/S ratio of 200? That’s not a valuation-it’s a suicide note scrawled in ticker symbols.

Analysts whisper about a $5.1 billion revenue crescendo by 2034, but 2030’s projected $0.48 EPS feels like a mirage. Six “buy” ratings, nine “holds,” and one lone “sell”-the market’s jury is out, but the verdict smells like desperation. Q3 results on Nov. 6 might tell us if NuScale’s still alive or just gasping.

Oklo’s Sales and Earnings Outlook

Oklo’s promise is a clean, reliable, affordable energy utopia. What it’s delivering is a $56.8 million loss and a roadmap to nowhere fast. Its first plant won’t be online until the decade’s end-a timeline that could rot in regulatory limbo. Analysts project $6.7 billion by 2034, but at 162 times forward earnings, it’s a bet on a future that might never materialize.

Ten “buys,” seven “holds,” and one “sell” keep the dream afloat. The $101 average price target? A 40% discount from today’s price. That’s not optimism. It’s a betting line drawn in the sand. Q3 earnings in mid-November will tell if Oklo’s a rocket or a dud.

Is One Better Than the Other?

Oklo’s got the momentum of a bullet-fast, loud, and likely to ricochet. NuScale’s got revenue, but it’s the kind that drowns in red ink. Both are speculative gambles dressed in lab coats. For the high-roller with a stomach for chaos, either could be a play on the next dip. But the smarter move? Let ETFs like the Global X Uranium ETF do the heavy lifting. They’ve got Oklo at 18%, NuScale at 4.8%. Diversification isn’t just a strategy-it’s a survival instinct.

The nuclear renaissance is a tale being written in smoke and mirrors. The only thing guaranteed is the price of the tickets we buy to watch it burn. 🎩

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-10-20 15:41