Many years later, old Mateo, a man who measured time not in hours but in the slow accumulation of dust on forgotten ledgers, would recall the day NuScale Power first bloomed on the financial screens as a premonition of both salvation and ruin. It was a Tuesday, if memory served, thick with the scent of impending rain and the metallic tang of distant, unseen currents. He remembered thinking that such small things, these modular reactors, held within them the weight of empires, the ghosts of promises made and broken. The air itself seemed to hum with a quiet desperation, a feeling he’d known before, during the collapse of the sugar plantations, when progress arrived disguised as a slow, relentless decay.

NuScale, they say, promises a revolution. A way to shrink the monstrous appetite of energy demand into manageable portions. To build power not in monolithic fortresses of concrete and steam, but in discreet, transportable modules, as if one could simply ship a sunbeam to a darkened corner of the world. The notion is seductive, especially in an age where data centers, those insatiable digital gods, demand ever more sustenance. These centers, humming with the ghosts of forgotten conversations and the feverish calculations of algorithms, require a power source as relentless and unforgiving as the logic that governs them. And NuScale, for a time, appeared to be that source.

But the river of ambition, as anyone who has navigated its treacherous currents knows, is rarely a straight line. The stock, a fragile vessel on that river, has bobbed and weaved, reaching for the heights only to be dragged down by the undertow of reality. Currently trading around twenty-one, a price that whispers of potential bargains to the impatient, it’s a number that should give pause to anyone who remembers the cautionary tales of past technological manias. It’s a price that feels less like an opportunity and more like a carefully laid trap.

The Entra1 Pact: A Necessary Illusion

The arrangement with Entra1, a partnership born of necessity rather than strategic brilliance, is the current narrative. It’s a tale of shifting the burden, of outsourcing the risk, of creating a labyrinthine structure designed to appease the cautious appetites of investors. Entra1, they say, will serve as the intermediary, absorbing the initial shock of capital expenditure, allowing NuScale to focus on the delicate art of module construction. It’s a beautiful deception, a way to present a solution without addressing the fundamental problem: the exorbitant cost of building anything new, anything ambitious.

The agreement, heralded as a historic deployment program, is, in truth, a confession of failure. A tacit acknowledgement that the original vision – the Carbon Free Power Project in Idaho – was unsustainable, a dream drowned by the rising tide of economic reality. It’s a recognition that utilities, understandably wary of shouldering the immense financial burden of nuclear construction, require a more palatable path. Entra1 offers that path, but at a price. A price that, like the slow erosion of a riverbank, will gradually diminish the value of NuScale itself.

The Dilution of Dreams

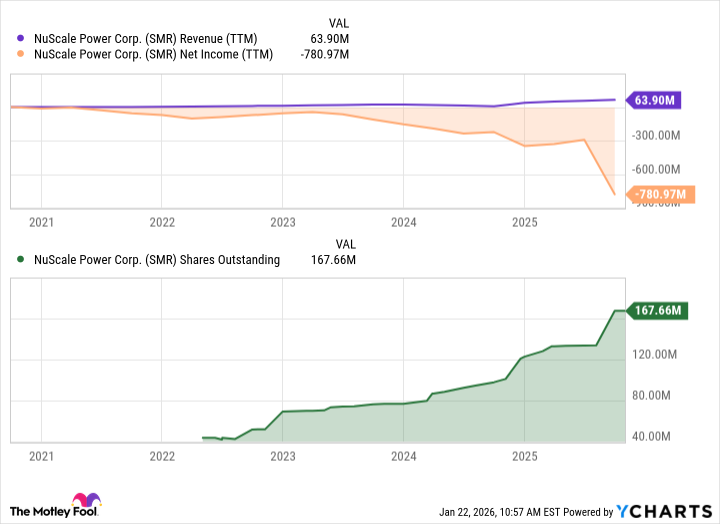

Analysts at BNP Paribas, those pragmatic seers of the financial world, understand this. They see the Entra1 deal not as a triumph, but as a fundamental shift in valuation. They estimate that NuScale could be obligated to pay six billion dollars over the next fifteen years. Six billion dollars, a sum that hangs over the company like a shroud, a constant reminder of the debt incurred in pursuit of a dream. The recent cash outflow of $495 million, a mere trickle compared to the coming deluge, should serve as a warning. And the decision to double the authorized share count? A desperate measure, a sacrifice of ownership in exchange for fleeting liquidity.

The first TVA plant, if it ever materializes, is not expected to be operational until 2030, at the earliest. Romania’s RoPower project, a distant glimmer on the horizon, is slated for 2028. These timelines are not merely projections; they are invitations to delay, to renegotiate, to succumb to the inevitable forces of entropy. The promise of clean energy, like a mirage in the desert, recedes with every step forward.

A Cautionary Tale

NuScale’s technology, in its essence, is elegant, even poetic. The notion of modular nuclear power, of bringing energy to remote corners of the world, is undeniably appealing. But potential, as old Mateo knew all too well, is a fragile thing. It can be crushed by the weight of reality, eroded by the passage of time, diluted by the relentless pursuit of capital.

For most investors, I suspect, NuScale remains a gamble best left untaken. A siren song promising riches, but carrying the faint scent of regret. The technology may eventually prove viable, but the path to profitability is fraught with peril. Until there is concrete evidence of sustained commercial operation, until the debt is addressed, until the dilution ceases, it remains a fascinating, but ultimately precarious, investment. A beautiful dream, perhaps, but one best observed from a safe distance.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Best Video Games Based On Tabletop Games

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

2026-01-26 15:32