NuScale Power. It sounds like something out of a particularly optimistic science fiction novel, doesn’t it? The company, for those not following the intricacies of next-generation nuclear technology (and honestly, who is, consistently?), is attempting to build small modular reactors – SMRs – which, if they work, promise to be scalable, cheaper, and, crucially, safer than the hulking behemoths of the past. The idea, you see, is to have reactors you can, well, add. Like Lego bricks, but with considerably higher stakes. Investors have certainly been intrigued, and it’s easy to see why. There’s a lot of talk about powering those energy-hungry artificial intelligence data centers, which, let’s be honest, are consuming power at a rate that would make a Victorian factory owner blush.

A Two-Year Trip to… Somewhere

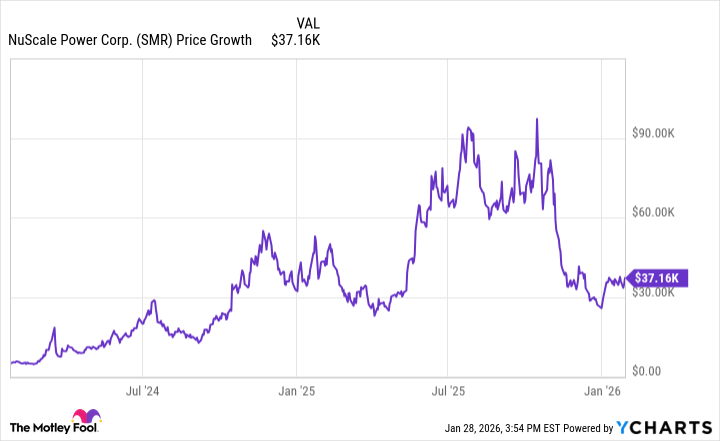

Now, let’s talk numbers. If you, with a boldness I frankly lack, had invested $5,000 in NuScale back in January 2024, you’d be looking at a return of… well, a rather startling 643.3%. That $5,000 would now be worth approximately $37,160. It’s the sort of return that makes you wonder if you’ve accidentally stumbled into a time warp or perhaps miscalculated your grocery budget. Here’s a chart, because humans seem to enjoy looking at wobbly lines that represent financial gains (and losses).

The Perils of Perfecting Atoms

There’s a definite opportunity here, of course. But let’s not get carried away. Nuclear power, even the miniature variety, is not exactly a walk in the park. It’s more like a very long, exceptionally complicated hike up a rather treacherous mountain. There’s a colossal amount of engineering to be done, regulations to navigate, and, crucially, money to raise. And that’s before we even get to the small matter of splitting atoms. It’s an expensive business, this energy generation, and NuScale is likely to require significant further investment, which will almost certainly involve… dilution. That is to say, more shares being issued, which means your existing shares are worth a smaller piece of the pie. It’s a bit like inviting more and more guests to a party while keeping the cake the same size.

For most investors, I suspect, this is a rather risky proposition. A thrilling, potentially lucrative risk, perhaps, but a risk nonetheless. If you happen to be one of those individuals who enjoys a particularly high level of financial jeopardy – and I confess I don’t fully understand these people – then NuScale might be worth a look. But approach with caution, and perhaps a healthy dose of skepticism. After all, the future of energy is a fascinating, complex, and often unpredictable thing.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 🎁 AGF 2025 Coupon

2026-02-02 20:26