The scent of obsolescence, dear reader, hangs heavy in the automotive air. To attempt to defeat the surging tide of Chinese electric vehicles is, shall we say, quaint. Far more sensible, and infinitely more profitable, is to observe, to dissect, and, if one is so inclined, to participate in the elegant dismantling of established norms. Nio, a name that whispers of nocturnal luminescence, presents itself not as a competitor, but as a particularly iridescent specimen in this rapidly evolving ecosystem. A flutter of fireflies, if you will, illuminating the path for those with the perspicacity to follow.

A Numerical Ballet

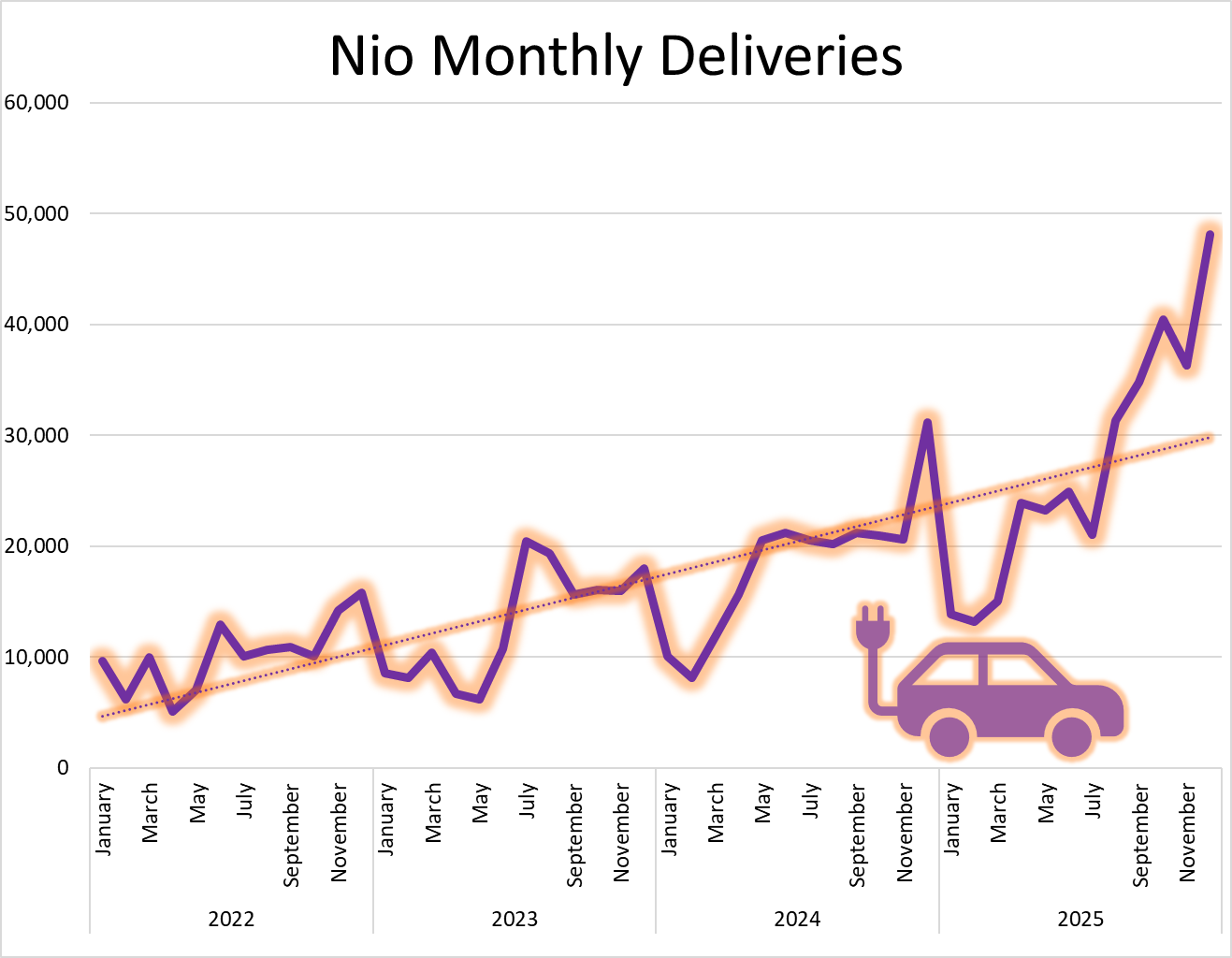

The numbers, those cold, hard arbiters of success, have been performing a rather fetching ballet of late. Nio’s recent deliveries—over 48,000 vehicles in December 2025, a figure that seems to multiply with each passing month—are not merely increments, but accelerations. A 54.6% increase, you understand, is not simply a larger number; it is a declaration. The Onvo and Firefly brands, those newer hatchlings, are still unfolding their wings, but their potential, though yet unquantified, is undeniable. Thirty-one thousand eight hundred and ninety-seven from the flagship Nio, a respectable showing, but it is the supporting cast—nine thousand one hundred and fifty-four from Onvo, seven thousand and eighty-four from Firefly—that hint at a broader, more intriguing strategy.

Observe the graphic—a visual testament to Nio’s ascendance. A staggering 71.7% increase in fourth-quarter deliveries. The company’s cumulative total—326,028 deliveries in 2025—represents, rather neatly, approximately one-third of its entire history. A third, you see, is a pleasingly symmetrical fraction, suggesting a certain…completeness. It’s as if the company is building itself, layer by layer, into something rather substantial.

