The market, that restless beast, has recently cast a pall upon Nio, diminishing its worth by a third over these past four months. A circumstance which, while unsettling to some, presents a certain…opportunity for those amongst us who possess the temperament to observe value where others see only decline. Nio, a purveyor of electric carriages in the burgeoning Chinese market, now stands at a peculiar juncture. Reports suggest a turn towards profitability, a glimmer of financial health after years of striving. Yet, as with all things in this world, a shadow accompanies the light. To speak of profit alone is to offer but half a truth.

A Corner Turned, or Merely a Bend in the Road?

Preliminary figures indicate that Nio anticipates an adjusted profit from operations – a sum between one hundred and one hundred and seventy-two million units of currency – for the final quarter of the passing year. A noteworthy achievement, to be sure. It suggests a capacity for sustained operation, a lessening of the constant need for external sustenance. The company speaks of reaching breakeven by the close of the subsequent year. Such pronouncements are, of course, to be received with a judicious skepticism. The future, as any seasoned observer of commerce knows, is a fickle mistress.

This improvement stems from a confluence of factors. Margins have broadened, and the volume of carriages leaving the factories has increased. Notably, the newer, more modestly priced sub-brands, Onvo and Firefly, are gaining traction amongst the populace. December witnessed a surge in sales – fifty-four and a half percent higher than the year prior, reaching a new monthly high of forty-eight thousand, one hundred and thirty-five deliveries. The fourth quarter saw an even more substantial increase – seventy-one and a half percent – bringing the total to nearly one hundred and twenty-five thousand carriages. It is a testament to the ingenuity of the engineers and the diligence of the laborers, though one must also acknowledge the relentless appetite of the Chinese consumer.

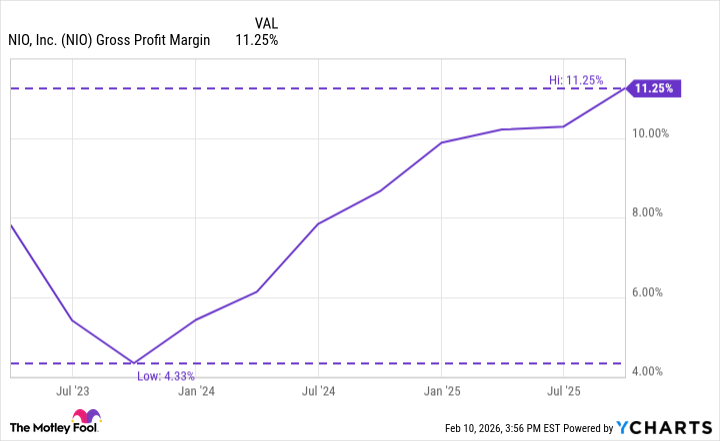

Despite the lower price points of these newer offerings, and amidst a fierce competition for dominance in the electric carriage market, Nio has managed to maintain its gross margins. This is a feat worthy of consideration. It suggests an ability to manage costs and to extract value from its production processes. Yet, one must ask: at what cost? And for how long can this balance be maintained?

The announcement of this anticipated profit should, in theory, inspire optimism. And yet, a prudent investor will not allow himself to be swept away by sentiment. There remain complexities, underlying currents that demand careful consideration.

The Hidden Costs of Innovation

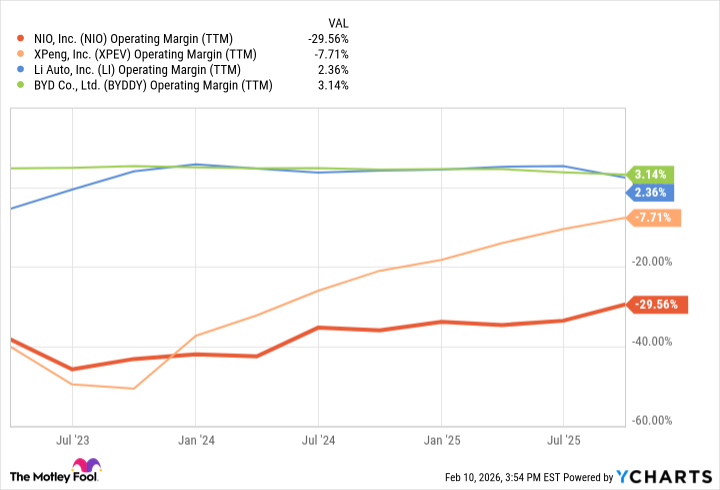

While Nio’s gross profit margins demonstrate a positive trajectory, its operating margins consistently lag behind those of its competitors. This discrepancy is not merely a matter of accounting; it reveals a fundamental challenge to the company’s business model. The difference, as any astute manager understands, lies in the distinction between the cost of building the carriage and the cost of bringing it to market – a distinction often obscured in the rush for headline numbers.

A significant contributor to this disparity is Nio’s ambitious battery swapping network. A bold undertaking, to be sure. The premise – to exchange depleted batteries for fully charged ones with the speed of filling a lamp with oil – is undeniably appealing. However, the reality is far more complex. This network requires a vast investment in infrastructure, a constant expenditure on maintenance and inventory, and a logistical undertaking of considerable magnitude. It is a drain on the company’s resources, a weight upon its balance sheet.

One cannot deny the potential advantages of such a system. In a world increasingly concerned with sustainability and convenience, the ability to rapidly replenish an electric carriage’s power source could prove to be a decisive competitive advantage. However, at present, the benefits remain largely theoretical. The number of Nio carriages utilizing this service is still relatively small, and the emergence of faster, more efficient charging technologies threatens to render the entire network obsolete. To invest heavily in a system that may soon be surpassed is a risk few can afford.

Therefore, while Nio’s announcement of its first adjusted profit is undoubtedly a positive development, it is crucial to maintain a clear-eyed perspective. The company has overcome a significant hurdle, but many challenges remain. The path to sustained profitability will be long and arduous. Investors who approach this opportunity with caution, and a thorough understanding of the underlying complexities, are most likely to reap the rewards. For in the world of commerce, as in life itself, appearances are often deceiving, and true value lies not in what is proclaimed, but in what is demonstrably true.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Wuthering Waves – Galbrena build and materials guide

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- Most Famous Richards in the World

- The Most Anticipated Anime of 2026

- Top 20 Educational Video Games

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-15 17:14