Right. Nio. The electric car company. It’s… complicated. Like all things involving money, really. I’ve been looking at it, trying to decide if it’s a potential portfolio booster or just another beautifully designed money pit. It’s one of those Chinese EV makers, you see, all sleek and ambitious, and apparently able to undercut everyone on price. Which is… good? Unless it means they’re selling dreams, not cars.

They’ve just had a rather good month, actually. And a good quarter. Which, in the volatile world of tech and automobiles, is practically a miracle. December saw 48,135 vehicles delivered. Honestly, it’s a bit dizzying. A solid 71% jump in quarterly deliveries. One starts to suspect they’re building cars in their sleep.

Units of optimism expressed today: 7. Hours spent refreshing stock charts: 6. Number of times I questioned my life choices: escalating.

The interesting thing is, everyone was expecting the delivery numbers to be good. The two newer brands, Onvo and Firefly, are gaining traction. But the real question is margins. Because delivering a lot of cars is great, but if you’re losing money on every one, it’s just a faster route to bankruptcy. It’s the classic ‘spending a fortune to look rich’ scenario.

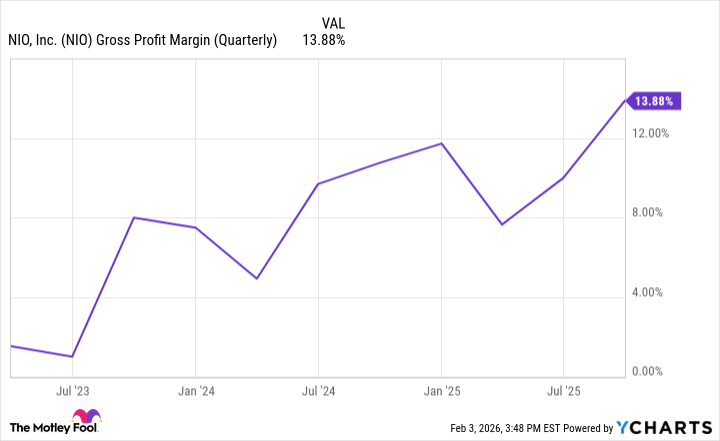

Fortunately – and it’s a genuine ‘fortunately’, not one of those sarcastic ones – Nio’s margins have actually been increasing. Which is… unusual. They were strong in the third quarter. It’s like they’ve stumbled upon some sort of automotive alchemy. There’s a chart, apparently, showing all this progress. I’m not usually one for charts, but this one actually made me feel… cautiously optimistic. (See image below)

Gross profit was up a robust 50.7% year-on-year. 50.7%! It feels… excessive. But in a good way, hopefully. And they have reinforcements on the way. Three new large SUV models, launching later this year. Honestly, it’s a bit overwhelming. I feel like I need a spreadsheet just to keep track of the SUVs.

New Launches (and My Increasing Anxiety)

They’re predicting a compound annual growth rate of 40-50% over the next two years. 40-50%! It’s ambitious, isn’t it? Like promising to run a marathon after a week on the sofa. They’re launching their flagship ES9 in April, which is apparently going to be their biggest and most expensive SUV yet. Price tag: around $72,000. It’s a statement, clearly. A very expensive statement.

The whole thing feels like a turning point. Nio is aiming for adjusted earnings in the fourth quarter and break-even for the full year 2026. It’s a long way off, of course. But it’s… progress. The recent record deliveries are encouraging, but it’s the margin growth that really has me… cautiously intrigued. It’s not a slam dunk, not by a long shot. But it’s… less terrifying than it was. Which, in the current market, feels like a win.

Lists made today: 3. Existential crises experienced: 1 (and counting). Number of times I’ve considered becoming a goat farmer: 6.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-07 18:04