In a plot twist that could only be concocted by a particularly mischievous deity, the North Korean Bybit hackers are galloping towards the finish line of laundering a staggering 499,000 ETH, which, if you squint hard enough, is worth about $1.5 billion. At their current speed, they might just finish this little escapade in the next three days—assuming they don’t trip over their own shoelaces.

Meanwhile, the USDC stablecoin issuer Circle is facing a barrage of criticism for allegedly taking its sweet time to blacklist wallets linked to this grand heist. Perhaps they were busy contemplating the meaning of life? 🤔

North Korean Hackers Ramp Up Bybit Laundering Efforts

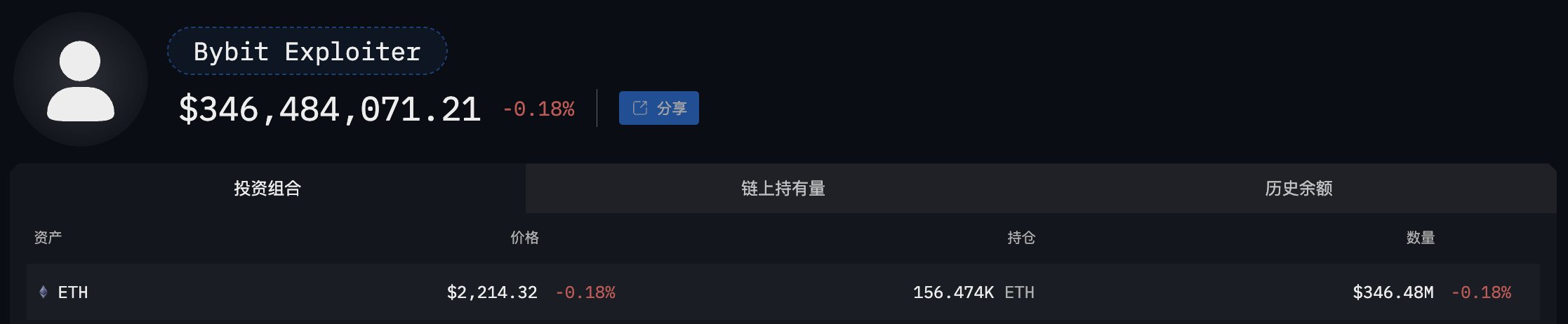

On the first of March, the hackers decided to move another 62,200 ETH, which is roughly equivalent to $138 million, leaving a mere 156,500 ETH still unlaundered. It’s like a game of hide and seek, but with a lot more zeros involved.

According to the ever-watchful crypto investigator EmberCN, who seems to have a knack for tracking these digital shenanigans, the swift movement of funds suggests that the laundering process could be wrapped up faster than you can say “Where did my money go?”

“Since the hacker resumed their money laundering spree yesterday at 3 PM, they’ve managed to launder 62,200 ETH (worth $138 million). Out of the 499,000 ETH pilfered from Bybit, only 156,000 ETH (worth $346 million) remain unlaundered. In about three more days, all of it should be fully laundered,” EmberCN tweeted on X, probably while sipping a cup of coffee.

This little escapade has been confirmed by the blockchain intelligence firm TRM Labs, which noted that the attackers possess “an unprecedented level of operational efficiency.” Or, as we like to call it, “a talent for mischief.”

According to the firm, this group employs a complex laundering strategy, using intermediary wallets, decentralized exchanges, and cross-chain bridges to disguise their movements. It’s like a magician’s trick, but with a lot more money and a lot less applause.

Meanwhile, the authorities have also taken notice. On February 27, the FBI identified a North Korean-affiliated hacking collective known as TraderTraitor as the masterminds behind the Bybit attack. Sounds like a name straight out of a bad spy novel, doesn’t it?

In response, Bybit has launched a $140 million bounty program to entice individuals who can help track and freeze the stolen assets. So far, 16 lucky souls have pocketed a combined total of $4.2 million for their efforts. Not a bad day at the office!

Circle Faces Criticism for Delayed Blacklist

Given the rapid pace of the laundering activity, on-chain sleuth ZachXBT has taken to the digital streets to criticize Circle for its sluggish response in blacklisting hacker-controlled wallets. Apparently, they took more than 24 hours to act, which is like watching paint dry in slow motion.

ZachXBT also pointed out past incidents where Circle allegedly failed to freeze illicit funds promptly, referencing major crypto breaches such as the Ledger and Nomad Bridge hacks. It seems like they might need a little pep talk on urgency!

He argued that Circle, as a key stablecoin issuer, should adopt a more aggressive stance in blocking stolen funds instead of waiting for law enforcement directives. After all, time is money, and in this case, it’s a lot of money!

Circle’s CEO, Jeremy Allaire, defended the company’s position, dismissing claims of negligence. He stated that Circle only responds to direct requests from authorities. Because, you know, why act quickly when you can wait for a formal invitation?

“We will share a post on how we immediately respond to law enforcement and not front run the law with our own or market intelligence. I don’t think the market or users benefit if a private company makes their own judgments to seize funds without a direct law enforcement request,” Allaire added, probably while checking his watch.

However, ZachXBT retorted that waiting for legal clearance creates unnecessary delays, allowing hackers to execute their laundering schemes before anyone can say “stop thief!”

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Does Oblivion Remastered have mod support?

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- DODO PREDICTION. DODO cryptocurrency

- Oblivion Remastered: How to get and cure Vampirism

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Summoners War Tier List – The Best Monsters to Recruit in 2025

2025-03-02 15:48