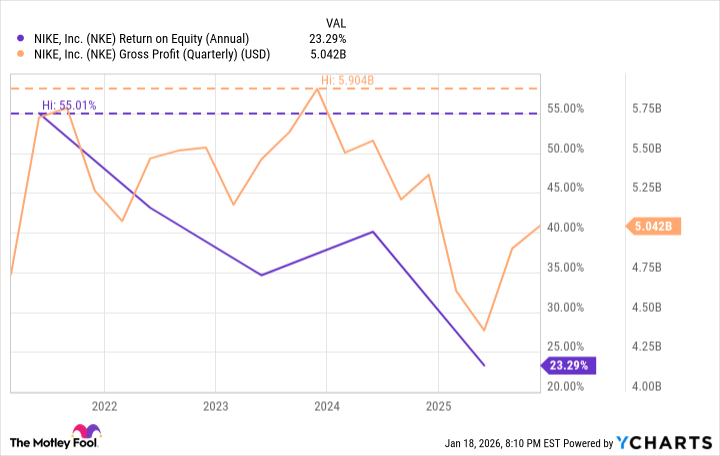

Okay, let’s talk about Nike. NKE. The Swoosh. Once a goddamn cultural tidal wave, now… sputtering. They launched Air Jordans, built empires on celebrity sweat, and for a long time, it felt like they could do NO WRONG. But the consumer economy? It’s a fickle beast, a goddamn hydra, and right now, it’s looking at Nike with a particularly hungry eye. Five years down 53%? That’s not a dip, that’s a freefall. A slow, agonizing spiral into the abyss. And the return on equity? Dropping like a bad trip. From 43.1% in ’22 to a pathetic 23.3% in ’25. It’s a goddamn bloodletting.

What the hell happened? We’re not talking about a simple market correction here. This is a systemic unraveling, a confluence of factors that are threatening to turn the most iconic brand in athletic wear into a cautionary tale. Let’s dive in, shall we? But be warned: it’s going to get messy.

The Tariff Trap: A Slow Bleed

Tariffs. The word itself tastes like ash. And Nike, like so many other apparel companies, is squarely in the crosshairs. Importing shoes from a global supply chain? It’s a logistical nightmare in the best of times. Now, it’s a goddamn economic hostage situation. Management’s expecting a $1.5 BILLION hit in fiscal ’26. $1.5 BILLION! That’s not a scratch, that’s a gaping wound. A 1.2% reduction in gross margin? They’re trying to downplay it, but this is a slow bleed, a death by a thousand cuts.

China: The Dragon’s Displeasure

Let’s be blunt: China is the key. The whole damn game hinges on the Chinese consumer. And right now, they’re sending a clear message: they’re not buying what Nike’s selling. A 17% revenue drop in Greater China? That’s not a blip, that’s a warning shot. This isn’t about shoes anymore; it’s about geopolitical leverage. If the Chinese market turns cold, Nike’s growth prospects are… let’s just say they’ll be spending a lot of time in the emergency room.

The Price of Cool: A Consumer Revolt

Elliott Hill, the new CEO, is trying to fix things, undo the damage done by the previous regime. He’s talking about rebuilding relationships with wholesale partners, getting back on the shelves of brick-and-mortar stores. Good luck with that. The consumer is a different beast now. They’re price-sensitive, skeptical, and they’ve got options. Nearly half of U.S. consumers aren’t planning to buy footwear this holiday season. FORTY-EIGHT PERCENT! And 65% of those who are shopping are blaming tariffs for the inflated prices. This isn’t about brand loyalty; it’s about basic economics. People are starting to realize they don’t need another pair of overpriced sneakers.

The FDRA survey is grim. Shoe executives are bracing for even higher prices, with nearly 30% expecting a 6-10% increase and another 15% anticipating a jump of over 10%. It’s a vicious cycle. Higher prices, fewer sales, shrinking margins. It’s a slow-motion train wreck.

The Casualization Crisis: Has the Trend Peaked?

For years, athletic footwear brands have ridden the wave of “casualization.” Sneakers as everyday wear, blurring the lines between gym and office. It was a brilliant strategy, a cultural coup. But what happens when the trend peaks? What happens when people start to get tired of wearing the same damn shoes everywhere? Bank of America research suggests we’re reaching that point. Sneakers already account for 50% of global footwear sales. U.S. participation in sports isn’t growing. The market is saturated. It’s a crowded field, and Nike is starting to look… vulnerable.

People love sneakers, sure. But love doesn’t pay the bills. Nike can’t rely on brand awareness alone. They need to innovate, to create something truly disruptive, something that will get people lining up around the block. Otherwise, they’re facing strong headwinds, a future of low growth, and shrinking margins. It’s a bleak outlook, a dark cloud hanging over the Swoosh. And frankly, it’s a fascinating, terrifying spectacle. A goddamn tragedy in the making.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-22 16:02