As a seasoned researcher who has spent years studying and analyzing global financial markets, I must say that watching Norway’s massive sovereign wealth fund perform is like witnessing a well-oiled machine at work. The fund’s ability to generate impressive returns while adhering to strict guidelines set by the Norwegian Ministry of Finance is nothing short of remarkable.

In the initial part of the year, Norway’s enormous investment fund, boasting approximately $1.7 trillion in investments, yielded a profit of 8.6%, translating to around $138 billion. This impressive gain was primarily driven by a significant increase in share values.

During the six-month span up to June, Norges Bank Investment Management (NBIM), responsible for managing the fund’s investments, stated that equity holdings increased by 12%, as reported by Bloomberg. However, the overall performance of the fund slightly underperformed its benchmark by a minimal 0.04 percentage points. This was partly due to a negative impact from real estate investment contributions.

Founded in the 1990s to handle Norway’s foreign oil and gas earnings, this fund stands as the world’s largest individual equity owner. Its investment decisions are shaped by stringent rules established by the Norwegian Ministry of Finance. The performance of this fund is assessed against a combination of benchmark indices: the FTSE Global All Cap Index for equities and Bloomberg Barclays indexes for fixed income.

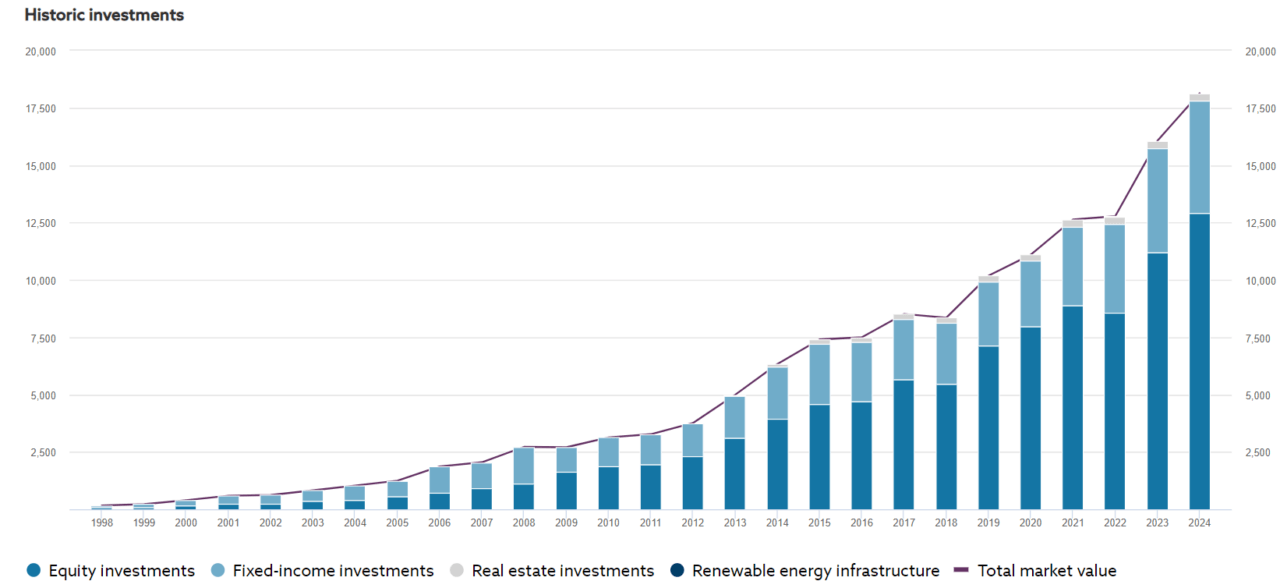

As a researcher, I find that the majority of NBIM’s capital is allocated to publicly traded equities, with holdings in 8,763 companies spanning across 66 diverse nations. These investments constitute approximately 72% of the fund. Fixed income securities from 49 different countries account for 26.1% of the fund’s portfolio, while nearly 900 properties in 14 countries contribute 1.7%.

Approximately 0.1% of this fund’s investments are directed towards renewable energy infrastructure, spread across five distinct projects in four various nations, as stated on their official site.

In his statement, the Fund’s CEO, Nicolai Tangen, highlighted that equity investments delivered exceptionally high returns during the initial part of the year. He further emphasized that the technology sector’s growth was primarily influenced by a surge in demand for innovative applications in artificial intelligence.

As per Bloomberg’s report, Tangen stated that there was a 1% decrease in fixed-income investments and a decline in the worth of unlisted real estate during the specified timeframe. Moreover, the value of the fund’s unlisted renewable energy infrastructure investments dropped by 18%.

It’s been revealed that NBIM decreased its investments in Meta Platforms, Novo Nordisk, and ASML Holding during the first six months of the year. Notably, these companies are among the fund’s leading 10 investments, with Apple, Microsoft, and Nvidia being its top three.

Last year, Norway’s prosperity fund recorded an unprecedented $213 billion in earnings, primarily due to the success of the technology sector. Interestingly, a high-ranking executive from BlackRock hinted earlier this year that sovereign wealth funds might soon invest in Bitcoin by purchasing shares in the iShares Bitcoin Trust (IBIT) ETF. It’s expected they could start trading Bitcoin within the next several months.

Worldwide investment entities such as Kuwait’s age-old Sovereign Wealth Fund, the Kuwait Investment Authority (KIA), and Norway’s renowned $1.7 trillion wealth fund could cause noticeable effects within financial markets by applying cautious investment strategies.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-08-15 01:57