Berkshire Hathaway’s (BRK.A +1.19%)(BRK.B +0.78%) portfolio composition continues to be subject to scrutiny, particularly in light of recent divestitures and the subsequent performance of former holdings. The fourth-quarter results remain a point of interest, reflecting a period of transition in capital allocation strategy.

The complete liquidation of the position in Nu Holdings (NU 5.38%) warrants consideration. While Berkshire Hathaway’s initial investment, made during a private seed round preceding the 2021 IPO, represented a departure from typical equity selection criteria, the decision to exit the position raises questions regarding long-term strategic alignment. The rationale, as is often the case with Berkshire’s investment decisions, remains largely undisclosed.

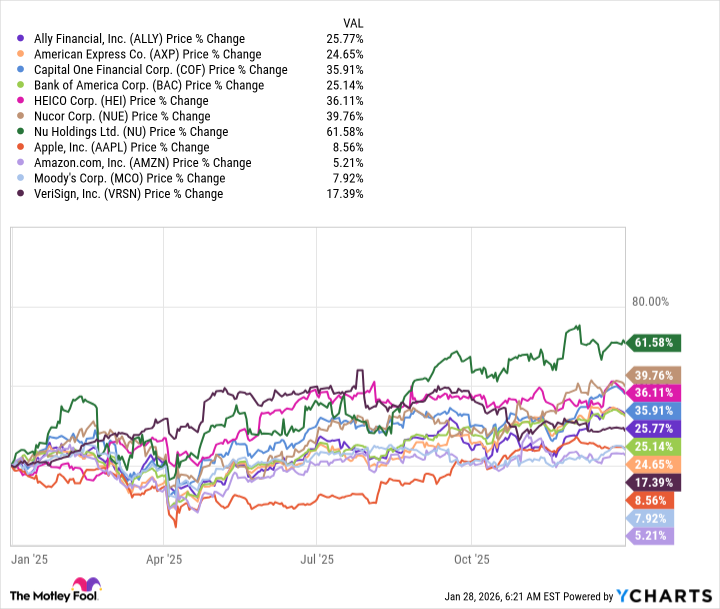

Subsequent market performance has, however, demonstrated a significant divergence. Over the past year, Nu Holdings has materially outperformed all other constituents within the core Berkshire Hathaway portfolio, including Nucor, Heico, Capital One, Ally Financial, American Express, Bank of America, VeriSign, Apple, Moody’s, and Amazon. This outcome, while noteworthy, does not necessarily validate the initial investment thesis or negate the considerations that prompted the divestiture.

The recent addition of Alphabet to the Berkshire Hathaway portfolio, with a 65% gain over the past year, further illustrates the dynamic nature of capital deployment and the potential for both gains and missed opportunities.

Nu Holdings currently exhibits a positive trajectory, with a year-to-date increase of 11%. This performance merits further examination.

Digital Banking in Emerging Markets

Nu Holdings operates as a fully digital bank across Brazil, Mexico, and Colombia. The company has rapidly ascended to become the largest financial institution in Brazil by customer count, achieving an annual growth rate that has positioned it to serve 61% of the adult population. Penetration rates in Mexico (14%) and Colombia (10%) indicate a growing, albeit nascent, presence in these markets.

Monetization of the Brazilian user base remains a primary focus, with a continued expansion of services and features. The company’s growth strategy extends beyond Brazil, with plans for expansion into the United States, including the establishment of offices in Miami, Palo Alto, and Washington, D.C. These initiatives, while ambitious, will require significant capital investment and effective execution to achieve desired outcomes.

Investors should approach Nu Holdings with a measured perspective, recognizing both the potential for high growth and the inherent risks associated with operating in emerging markets and the rapidly evolving digital banking landscape. Further monitoring of key performance indicators, including customer acquisition costs, net interest margins, and regulatory compliance, will be essential to assess the company’s long-term viability.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2026-01-31 10:53