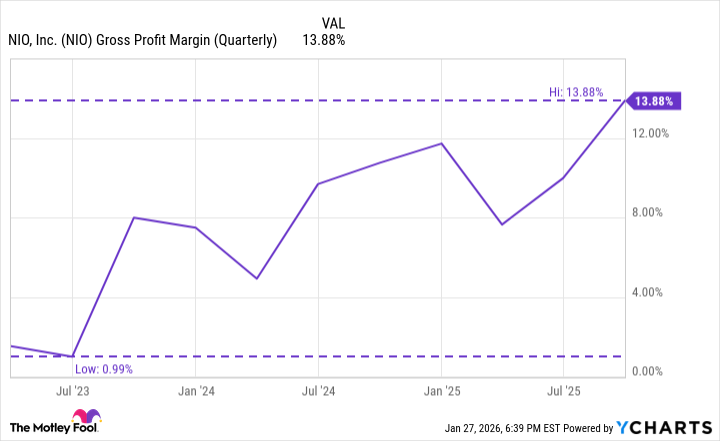

There was, of course, the predictable murmur about margins. The fear that expanding into more ‘affordable’ vehicles would dilute the brand, diminish the perceived exclusivity. A perfectly reasonable concern, naturally. But Nio, it appears, has been engaged in a rather clever game of cost reduction and scale enhancement. A delicate balancing act, executed with a degree of finesse that is, frankly, rather uncommon in this industry.

The Art of the Possible

Vehicle margin, at 14.7% during the third quarter of 2025, is not merely an improvement over the previous year’s 13.1%; it is a statement of intent. And the second quarter’s 10.3%? A distant, almost forgotten memory. A robust 50.7% jump in gross profit, you see, is not simply a larger number; it is a promise. A promise of profitability, of sustainability, of a future where Nio is not merely surviving, but thriving. The company, it seems, is learning to paint with a broader palette, to orchestrate a more complex symphony of financial performance.

A Turning of the Wheel

This, dear reader, may well be a turning point. Nio is not merely growing; it is evolving. Expanding its brands, improving its margins, and navigating the treacherous currents of the Chinese automotive market with a degree of skill that is, frankly, rather remarkable. The competition is fierce, the tariff barriers formidable, and the price wars relentless. But Nio, it seems, is prepared to fight. To adapt. To win. The company hopes to announce its first quarterly profit, and is targeting full-year breakeven in 2026. If it succeeds—and I suspect it will—it may be time for the discerning investor to consider a small, carefully calibrated position. A flutter, if you will, in the direction of the fireflies.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

2026-01-31 22:13