Imagine, if you will, a world where machines with minds of their own—these so-called “AI”—devour energy like greedy goblins at a feast. Goldman Sachs, that great number-wizard, has predicted that by 2030, data centers will guzzle 165% more power than they do today. A problem, you see? A riddle wrapped in a nuclear reactor.

Enter nuclear energy, that old grumpy giant who’s finally been dusted off and given a new hat. The U.S. government, with its golden pockets and bureaucratic wands, is waving billions toward small modular reactors (SMRs), those clever little boxes that hum with carbon-free magic. It’s a tale of energy independence and climate resilience, all wrapped in a bow of regulatory paperwork.

NuScale Power, that plucky inventor in the corner of the room, is toiling away on its SMR contraption. The only one with a government stamp of approval, you understand? A rare jewel in a world of leaden bricks. But beware, dear investor: the path to commercial glory is paved with years of patience and the occasional misstep.

How NuScale Can Power the World’s Playthings

At the heart of NuScale’s invention lies the Power Module, a dinky little reactor that whirs out 77 megawatts of electricity. It’s the sort of thing that would make a toymaker weep with joy—if only the toymaker were also a climate scientist. The design? Simple as a chocolate teapot. No coolant pumps, no great pipes—just a whisper of engineering that makes safety a bedtime story and costs a polite cough.

What truly delights the data-center gnomes and industrial giants is the modular charm. One module today, twelve tomorrow. A game of Jenga with electricity, where you start small and build upward without toppling into bankruptcy. A dream, perhaps, but a dream with a plug.

The First-Mover’s Crowning Glory

NuScale has snatched the golden ticket from the U.S. Nuclear Regulatory Commission, the first and only to earn Standard Design Approval. A feat akin to a mouse outwitting a lion, if the lion happened to be named “Regulatory Hurdles.” The company’s 50 MWe module was certified years ago, and now the 77 MWe design joins the parade. A head start in a race where others still wear training wheels.

With data centers set to triple their energy consumption by 2028, NuScale’s reactors could power the next generation of AI’s digital dragons. Microsoft and Meta, those tech titans with bottomless pockets, are already circling like vultures with blueprints. A feast, if only the chickens could lay eggs faster.

Why Investors Should Pack a Snack and a Blanket

Let us not pretend this is a sprint. NuScale’s journey is more marathon—and perhaps a detour through a swamp. Consider the Carbon Free Power Project, a venture that once gleamed like a new penny but collapsed under the weight of costs tripling like a greedy baker’s dough. UAMPS, its former partner, pulled the plug with the grace of a toddler smashing a cake. A bitter lesson in the perils of overpromising and underbudgeting.

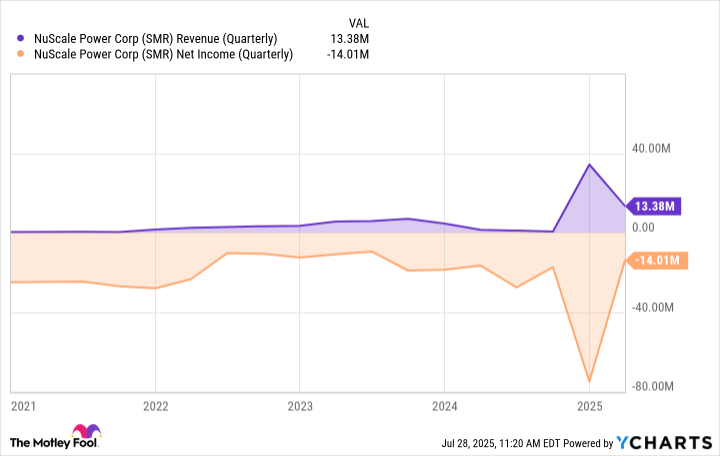

And then there’s Romania. Ah yes, the RoPower project, where NuScale plans to turn a coal site into a nuclear wonderland. Six modules, 462 MWe, and a target date of 2029. A decade-long nap for a stock that’s already priced like a five-star meal at a fast-food price. The cash flow? A trickle of $34 million here, $13 million there—enough to keep the lights on but not the champagne flowing.

Buy the Stock or Buy the Farm?

NuScale is a curious creature. Its stock has soared 373% in a year, riding the nuclear renaissance like a broomstick to the moon. Analysts predict $467 million in sales by 2028, giving it a price tag of 23 times those numbers. A valuation that smells of fairy dust and hubris.

As a portfolio manager, I find NuScale’s story as enticing as a box of chocolates with one rotten center. The first-mover advantage is a glittering lure, but the road ahead is strewn with potholes and tollbooths. For now, I’d rather watch from the sidelines with a magnifying glass, waiting for the smoke to clear. After all, the best investments are those that don’t turn your portfolio into a bonfire. 🧙♂️

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Best Actors Who Have Played Hamlet, Ranked

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-01 13:37